Is the calf being led to slaughter — again?

In the futures market typically the wisest bet is against the small or unreportable speculator (as opposed to the large reportable spec/futures funds and commercial interests). The Commodity Futures Trading Commission (CFTC) releases weekly the composition of open interest for futures markets. You all remember the CFTC, don’t you? They drove the getaway car for the MF Global robbery.

[Note: I am not the expert on the CFTC COT data. That honor, in my opinion, goes to Steve Briese from Malta. Steve publishes his weekly Bullish Review of COT data. You will receive a discounted subscription to Steve's service going to http://bullishreview.com/ and entering the code Factor in the code.]

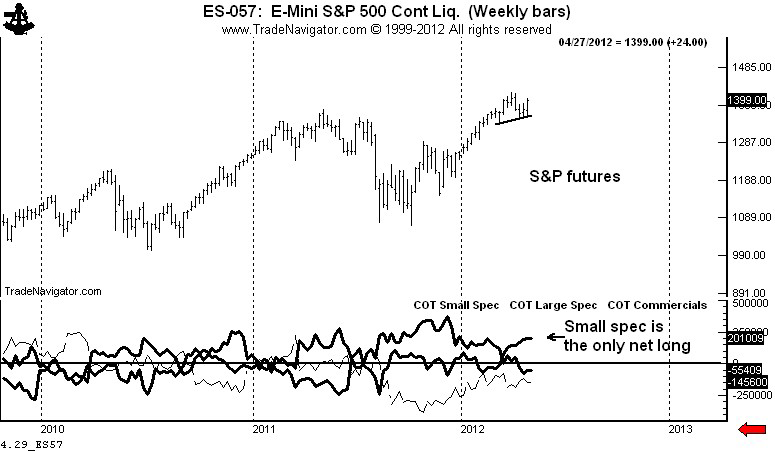

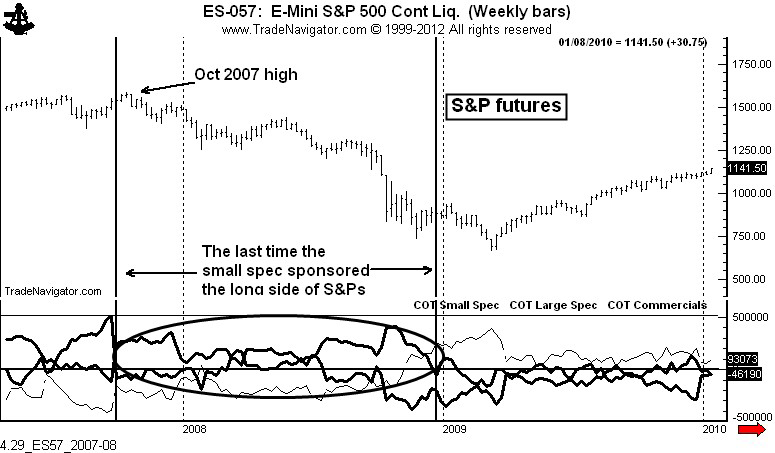

This latest week’s release confirmed a significant development — the small speculator has taken the long sponsorship away from the commercials in S&P futures. With the commercial joining the large specs in now having net short positions, this leaves the small spec as the only net long holder of S&P futures contracts. So, the gun fight at the “CME coral” is between the small spec on one end of the street and the large spec along with the commercial at the end of the street. In my view, this is like a guy with a knive facing off against a 50-cal. machine gun and an F-22.

For full disclosure, you need to know that the small speculators are periodically right in the markets. They don’t always lose. But, as a general practice the small spec is on the losing side, especially when they ARE the sole sponsors of the long side of a trade.

To put this into perspective, the small spec is net long 201,000 contracts representing a net S&P futures ownership equal to $14.1 billion. The small spec has carried a larger net long position in S&Ps. The dates were:

- Dec. 2007

- July 2998

- Early Oct. 2008

Check the chart below to see what the market was doing during these periods. Interestingly, by the time the market bottomed in Mar. 2009 the small spec had become the big short.

The message is NOT that ownership in the hands of the small spec is immediatley bearish. The message is that if prices turn down with the small spec in control of the long positions, look out below. The CFTC COT data are a must follow element of the market.

Personally (and I talking my position), I hope the small spec remains in control. As I view the S&PS as a classical chartist, the current trend is very powerful. The market had attempted to form a H&S top, but the right shoulder high was blown out last Thursday. Only a close below 1357.50 would alter my interpretation. My target on the daily chart is 1455. Perhaps I am just another cow being led to slaughter. MOOOOO!