Snap Inc. (NYSE:SNAP) recently announced that users will be able to share links to certain “Stories” via email or text on snapchat.com, which can be viewed by anyone, irrespective of whether they have a Snapchat account or not.

The new feature is currently available to users in Australia and Canada who have the redesigned Snapchat application. Reportedly, the company aims to roll out this update to iOS and Android users globally in the coming weeks.

Per media reports, Official Stories, Our Stories and Search Stories are the only kinds of Stories that can now be shared. The external links to Official Stories expire after 24 hours while the other two types can be viewed within 30 days.

Snap had announced its plans to bring “Stories Everywhere” feature last month with the appointment of former Storyful CEO Rahul Chopra who will lead the effort. Chopra has also worked with News Corp (NASDAQ:NWSA) as senior vice president and global head of Video.

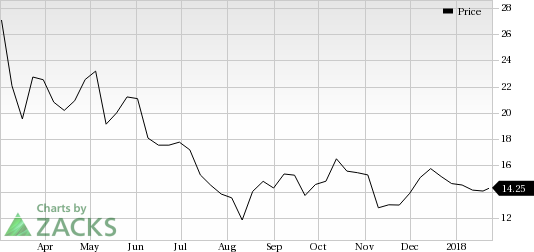

Snap is trying to find luck with such initiatives after a bloodbath on the market. Notably, shares of Snap have lost 36.7% since its listing date of Mar 2, 2017 against 26.1% growth of its industry.

Focus to Aid Growth Amid Growing Competition

Snap’s decelerating user growth rate is a major concern. The company has been struggling to expand its presence, given the robust competition that it faces from arch rival Facebook (NASDAQ:FB) and its photo-sharing platform, Instagram.

Analysts have attributed the slowdown in user growth to the popularity of Instagram Stories, which is a blatant copy of Snapchat’s feature of the same name.

As a matter of fact, media reports have quoted Snapchat “admitting” that increasing competition from big players like Facebook, which have better resources, is a big threat as they can easily lure users to their platform. At the end of November 2017, Instagram Stories had more than 300 million daily active users (DAUs) almost double that of Snapchat’s.

Earlier this month, Facebook began testing a feature that will enable users to share Instagram Stories as WhatsApp status. The company’s attempt to bring the feature to WhatsApp is expected to boost engagement further, which will intensify competition for Snapchat.

Besides, Snapchat has faced severe criticism for its difficult to use and understand platform. Management noted that the application’s need for affordable high-speed Internet connectivity has emerged as a barrier to growth in the rest of the world market. Failure to attract the older generation (above 34 year olds) by focusing only on the younger demographic has also been a major headwind for Snap.

We believe by bringing Stories outside of the application, Snap will be able to target other age groups, increase their interest level and thereby draw more users to the platform.

Zacks Rank

Snap has a Zacks Rank #3 (Hold).

The Trade Desk (NASDAQ:TTD) and Micron Technology (NASDAQ:MU) are two better-ranked stocks in the broader technology sector, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for The Trade Desk and Micron Technology is estimated to be 25% and 10%, respectively.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Facebook, Inc. (FB): Free Stock Analysis Report

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research