Forex News and Events

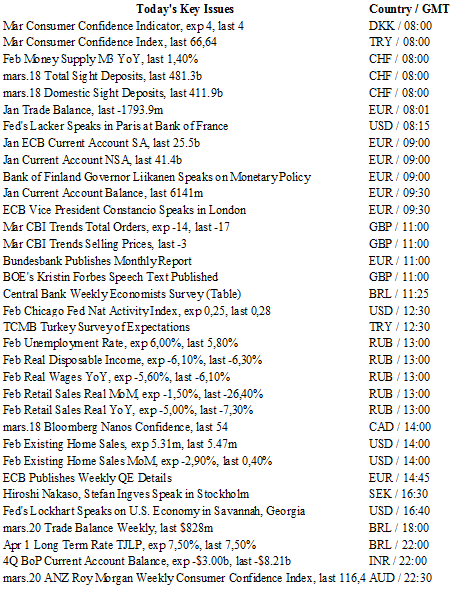

U.S.: Weaker housing data expected

A weekend after the Fed decision to hold rates unchanged at 0.25% to 0.50%, markets do not exclude domestic data. Housing data are closely monitored and we are looking at the ongoing trend as it reflects the health of the U.S. economy. It is true that positive developments have been made over the past year but they are not sufficient to confirm any sustainable recovery. The February figure is expected to be released lower than the January print (5.31ml vs 5.47) but we do not believe it will have a massive market impact today. In our view, the U.S. economy is still very fragile and we are bullish on the EUR/USD as the Fed rate path looks more and more uncertain.

Expect further USD weakness

The surprisingly dovish Fed has put the USD on a back footing and triggered a broad risk rally. This week markets will look for data and Fed speak to support the shallow rate path. Incoming data should indicate that following solid January reads are new data is expected to weaken. February existing homes sales today is expect to show softness after a strong January read. After a downward revision in factory orders, this week durable goods orders should retrace marginally from the strong January read. We don't think the incoming data is strong enough to support policy tightening in light of external weakness. Which will eventually pull US data down. Chinese data for January and February broadly disappointing however, there were some marginal signs that policy support will help growth into 2Q. Even the healthy Chinese consumer eased back a bit. Chinese retail sales dropped below recent trend following a collapse in car sales (partially due to surge in 4Q car sales on temporary sales tax cut). For the US much will depend on how quickly Chinese policy actions can boost domestic demand. A lethargic China makes a hawkish Fed unlikely. Today Fed president Lacker and Lockhart are anticipate to keep hope of June policy tightening alive yet hawkish comments will be balance by tomorrow President Hacker and Evans dovish view. From a risk outlook we suspect that the current risk rally has more room to run. With the Fed taking a divisively dovish turn, ECB implementing significant policy measures and BoJ holding back but still convinced that more negative rates are possible loose liquidity conditions remain dominate. And easy monetary conditions support risk taking most likely in EM currencies. We would reload on high beta currencies with elevated interest rates for a short-term carry trade.

EUR/JPY - Short-Term Weakening.

The Risk Today

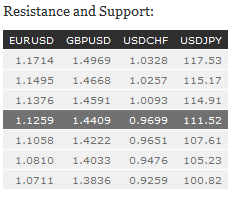

EUR/USD is still riding a short-term uptrend channel. Hourly resistance lies at 1.1376 (11/02/2016 high). Hourly support is given at 1.1236 (intraday low) while stronger support is located a 1.1058 (16/03/2016 low). Expected to show further strengthening. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is now consolidating after last week's sharp increase. Yet, the technical structure is still showing a medium-term bearish momentum. Hourly resistance is given at 1.4514 (18/03/2016 high) while hourly support can be found at 1.4385 (intraday low). A break of strong resistance at 1.4668 (04/02/2016) is needed to show a reverse in the short-term momentum. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has exited its range by breaking hourly support at 110.99 (11/02/2016 low) but the pair has failed to remain below 111.00. Hourly resistance is given at 112.96 (17/03/2016 high). Stronger resistance is given at 114.91 (16/02/2016 high) . Expected to see further consolidation. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is now consolidating after it lost two figures last week. The short-term momentum is clearly bearish. Hourly support can be found at 0.9651 (11/02/2016 low). Hourly resistance is located at 0.9913 (16/03/2016 high). Expected to show further consolidation In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.