A new roundup of nowcasts for US economic activity in the first quarter continue to reflect an ongoing slowdown. Based on the estimates, output in the first three months of 2019 is on track to decelerate again — for the third straight quarter.

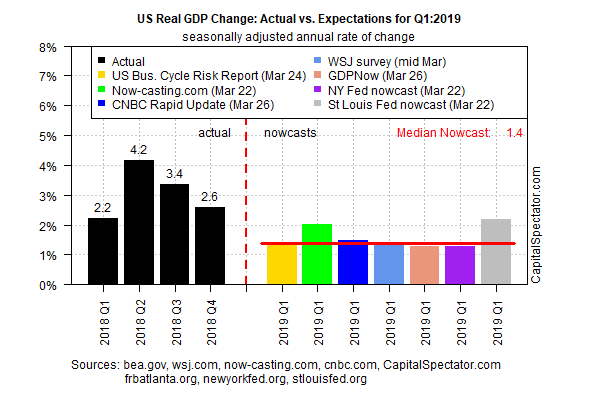

The Bureau of Economic Analysis (BEA) is set to report in late-April that gross domestic product increased by a sluggish 1.4% in Q1 (seasonally adjusted annual rate), based on a set of estimates compiled by The Capital Spectator. The 1.4% Q1 nowcast is unchanged from the previous outlook published earlier in the month.

Assuming that the Q1 nowcast is accurate, output will slide to a pace that’s well below the 2.6% rise in last year’s fourth quarter. (Note: BEA is scheduled to release a revised Q4 GDP report tomorrow (Mar. 28) that’s expected to trim growth for last year’s final quarter to 2.2% via Econoday.com’s consensus forecast.)

The main takeaway is that a slowdown in the US macro trend is alive and kicking – an outlook that’s been reinforced by last week’s inversion of the Treasury yield curve, which is widely seen as a harbinger of an approaching recession. On Friday, Mar. 22, the 3-month Treasury bill rate exceeded the yield on the 10-year Note for the first time since 2007 – a shift that’s considered a sign that an economic contraction is near, although not necessarily imminent.

Credit Suisse’s global chief investment officer, Michael Strobaek, is on board with that view, advising that the Treasury market’s implied economic forecast is relatively reliable. Speaking with CNBC on Wednesday, he said “I’m a bigger believer of the predictability by the bond market. And they’re signaling either a combination of inflation going much lower and, or, growth going much lower.” Although he sees a slowdown and a recession approaching, he’s careful to qualify the outlook by adding that a new downturn may not arrive for two to three years.

Looking out that far in advance is subject to a high degree of uncertainty and so all the usual caveats apply. By contrast, the case is stronger for expecting that growth will remain relatively soft for the near term compared with last year’s economic expansion, which peaked at 4.2% GDP growth in 2018’s Q2.

Last week’s updated economic forecasts from the Federal Reserve align with the softer growth outlook. The central bank revised down its full-year 2019 estimate for output to 2.1% from December’s 2.3% forecast, for example.

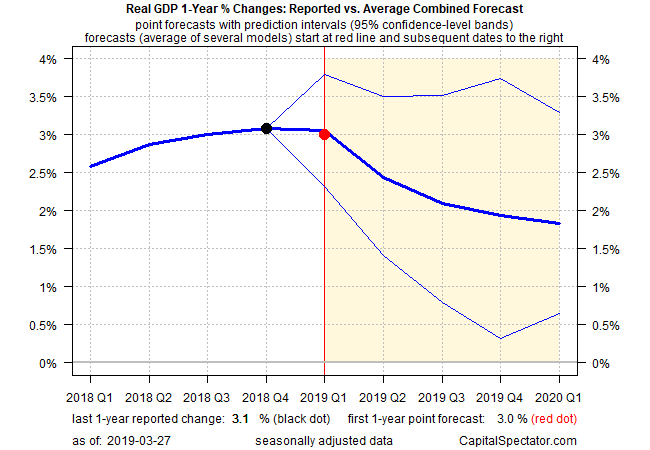

Monitoring the GDP trend on a year-over-year basis via the quarterly data points also suggests that economic activity is on track for a downshift. The Capital Spectator’s average estimate via a set of combination forecasts indicates that the point forecast for this year’s annual first-quarter increase will tick down slightly to a 3.0% pace from 3.1% in Q4 and continue to soften in the quarters ahead. If the forecast is correct, this year-on-year change will tick lower for the first time since 2016’s Q2.

Although the deceleration in growth raises questions about the health of the business cycle, there’s still room for debate about whether an NBER-defined recession is fate in the near term. As discussed last week, recent economic numbers suggest that the slowdown may be stabilizing.

In any case, the odds look moderately encouraging for expecting that the US expansion will stay alive long enough to reach its tenth-year anniversary this June and thereby match the 1991-2001 run, which is currently the longest period of economic growth on record, according to NBER.

The US economy will set a new record for growth if the expansion lasts through July. Forecasting that milestone, however, is subject to a rising level of uncertainty.