On Monday, Jan. 18, Brent continues moving to the downside; the asset is trading at $54.60 amid the oil demand contraction in Europe and a new round of the COVID-related concerns.

According to Bloomberg, the car fuel demand and the road traffic in Europe dropped to their lows since June 2020 due to lockdowns in major economies, which were aimed at reducing the pandemic influence and the coronavirus attack rate. In part, these factors may reach stability a little bit during the cold winter in Europe this year, when households’ needs in energies increase but it’s a local driver.

As opposed to them, a threat of the economic slump due to the coronavirus is quite real and long-term, that’s why prices are going down.

The latest data from Baker Hughes showed that the Rig Count in the USA added 13 units over the week and now equals 373. The indicator has been growing for the eighth consecutive week and that’s another reason to sell oil.

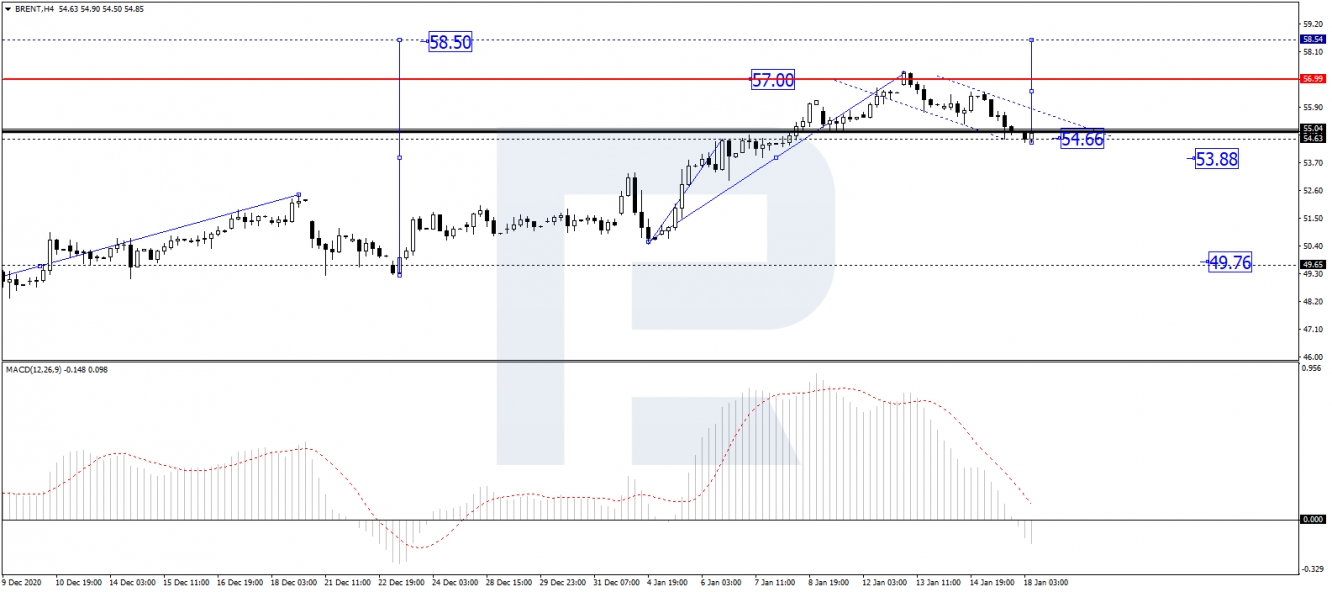

In the H4 chart, after reaching the short-term upside target at 57.00 and then the predicted correctional target at 54.66, Brent is expected to consolidate above the latter level. Later, the market may break this range to the upside and forming one more ascending wave with the target at 58.50. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is approaching 0 and may later rebound from to resume moving to the upside.

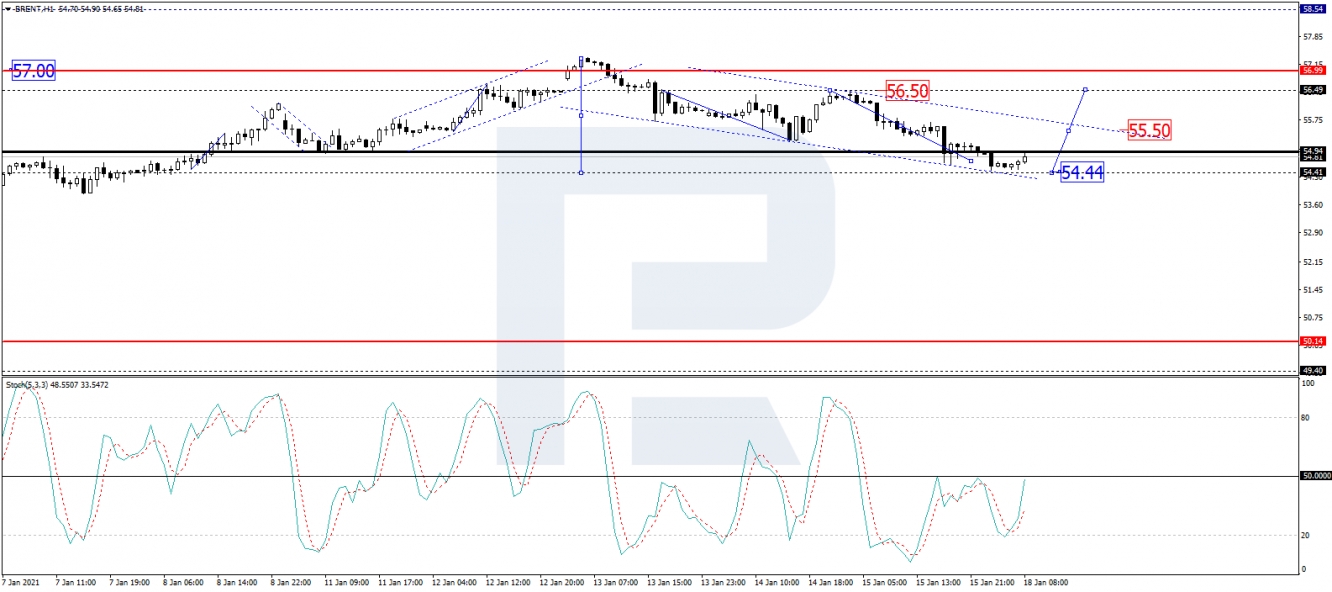

As we can see in the H1 chart, after completing the descending wave at 54.66, Brent is expected to grow to break 55.50 and then continue trading upwards with the first target at 56.50. Later, the market may correct to return to 55.50 and then resume moving within the uptrend to reach 58.50. From the technical point of view, this idea is confirmed by Stochastic Oscillator: its signal line is moving to rebound from 20, which means that the market may reverse to the upside to start a new growth towards 50. After that, the line may break this level as well, thus leading to further uptrend on the price chart.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sluggish Demand Puts Pressure On Oil

Published 01/18/2021, 08:41 AM

Updated 07/09/2023, 06:32 AM

Sluggish Demand Puts Pressure On Oil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.