There is little evidence that the USA is in recession - except in the goods producing sectors and business sales which are marginally in a decline. Even in the contracting goods producing sectors, the recession evidence is far from overwhelming.

Follow up:

What triggered this post is continued unwavering assertions by some that the USA is NOT in a recession. Understanding the data, historical movements, and data gathering / methodologies - the wise pundit would not assert anything with conviction at this time.

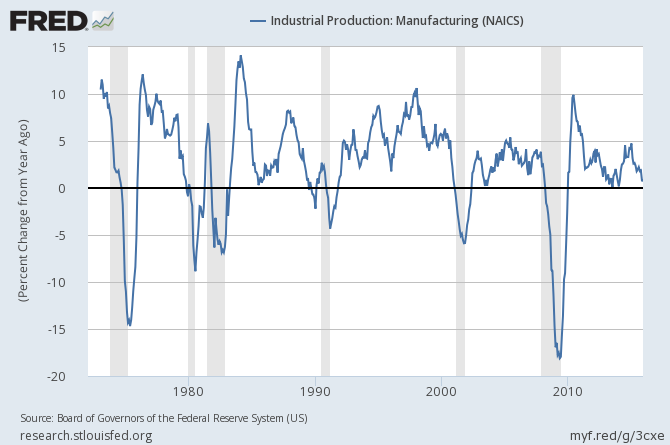

Looking at manufacturing's historical movements, manufacturing can be growing, flat or declining going into a recession. One cannot simply use goods production as a single litmus test of a recession.

And this is not to mention that goods production data is revised for six months up to YEARS after the initial data release.

There is no way for ANYBODY to use most data sources with any confidence in real time. Data collection systems remain in the 20th century - even though real time systems have been possible for almost 20 years - with the USA continuing to use sampling, extrapolation, voodoo seasonality adjustments, and wild guesses in data building until long after the original release date.

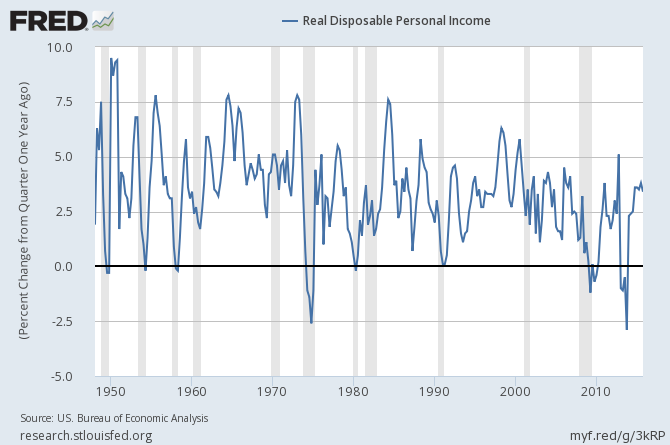

This week personal income data was released for December. As a side note, personal income is one of the four elements used to mark recessions. Here, personal income looks strong - but depending on what causes a recession - even personal income growth rate may be accelerating going into a recession.

I remember arguing with many on Seeking Alpha in 2008 that the USA was in a recession. Overwhelmingly, the data junkies and pundits insisted that there was no recession. It took one year AFTER the recession began for an admission there was a recession. This was the Great Recession and arguably the second worst recession in USA history, certainly in the last 100 years. If that super recession was so difficult to identify in real time, why would anyone argue with conviction that the USA was NOT in a recession now?

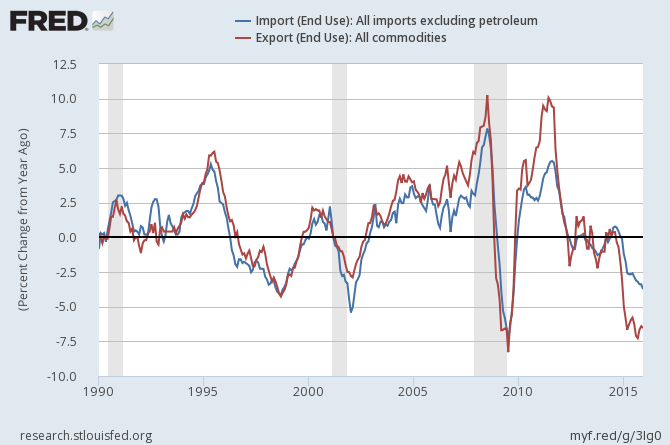

I repeat, there is NO convincing evidence that the USA is in a recession. And I am NOT arguing the USA is in a recession yet. But recession signs are flashing - slowing growth literally across the board and contraction in many data points in the transport sector - and rate of contraction in trade is now close to the days of the Great Recession.

The question I pose is: What dynamic exists to strengthen the economy? Trends continue until they do not. In the current circumstance, plan for the worst, and hope for the best.

Other Economic News this Week:

The Econintersect Economic Index for February 2016 declined again, and is barely positive - and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014.

Current ECRI WLI Growth Index

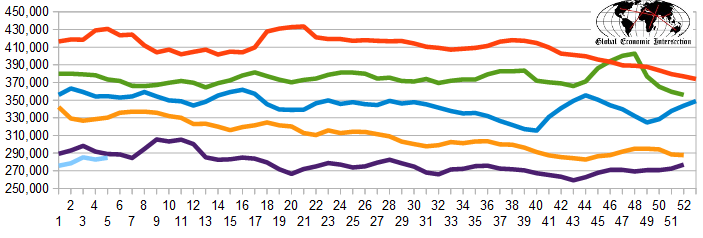

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 274 K to 290 K (consensus 280,000) vs the 285,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 282,750 (reported last week as 283,000) to 284,750. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: SFX Entertainment (O:SFXE), Horsehead Holding (O:ZINC), Wave Systems (O:WAVX) (Chapter 7), Hancock Fabrics (OTC:HKFI), Privately-held Ryckman Creek Resources, Osage

Weekly Economic Release Scorecard: