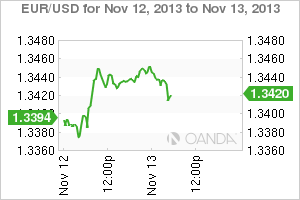

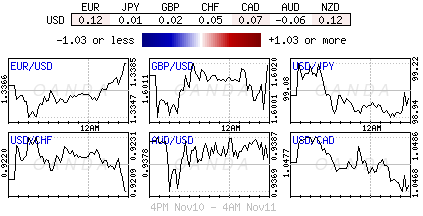

It seems that the forex market want to revisit the popular 'slow grind movement.' Not technically or fundamentally the investors choice, but it's the tight contained trading range that capital markets seems to have become accustomed so far this quarter. Volatility in any asset class is of prime importance, however, even with event risk and thanks to central banks actions and reactions globally, investors are not buying into any market momentum trading as witnessed by low volumes and short squeezes dominating market reaction. EUR/USD" border="0" height="200" width="300">

EUR/USD" border="0" height="200" width="300">

Any market interest in the 17-member single currency is facing this known problem. Overall, investors are 'short' the EUR (long dollars) and for good reason – a dovish ECB versus perhaps, a soon to be, a hawkish Fed. The loss in market momentum is backing "short-squeeze trading," where the weakest of market positions now becomes fresh fodder in either direction. The EUR ascent in the past couple of trading sessions is a good example of the loss of momentum trading.  EUR/JPY" border="0" height="200" width="300">

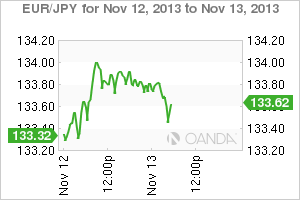

EUR/JPY" border="0" height="200" width="300">

The single currency rise, particularly over the past 24-hours, has been guided by where the weakest of shorts have been placing their stop-losses. The markets conviction to add to their dominant current short positions largely depends on expectations for the timing of the Fed taper. After last weeks surprise NFP print, the market seems to have switched its focus from a March 2014 taper to as soon as next month. However, it’s a long wait until the next US jobs report and to the next Fed meet a week before Christmas. The loss of momentum has the less brave of investors beginning to doubt their convictions and pare some of their primary currency holdings or at least implement tighter stop-losses to positions entered after Euro inflation and US job numbers. A combination of these investor reactions has led to the rise of "slow-grind" trading. Can Janet Yellen, testify in front of the US Senate Banking Committee tomorrow, be able to spin a different tail that brings forex's mojo back?  USD/CNY" border="0" height="200" width="300">

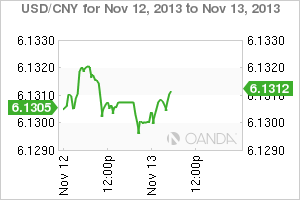

USD/CNY" border="0" height="200" width="300">

Even the blasé trading style is beginning to spill over into other asset classes. In overnight trading, China was considered the primary culprit to lead global equity bourses lower. Investors did not react kindly to the rather vague communiqué from the third plenary session of the 18th Central Committee released overnight. It seems that investors insist on knowing the details, however, when has a communist party ever given the 'free' world all the details? Chinese party leaders, right on cue, preferred to use broad strokes to get their point across – they expect to oversee the transition toward a more "decisive" market role in allocating resources from a "basic" role. However, they neglected to include the how part, and also gave little suggestion on what they would do to deepen fiscal/tax reform – in other words, how they are going to keep the wheels greased.  NZD/USD" border="0" height="200" width="300">

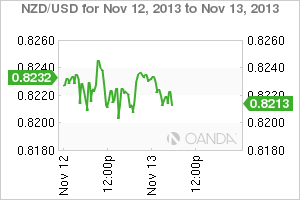

NZD/USD" border="0" height="200" width="300">

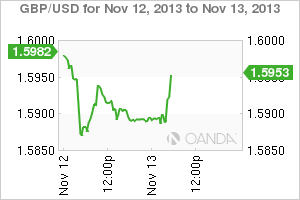

Elsewhere, central banks continue to pursue a policy of covertly weakening your own currency without admitting any responsibility. Yesterday it was Japans Economic Minister who tried to deflect any direct responsibility to manipulating their currency strength via Abenomics. Today, it was the Reserve Bank of New Zealand using reverse psychology on smart investors. RBNZ financial stability report reiterated the kiwi dollar is elevated but affirmed its commitment to start raising rates in early 2014. The transparent stance has done little to fool anyone – the NZD is back to its own contained range for now. As for the well-documented 'patience' trade of choice – short JPY – USD/JPY has kept the pressure on the upside toward parity amid renewed signs that policy momentum was picking up once again in Japan. Option barriers supposedly remain in play at the psychological ¥100 level.  GBP/USD" border="0" height="200" width="300">

GBP/USD" border="0" height="200" width="300">

The pound has found a second gear this morning, comfortably revisiting levels above £1.5900 outright after continued improvement in the UK job market was reported. The UK's unemployment rate fell to +7.6%. It's still above Governor Carney's +7% threshold, but moving in the correct direction and at a faster pace. Analysts expect the improvement to continue given the better than expected claimants count. The forward-looking measure reported a fall of just under -42k last month with a downward revision for the previous month. The weaker inflation numbers reported yesterday took "some of the sting of the numbers today, but raises the pressure on the BoE to communicate that any further tightening of monetary policy is guided by more than just the unemployment rate." The BoE is seen in paving the way for raising interest rates earlier than prior forecast thanks to stronger-than-expected data over the past quarter. However, the outlook for inflation could be revised to show it easing faster than previously expected – benign inflation is a global phenomenon. The market remains bullish sterling, particularly versus the EUR but with potential further downside versus the resurgent dollar.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Slow-Grind Trading Killing Weaker EUR Positions

Published 11/13/2013, 06:44 AM

Updated 07/09/2023, 06:31 AM

Slow-Grind Trading Killing Weaker EUR Positions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.