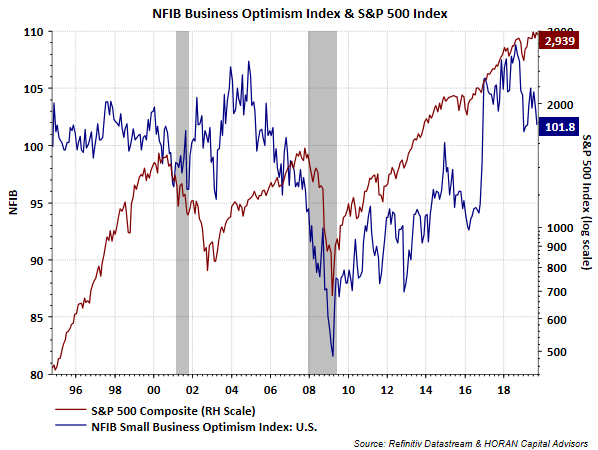

The NFIB Small Business Optimism Index fell 1.3 points to 101.8 for the month of September. Although this is the second decline in as many months, the Index remains at a high level. The NFIB report notes, "The survey shows no sign of a recession and indicated continued job creation, capital spending, and inventory investment, all consistent with solid, but slower growth."

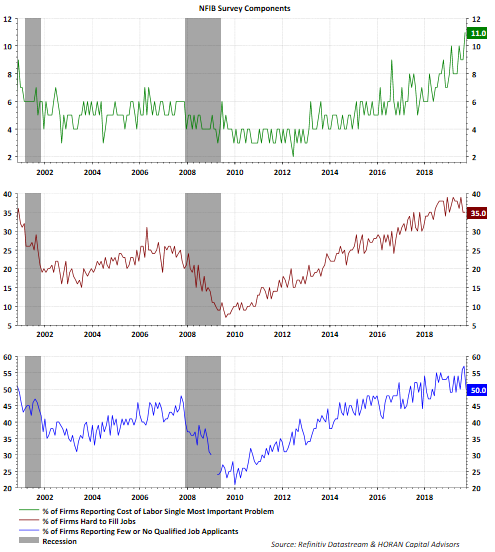

The single most import problem facing businesses is the 'quality of labor.' This has translated into elevated cost of labor as a problem for small businesses. The 11% citing this factor is at the highest level recorded in the survey's history. Hard to fill jobs and few or no qualified applicants remain issues as seen in the below chart.

All in all, small business optimism is holding steady even if down from recent highs. It is the expectations aspect of the survey that causes pause. As noted in earlier posts, we can talk our selves into a recession if the focus is only on the negatives. The report notes, "The perceived environment for expansion and expected business conditions deteriorated further, perhaps the US will indeed talk itself into a recession [emphasis added], but not anytime soon. The persistence of unfilled job openings and reports of a deficiency of job applicants indicates that there is still substantial economic strength optimism about the economy on Main Street."