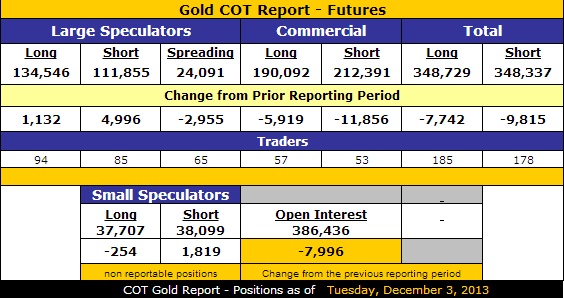

For the 3rd time in 2013 small speculators have moved to a net short position in gold futures (as of Tuesday December 3rd):

The last time the ‘dumb money’ moved to a net short position in gold futures was during the week of July 29th, which happened to be within one week of a significant short/medium term bottom (12%+ rally ensued in August):

In general, CFTC Commitment of Traders data is far from an exact market timing tool, however, it does offer a fairly accurate assessment of how markets are positioned. Moreover, the positioning of small speculators offers a timely contrarian sentiment gauge which has worked fairly well in precious metals over the years.

Those betting on gold to make new lows into year end may be sorely disappointed due to a unique confluence of factors:

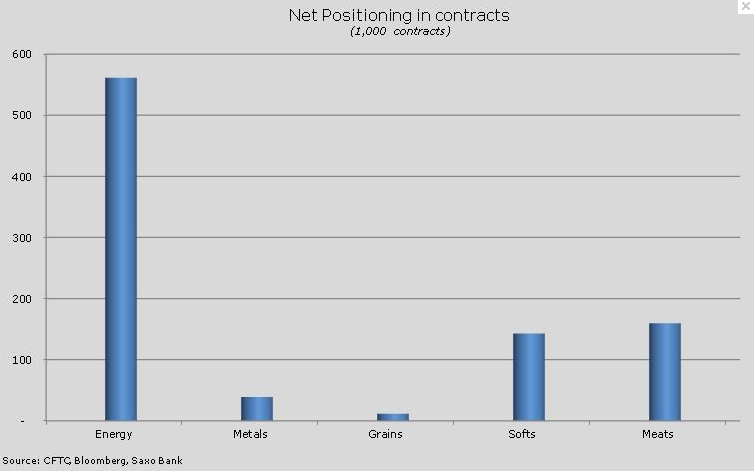

Net long positioning has fallen to its lowest level since 2007

- Net short position among small speculators

- Price failed to make a new low last week despite an increase in bearish sentiment and seemingly strong macro data (negative for gold)

- Strong evidence of a market that is “sold out” as seen via various momentum indicators (Force Index, RSI, etc.)

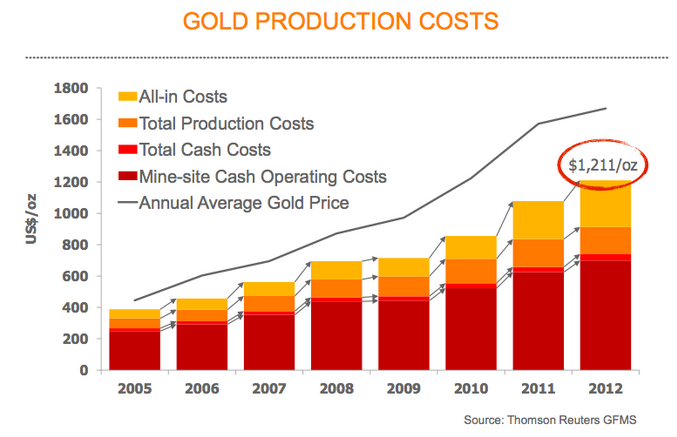

With price supported by marginal all-in cost of extraction just below current levels, there is strong potential for a year end short covering rally

The technical levels to watch in gold are very clear with double-bottom support at $1210 and major resistance between $1250 and $1260 – a move above $1260 could easily set in motion a short covering rally back up to $1300.

Original post