Snap Inc. (NYSE:SNAP) is partnering with NBC News to produce a twice-daily headline news show, called “Stay Tuned,” for the Snapchat app in a bid to reach the highly sought-after millennial cohort, per media reports.

“Stay Tuned,” which began airing on Jul 19, is a two- to three-minute news broadcast, and marks the first ever daily news show on Snapchat. Topics will include national and international news as well as politics and pop culture.

Reportedly, NBC has put together a team of 30 people on the show, which will be led by executive producer Andrew Springer, and hosted by Gadi Schwartz and Savannah Sellers, correspondents for NBC News and MSNBC, respectively.

The show is supported by sponsorships and advertising – NBC will reportedly share a portion of its ads revenue with Snap.

NBC News’ “Stay Tuned” will feature in the new “Shows” section of Snapchat, which has previously hosted other NBC-owned shows like “The Voice” and E! News’ “The Rundown.”

“Stay Tuned” Targets Millennials

Millennials, also known as Generation Y or the Net Generation, are the demographic cohort consisting of young individuals who are vastly different, given their digital media consumption habits, most apparent in their mobile usage. The show aims to connect with these younger viewers who are no longer attuned to traditional television for getting their news.

Notably, Snapchat is striving to boost its 166 million user base, primarily consisting of millennials. In fact, content partners and advertisers are powerfully allured by Snapchat’s highly engaged, young, mobile audience.

Increased focus for exclusive shows

The program also represents the latest development in Snap's move to bring original content to its platform. The company hopes to air up to three shows per day by the end of the year.

We are positive about Snap's decision to dive in head-first into news, especially as its arch-rival Facebook, Inc. (NASDAQ:FB) is also sprucing up its nascent efforts in the original programming space and recently confirmed launching Paywalled News Subscription Service.

We further note that Snapchat has been adding plethora of new features throughout the last few months, as it continues to face fierce competition from Facebook’s Instagram. Last week, the company announced two new features for its app, Tint Brush and multi-snap recording.

Comcast is still bullish on Snapchat

It is worth mentioning that Comcast (NASDAQ:CMCSA) -owned NBCUniversal invested $500 million in Snap's IPO.

Finally we believe, there is often a “follow the leader” effect – that could draw other big media houses to follow shortly afterwards, thereby opening new revenue channels for Snap.

Zacks Rank and Share Price Movement

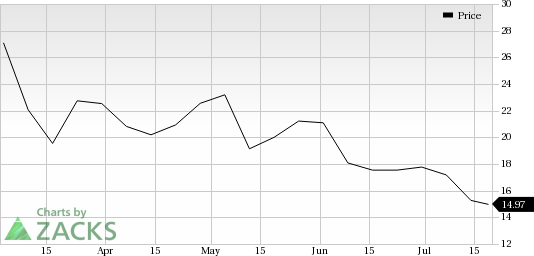

On Tuesday, following a recent downgrade from Morgan Stanley (NYSE:MS), shares of Snap Inc. had dropped below the $15 per share mark for the first time since its historic market debut a few months ago. Snap is down 11.9% since its initial public offering at $17 in March.

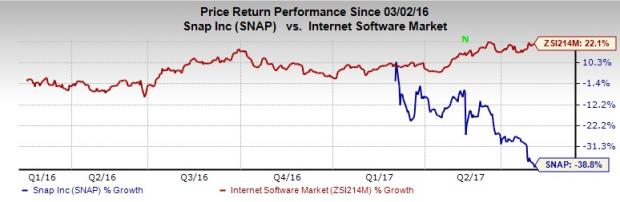

Also, shares of Snap have fallen 38.8% since its IPO on Mar 2, while the Zacks categorized Internet Software industry has gained 22.1%.

Yesterday however, the company’s shares started trading higher following the announcement of the news program and new app features. The stock eventually closed at $14.97.

At present, Snap carries a Zacks Rank #4 (Sell).

Stock to Consider

A better-ranked stock in this industry is Autohome Inc. (NYSE:ATHM) sporting a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) Stocks here.

Autohome has delivered an average positive earnings surprise of 41.38% in the trailing four quarters.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy…

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Facebook, Inc. (FB): Free Stock Analysis Report

Autohome Inc. (ATHM): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Original post

Zacks Investment Research