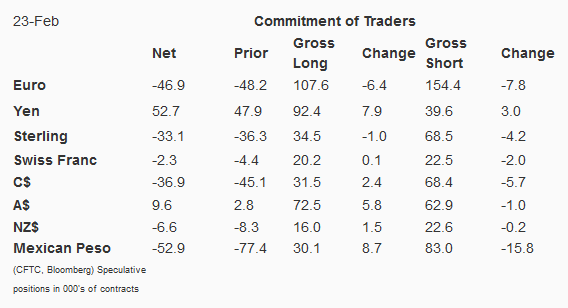

The position adjustment among speculators in the currency futures market were minor in the reporting week that ended February 23. There was only one gross adjustment we regard as significant (more than 10k contracts). The Mexican officials sprung a bear trap and forced speculators to cover. There were 15.8k gross short peso in speculative hands that were bought back, leaving 83k contracts still short.

Despite the minor adjustments elsewhere, two patterns were clear. First, speculators mostly added to gross long currency positions. The euro and sterling were the two exceptions among the eight currency futures we track.

The second pattern is that speculators are reduced gross short positions. Here there is one exception. The bears add 3k contracts to the gross short position, bringing it to 39.6k contracts.

There are a few other observations worth sharing. The net short euro position has been reduced for seven consecutive weeks. Over this period, the net short position has been cut to 46.9k contracts from 160.6k. The net long yen position of 52.7k contracts is a new four-year high. The net short Canadian dollar position of 36.9k contracts is the smallest since November. Speculators maintained the net long Australian dollar position for a second week.

The speculative bears in the 10-year note futures capitulated. They covered 95.2k gross short contracts, the largest squeeze since November, leaving them with 452.9k contracts. The bulls added 29.7k contracts, giving them a gross long position of 537.5k contracts. The result was a swing in the net position from short 40.3k contracts to long 84.7k contracts.

Speculators anticipate oil prices to move higher. The shorts covered 31.5k contracts leaving 327.4k gross short position. The longs added 15.3k contracts, giving them a 533.3k gross long position. The net long position rose 46.9k contracts to 205.9k.