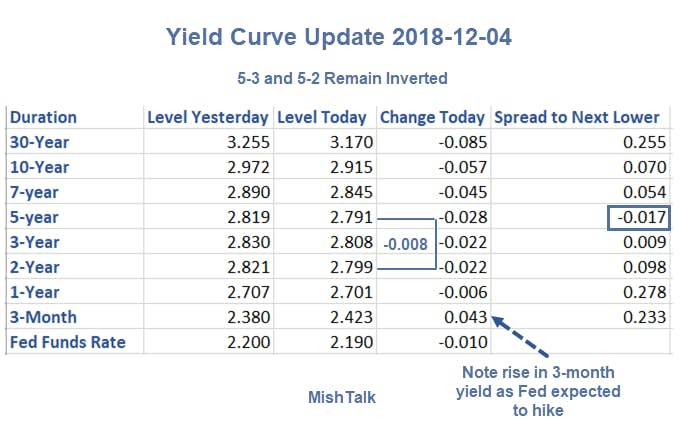

The Fed is expected to hike on Dec 18 and perhaps in Mar 2019. The rise in the 3-month yield reflects that expectation.

The inverted yield curve persists for a second day. It reflects the idea that the Fed is slowly hiking the economy into recession.

Let's take a look at how we got here.

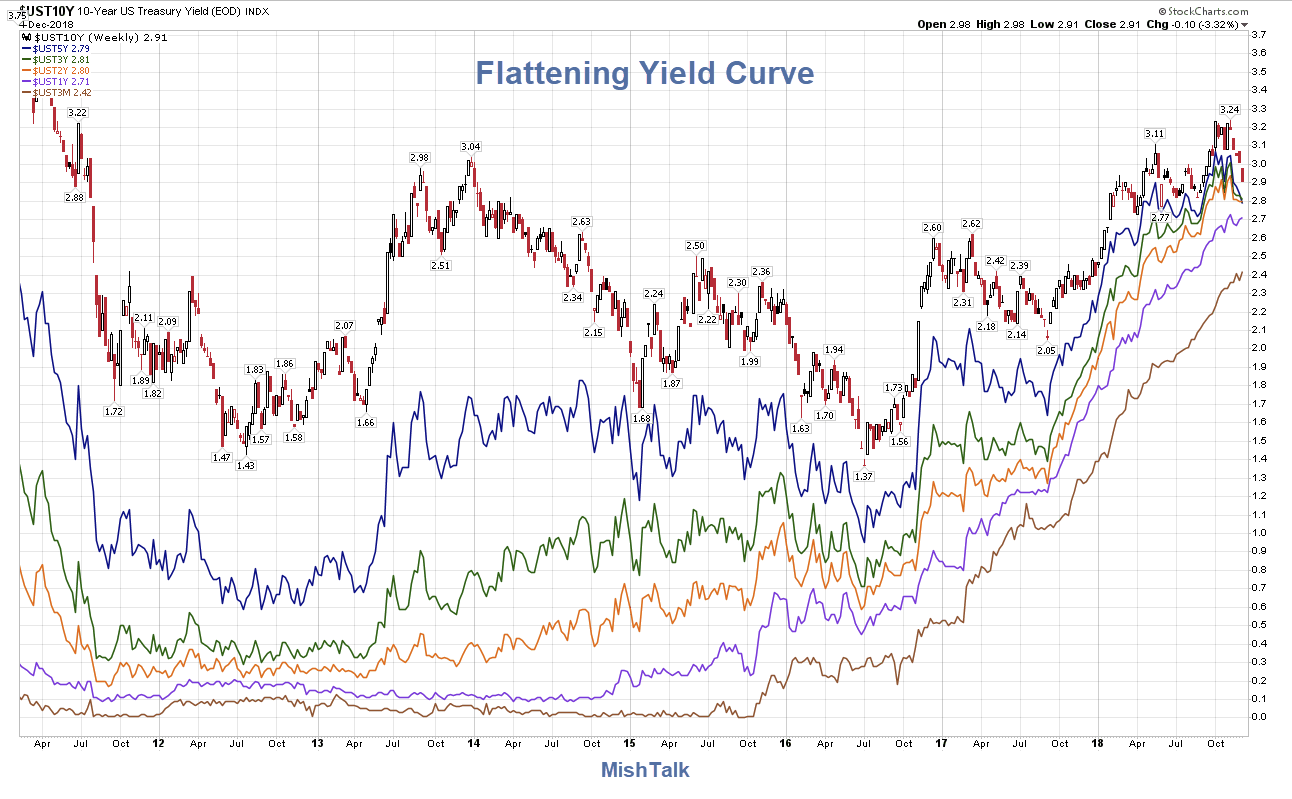

Yield Curve 2011 to Present

Click on the chart for a larger image.

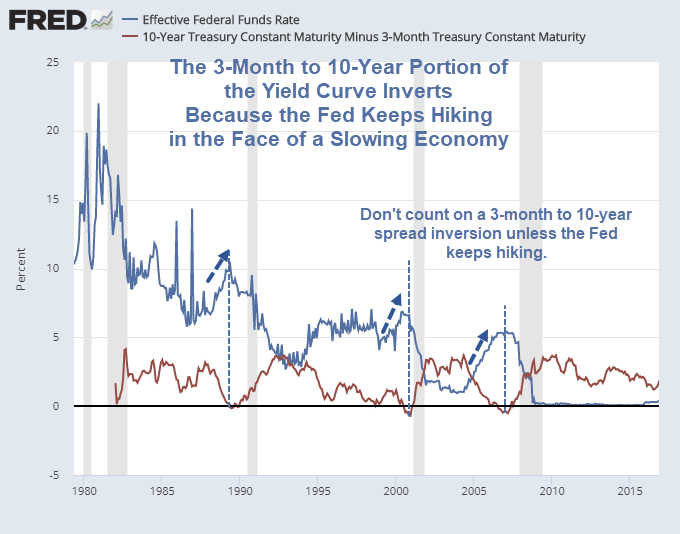

Why the Yield Curve Inverts in One Simple Picture

Earlier today I posted Why the Yield Curve Inverts in One Simple Picture

Here's the chart once again.

Inversion Not a Recession Requirement

Whether or not the 3-month to 10-year spread inverts may very well depend on how many more hikes the Fed gets in.

Nearly everyone seems convinced the bond market will give its standard recession signal in a timely fashion. That is to say, nearly everyone is convinced the two-year to 10-year if not the 3-month to 10-year spread will invert.

Japan has had numerous recessions where its yield curve did not invert at all. The US could easily do the same.

Current Spread

The 3-month to 10-year spread is currently 0.492 percentage points. It may take two rate hikes or more for that portion of the curve to invert.

Don't count on it.

Actually, I expect a recession before that portion of the curve inverts.

Bear in mind, I am not suggesting it is wrong for the Fed to hike. Rather, I suggest there should not be a Fed at all and interest rates should be left to the free market.

The Fed has blown three major bubbles in 18 years.

Mike "Mish" Shedlock