Per a Business Insider report, Snap Inc.’s (NYSE:SNAP) messaging application, Snapchat is being used for recruiting “next generation bankers” from 19 U.S. universities by leading global financial services firm Morgan Stanley (NYSE:MS) . The investment bank was also the lead underwriter of Snapchat’s parent company when it went public on Mar 2, 2017.

Moreover, a geofilter has also been themed on Morgan Stanley that will enable students of these universities to take a picture with it.

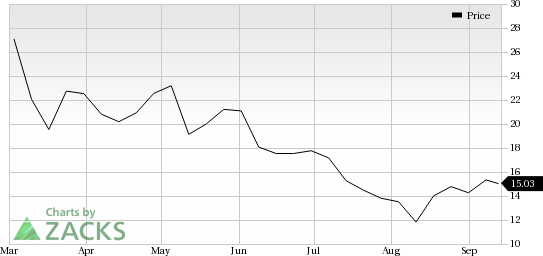

Notably, shares of Snap have lost 38.6% of its value since its listing date of Mar 2, 2017 against 8.5% growth of its industry.

Focus on Boosting Subscriber Base

Snap has been experiencing a slowdown in its user base and revenue growth rates. A decline in user growth may look unattractive to advertisers, the primary source of revenues for Snap, and thereby dampen its growth opportunities.

Interestingly, analysts have related the slowdown in Snapchat’s user growth to the popularity of Instagram Stories, a blatant rip-off of the former’s hallmark feature.

However, per eMarketer’s latest report, this year, Snapchat’s domestic user base is likely to increase 25.8% to 79.2 million driven by a 19.2% increase in users in the 18 to 24 age group. In fact, for the first time, Snapchat is projected to have the highest teen audience (12 to 17 & 18 to 24 cohorts) compared to both Facebook (NASDAQ:FB) and Instagram, per eMarketer.

We believe a big name like Morgan Stanley choosing the platform for recruitment purpose bodes well for the company. Snapchat will be able to lure the students of University of Pennsylvania, Harvard, Villanova, Howard, and all the other 14 colleges where this recruitment strategy is operational.

Social media is being used by most of the companies for recruitment purposes. Per HireRight’s 2017 Benchmark Report, social networking is the fastest growing source of finding and recruiting new hires. Usage of social media platforms like Microsoft’s (NASDAQ:MSFT) LinkedIn (NYSE:LNKD) and Twitter (NYSE:TWTR) for recruitment purposes increased 10% over the last year. Additionally, per HireRight’s 2017 Transportation Employment Screening Benchmark Report, social media’s utilization increased 13% while the use of print media and online job boards declined 6% and 10% compared with the data of the previous year.

This trend bodes well for platforms like Snapchat as it will help it increase its user base. Further, advertisers will also be attracted to the platform if more names like Morgan Stanley choose the platform for such purposes.

Zacks Rank

Snap has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Twitter, Inc. (TWTR): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

Original post

Zacks Investment Research