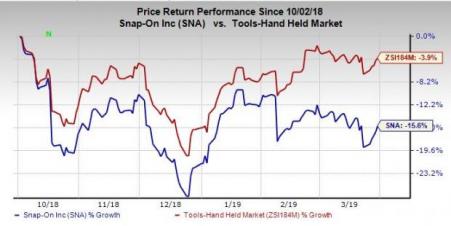

Shares of Snap-On Inc. (NYSE:SNA) have not only declined but also underperformed the industry in the past six months. Notably, this Zacks Rank #4 (Sell) stock has decreased 15.6% in the said time frame compared with the industry’s decline of 4%.

This decline can be attributed to the company's soft sales performance, mostly due to sluggishness in its Tools Group division for quite some time now. Volatility in raw-material prices and negative currency translations also impacted the company’s top line in fourth-quarter 2018.

Let’s delve deeper into the factors affecting the stock.

What’s Hurting the Stock?

Snap-On is grappling with dismal sales trend for the past few quarters. Markedly, sales missed estimates for the third straight time in fourth-quarter 2018. Sales dropped 2.3% in the fourth quarter and lagged estimates, owing to soft organic sales and adverse impacts from currency translations, which were somewhat offset by gains from acquisitions.

Organic sales dipped 0.6% as gains from critical industries and the Asia-Pacific region, and the initial growth in the U.S. van channel were mostly offset by shortfalls in the OEM dealership arena and the international franchise businesses.

These challenges also impacted sales in the Tools Group segment and the International franchise business. In the fourth quarter of 2018, sales in this segment recorded 0.4% decline year over year. Prior to this, the Tools Group segment witnessed sales decline of 0.7%, 0.5% and 1.1% in the third, second and first quarters of 2018, respectively. Although management is making constant efforts to revive performance at the Tools Group division, it is to be seen whether these efforts will bear fruits in the near term.

Efforts to Revive the Stock

Despite such downsides, the company is leaving no stone unturned to get back on the growth trajectory, evident from strategies undertaken. Snap-on has introduced a robust business model that helps enhance the value-creation processes, which in turn improves safety and quality of services, boosts customer satisfaction, and aids product innovation. In fact, the company’s growth strategy focuses on three critical areas — enhancing the franchise network, improving relationship with repair shop owners and managers, and expanding critical industries in emerging markets.

Further, Snap-on is dedicated toward various strategic principles and processes aimed at creating value in areas like Rapid Continuous Improvement (RCI). Notably, the RCI process is designed to enhance organizational effectiveness and minimize costs along with helping Snap-on boost sales and margins, and generate savings. Moreover, management intends to boost customer services along with enhancing manufacturing and supply-chain capabilities through the RCI initiatives and further investments.

3 More Retail Stocks to Bank On

Columbia Sportswear Co. (NASDAQ:COLM) has long-term earnings growth rate of 10.9% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

G-III Apparel Group (NASDAQ:GIII) has long-term earnings growth rate of 15% and a Zacks Rank #1.

Under Armour (NYSE:UAA) has long-term earnings growth rate of 22.7% and a Zacks Rank #2 (Buy).

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

Columbia Sportswear Company (COLM): Free Stock Analysis Report

Snap-On Incorporated (SNA): Free Stock Analysis Report

Original post

Zacks Investment Research