The momentum established by small-cap stocks in 2013 is supporting a continuation in the solid performance of small caps as 2014 unfolds. As expected, the Russell Index shows small caps to be outperforming large caps through the beginning of 2014.

The Russell Developed Europe Small Cap Index presents a January 2014 picture of 2X the growth of the Europe Large Cap Index, 4.2% against 2.1%. Likewise the Russell Global Small Cap Index exhibits in excess of twice the percentage of Global Large Cap growth, 2.5% against 1.2%.

Various small-cap equities are expected to offer continued substantial gain with lower risk than that associated with large-cap equities. The recommended small caps that led the 2013 market in high performance and continue in that strong upward trend in the current year, include Realogy (RLGY), WebMD (WBMD), Cepheid (CPHD) and Horace Mann Educators (HMN).

Realogy (RLGY)

With subsidiaries at the top of the global real estate industry, Realogy experienced a phenomenal 21.2% rise in 2013 third-quarter earnings. The end product of that increase was $1.55 billion. Coldwell Banker, Sotheby’s International Realty, ERA, Coldwell Banker Commercial, Better homes and Gardens Real Estate, Century 21, Corcoran Group and CitiHabitats are its subsidiaries, with branches in over 100 countries. Realogy projects 2014 growth to be in the area of 17% to 19%.

The company is composed of four main departments: Relocation Services, Real Estate Franchise Services, Company Owned Real Estate Brokerage Services and Title and Settlement Services. RLGY provides lenders with a complete line of foreclosed home transactions as well as tending to every aspect of the buyer/seller real estate market, all within the brokerage services segment of the company. By the end of 2012, Realogy had 13,600 franchised offices spanning the entire world, with a total of 238,900 sales associates.

Previously known as Domus Holdings Corporation, in September 2012 the company acquired its current name Realogy Holdings Corporation. The 2013 net income of this entity was $320 million, an increase of $28 million over the net earnings in 2012.

As the economies of the developed regions such as Europe, Japan and the US continue to proceed in a pattern of healthy monetary growth, market analysts predict a 2014 global economic recovery. GDP increases lead to sharp and sustained surges in real estate sales. The perception of an ongoing worldwide economic recovery further enhances and maintains the rise in home sale closings.

The price of Realogy stock as of 02/26/2014 was $46.65 on a volume of 3.8 million, up $1.43 (3.1%) from the previous close of $45.22. The current earnings per share is $3.26.

As the parent company of three enormous entities, Realogy was a participant in 26% of the 2012 real estate firm transactions that took place around the world. The expectation is that this company is poised to continue its growth in 2014.

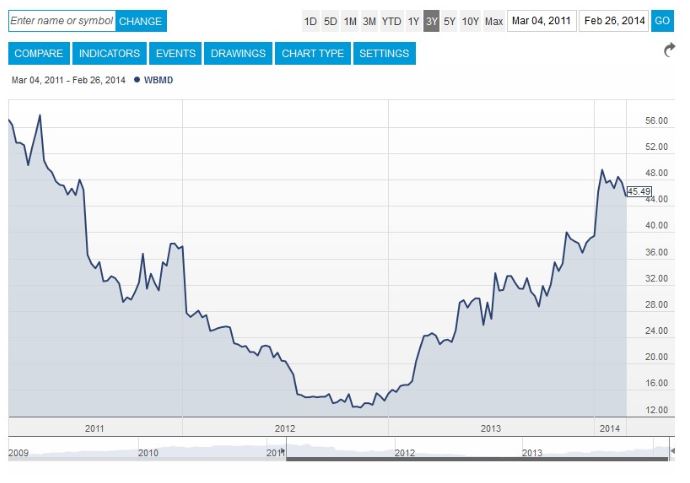

WebMD (WBMD)

Resilience is the name of the game for WebMD Health Corporation. Following a downturn in 2012, WebMD reconstructed a winning format. The company diversified its sources of income, effectuated a major cost-cutting program and overhauled its advertising agenda. The 2013 result was a 144% rise in the stock price. Market analysts project a comparable 131% increase in 2014.

As of 02/26/2014, the price of WebMD was $45.49, up $0.33 from the previous close, on a volume of $1.39 million. In terms of income, the company continues to dig itself out from its 2012 devastation. WebMD expects to achieve a profitable outcome in 2014.

WebMD is an investment opportunity sailing forward on the tailwind of Obamacare. The health corporation is the access initiation for greater than five million members of the Blue Cross/Blue Shield Benefit Plan.

Revenue and per-share earnings both exceeded analyst projects. As to dividends, the expectation for fourth-quarter 2013 had been 18 cents per share; in reality the earnings totaled 23 to 25 cents a share. Sales are expected to reach $130 million to $133 million by the end of the first quarter 2014. The projection had been $128.7 million. The company revenue is running approximately 10% higher when compared to the previous year’s quarter.

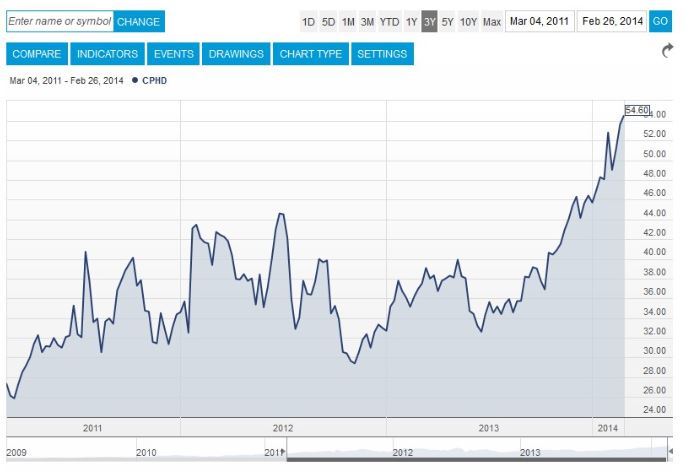

Cepheid (CPHD)

FDA approval often brings with it the threshold of major profits. That approval was garnered by Cepheid in June 2013 in regard to its Xpert MRSA/SA BC test. This molecular diagnostic company developed its BC test for the purpose of detecting sepsis infections in hospital patients. Not surprisingly, the third-quarter 2013 earnings saw a year-over-year increase of 24%.

Cepheid is a $2.7 billion entity that has invented the GeneXpert platform. This system is the most-used program available in the molecular diagnostic field. The CPHD stock rose 25% during the second half of 2013. As of 02/26/2014, the price per share was $54.60, down $0.21 (-0.38%) from the previous close. The current recommendations for Cepheid Inc. at MSN MONEY includes a ‘Strong Buy’ as well as a ‘Hold’.

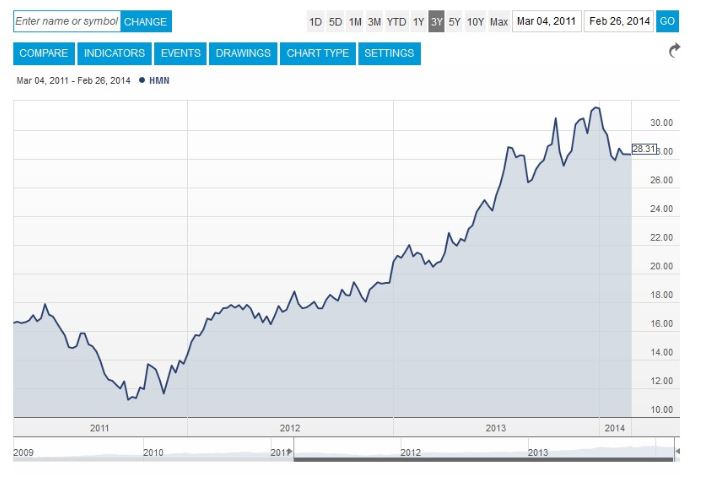

Horace Mann Educators Corp. (HMN).

This education-oriented insurance company has existed for 69 years. 2013 third-quarter assets totaled $8.5 billion, a rise of 4.9% over the same quarter of the previous year. Its clientele includes public grade-school staff throughout the U.S. A total of 3.8 million current and retired school administrators and teachers are covered by HMN. Almost half a million students in higher education are future teachers.

Horace Mann is the largest U.S. educators’ multiline insurance enterprise. Situated throughout the nation, 800 distribution centers provide annuities along with home, auto and life insurance.

While the expected growth of 14% over the next seven years is far from large, the stock of this profitable company carries a low risk. Horace Mann Educators is a recommended small-cap entity, as it is a relatively safe investment and lends itself well to the aim of portfolio diversification.

Investors profit from small-cap companies that follow a strong upward trend and have proven to be resilient, pro-active in the adaptation of industry advancements and diversified in their growth strategies. Such entities are the high-performance leaders in the market.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Small-Cap Momentum Continues

Published 03/12/2014, 10:22 AM

Updated 04/25/2018, 04:40 AM

Small-Cap Momentum Continues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.