Optimistic SNB

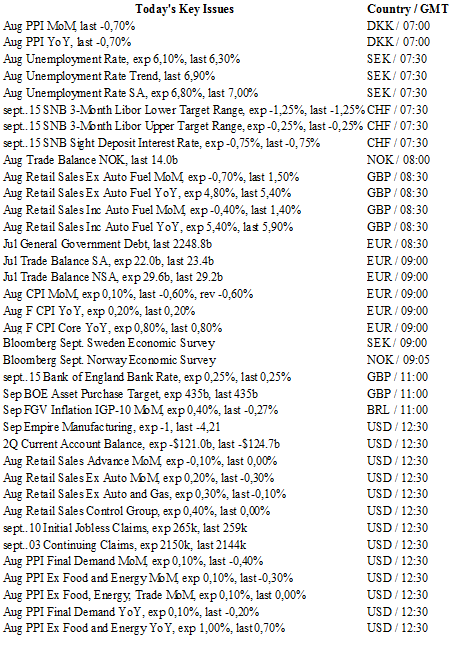

As expected, the Swiss National Bank did not modify its monetary policy stance and reiterated that it will remain active in the foreign exchange market to prevent further Swiss franc appreciation. The central bank also left its interest rate on sight deposits unchanged at -0.75% and the target for the three-month Libor at between -1.25% and -0.25%. On the growth and inflation sides, as expected the SNB revised its growth and inflation forecast slightly lower.

The SNB projects that inflation will move above the 1% threshold during the first quarter of 2019, compared to the third quarter of 2018 as estimated in June. In the short-term, inflation should barely reach the neutral threshold by year-end in reaction to a “slightly less favourable global economic outlook”.

On the growth side, the central bank acknowledged the surprisingly solid recovery in the second quarter as GNP grew +2%y/y. However, it expects more modest growth in the second half of the year as Europe slows down. Overall, it was rather an optimistic statement even though the Swiss institution did not pass up on the occasion to point out its commitment to defending the CHF.

In the long-term, the picture has much changed. The SNB will remain in “wait and see” mode. In this regard, development in Europe is being monitored. The ECB holds policy steady, opting to conserve firepower. However, the issues from Brexit are only now beginning to materialize both on the economic and political front and may turn up the heat on the Swiss franc in the coming months.

Moving forward, direct FX intervention and interest rates will remain the policy tools of choice of the SNB. Price stability is the bank's mandate with a focus on the overvalued CHF. Intervention effectiveness has proven difficult to sustain over a long period but highly effective in the short-term to discourage speculators.

In the longer term, negative interest rates seem to be the SNB members' option of choice. It’s a simple way of maintaining the interest rate differential with the euro, making the CHF less attractive. Given the current environment, the SNB will be comfortable to stay on the sidelines indefinitely. Only if a “shock” threatens the EUR/CHF exchanges rate will the SNB jump back with a policy response.

US retail sales set to weaken

The market is awaiting August US consumption data today. Last month, the data printed in negative territory at -0.1% excluding auto & gas. Any adverse outcome will ironically send stocks higher as markets will likely adjust lower a Fed rate hike possibility before year-end. Indeed, investors are looking for yields and the stock markets represent a great opportunity as the cost of money is very weak.

We believe that the US economy is fragile and that there is no actual recovery. Economic data remains either soft or subdued. Industrial production is for example trading mixed. It has been more than two years since this indicator last released three months of consecutive increases.

The dollar should therefore weaken over the next few weeks as a Fed rate hike will be repriced. A strong FX strategy is to buy/sell dollars when the probability of a hike is reaching a bottom/top. For December we would sell the dollar as a Fed rate hike looks too awaited.

USD/CAD - Monitoring Resistance At 1.3253.

The Risk Today

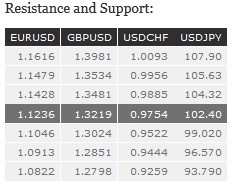

EUR/USD is trading mixed since the recent increase from hourly support given at 1.1123 (31/08/2016 low). Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Strong support can be found at 1.1046 (05/08/2016 low). The symmetrical triangle suggests further weakness. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is moving lower. The pair has broken support implied by the lower bound of the uptrend channel. Hourly resistance is given at 1.3445 (06/09/2016 high). Key resistance is given at 1.3534 (29/06/2016 high). Hourly support is given at 1.3139 (14/09/2016 low). Expected to further decline. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative

USD/JPY is having difficulties to go any lower. Strong resistance can be found at 104.32 (02/09/2016 high). Hourly support is given at 101.21 (07/09/2016 low). A key support lies at 99.02 (24/06/2016 low). Ready to bounce back on symmetrical triangle. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF's medium term momentum is clearly mixed. There are periods of strong and low volatility and the pair seems without direction. Support at 0.9739 (02/09/2016 low) has been broken. Hourly resistance is given at 0.9885 (01/09/2016 high). Next resistance lies at 0.9956 (30/05/2016 high). Expected to further weaken towards support at 0.9632 (26/08/2016 low). In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.