A new Celent report on mutual funds in India contends that though the industry there has grown since 2008, it has done so only slowly, and has witnessed the exit of many of its asset managers from the Indian market.

Celent attributes the low-growth numbers to “lackluster equity market conditions and key regulatory changes” that has forced Indian asset managers to navigate “tumultuous waters.” In this tumult, the assets under management reached Rs 7,024 billion (US$131.5 billion) in March of this year. But, that comes as a consequence of an annual growth rate of less than 5.5% since the global financial crisis.

There are four distinct channels for the distribution of mutual fund products in India: banks; large distributors; individual financial advisers; direct sales. Distributors are nonbank financial services, and they account for 31% of assets.

Entry Loads

Celent has favorable things to say about one example of a regulatory change: the Securities and Exchange Board of India has ended the once-mandatory charging of entry loads [the 2.25% commission formerly charged by distributors for the sale of new funds.] Some in the industry believe this has harmed their growth prospects. Celent notes that the transition from an entry load system to a no load system was quite abrupt, taking just six weeks. This may have compounded uncertainties.

Nonetheless, Celent contends that incentivizing distributors by transaction rather than advice encouraged churning of portfolios. The change has had positive consequences, “it is achieving its objective of reducing ‘churning,’ or premature selling of fund investments from retail investors.”

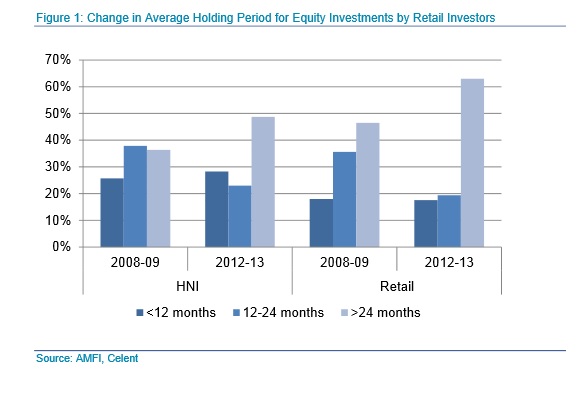

The report infers the reduction in churning from the rise in longer holding periods. For retail investors, the proportion of equity investments for which the holding period has exceeded 24 months has risen from 46% to 63%. For the high net worth individuals, that percentage has also risen markedly, from 36% to 49%.

Geographical Concentration

The report also observes that one of the challenges the industry faces is its geographical limits within India.

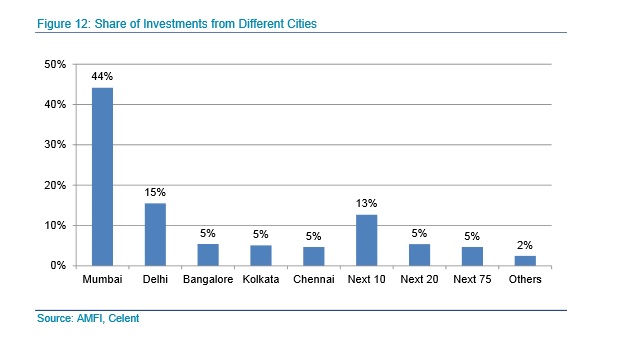

“Currently investments from the top five cities dominate the industry,” accounting for nearly three-fourths its AUM. The top five cities are: Mumbai, Delhi, Bangalore, Kolkata, and Chennai. Mumbai alone accounts for 44% of the AUM. Why is the mutual fund industry concentrated is this way? Celent considers the question briefly and offers three reasons:

Why is the mutual fund industry concentrated is this way? Celent considers the question briefly and offers three reasons:

1)India’s growth in the last two decades has been largely service based, and the services are concentrated in the same cities, so it is natural that the investors, as well as the investment opportunities, are there as well.

2)There has been a migration into those cities from the outlying rural areas.

3)The growth in India, in terms of economic output and levels of income, is likewise to be found there.

Working against this trend of concentration, some of India’s regulatory are working toward geographic inclusion. The Reserve Bank of India, for example, is pressing banks to open more branches, accounts, and automated tellers in remote areas. “SEBI’s attempts to increase the reach of the mutual fund industry can be seen in a similar light,” the report says.

Conclusions

More broadly, the report observes that asset management firms are looking at a number of models that might suit the new environment. Celent believes that firms especially need to focus on improving their operational efficiency. Indian firms have “traditionally lagged in the adoption of technology and processes that increase efficiency of operations.”

It is likely, the report says, that some of the “smaller players” now in the market will disappear over time, since success is scale based.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Slow Growth And Much Tumult For India’s Mutual Funds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.