SM Energy Company (NYSE:SM) recently announced its decision to indefinitely defer its planned sale of Divide County, ND assets.

The company has cited failure of valuations in the sales process to reach the company's threshold to meaningfully reduce its leverage as the reason for the decision.

Moreover, SM Energy has successfully pre-funded the projected capital outspend for 2017–2018 with the completion of the sale of third party-operated Eagle Ford assets. Thus,it no longer needs to divest the Divide County assets.

Based on its decision to retain the Divide County assets, SM Energy has added 1.3 million barrels of oil equivalent (MMboe) to its 2017 production guidance, increasing the projected cash flow and lowering the projected outspend.

Retention of the assets will help the company to witness substantial growth in high-margin production and cashflow. Operating margin is expected to increase by 80% during fourth quarter of 2016 and 2019.

Denver, CO-based SM Energy, previously known as St. Mary Land & Exploration Company, is an independent oil and gas company engaged in the exploration, exploitation, development, acquisition and production of natural gas and crude oil in North America. The company’s operations are focused in five core operating areas in the United States – the ArkLaTex region, the Mid-Continent region, the Gulf Coast region, the Permian Basin region and the Rocky Mountain region.

We expect the company’s attractive oil and gas investments, balanced and diverse portfolio of proved reserves and development drilling opportunities to create long-term value for shareholders. We view SM Energy as one of the most attractive players in the exploration and production space.

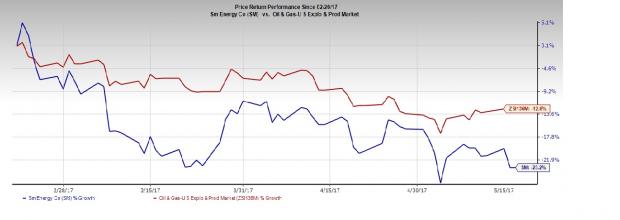

SM Energy’s price chart is unimpressive. Shares of the company have lost 23.2% in the last three months, while the Oil & Gas – U.S. Exploration & Production industry registered a decrease of 12.6%.

SM Energy currently has a Zacks Rank #3 (Hold). Some better-ranked stocks from the same space include SunCoke Energy, Inc. (NYSE:SXC) , Exterran Corp. (NYSE:EXTN) and Canadian Natural Resources Limited Ltd. (TO:CNQ) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SunCoke Energy posted a positive earnings surprise of 120.0% in the preceding quarter. The company beat estimates in two of the four trailing quarters with an average negative earnings surprise of 35.78%.

Exterran posted a positive earnings surprise of 123.21% in the year-ago quarter.

Canadian Natural Resources posted a positive earnings surprise of 30.77% in the preceding quarter. It surpassed estimates in two of the four trailing quarters with an average negative earnings surprise of 275.46%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

SM Energy Company (SM): Free Stock Analysis Report

Exterran Corporation (EXTN): Free Stock Analysis Report

Original post

Zacks Investment Research