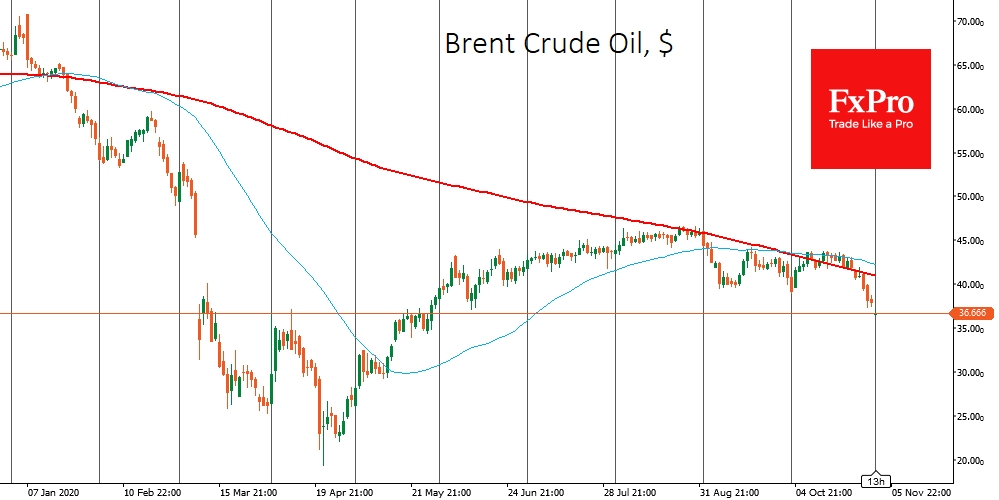

Once again, the oil situation is extremely unfavorable, and news from both supply and demand sides put pressure on quotes as it fell by 3% on Monday, to 5-month lows. So far, technical factors cause us to believe in the temporary defeat of the bulls. A combination of adverse factors brings back on the agenda the possibility of a fast (but short-lasting) sinking of prices to $25 per barrel of WTI and $30 per barrel of Brent.

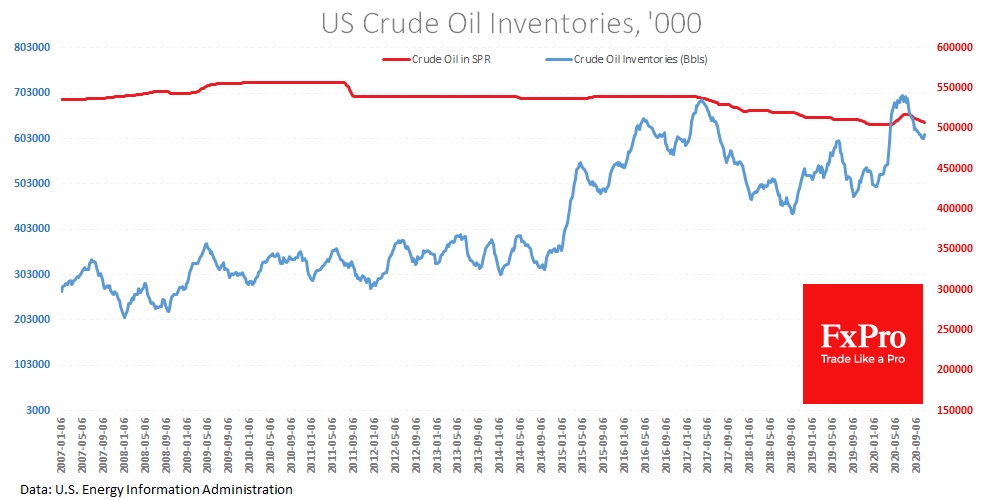

Last week's weekly data showed the biggest inventory increase in 14 weeks, by 4.3 million barrels. The same report reported a rise in production to 11.1 million barrels per day, which is also a return to late July levels. Additionally, a gentle decline is taking place in the Strategic Petroleum Reserve, bringing it back to May levels.

This report has once again highlighted the threat of overstocking the oil market, as we see production and reserves growth that is not so far away from record levels.

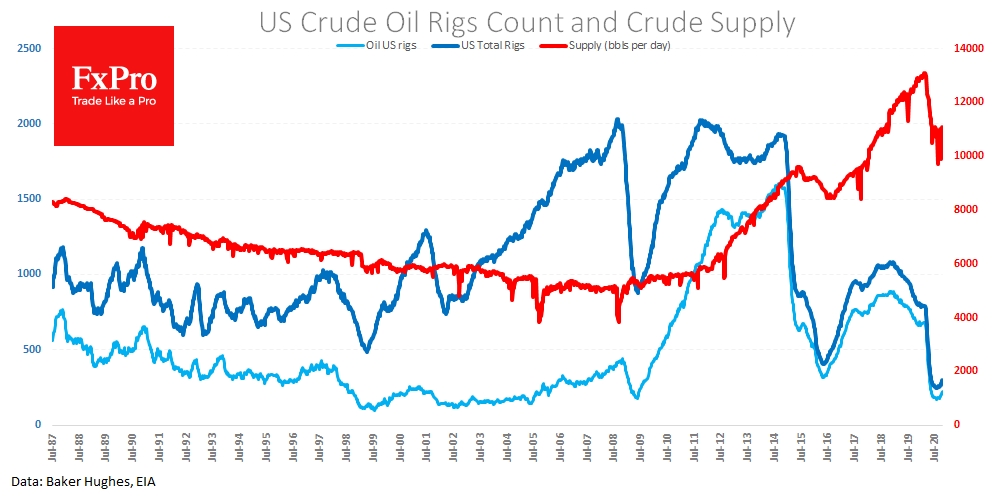

Perhaps the picture is even bearish when considering forecasts on production and consumption. On Friday, Baker Hughes reported new growth in operating oil drilling rigs to 221 (+10 per week) and 296 (oil + gas). These are the highest figures since May, but the most important thing is the positive dynamics, which reflects the attitude of Americans to increase production in the next six months.

Apart from this, OPEC Libya has already reported an increase in its production to 0.8 million barrels per day and confirmed its plan to return to production of over 1 million barrels per day in the coming weeks. This increase will force other OPEC countries to partially reduce their production, demanding the largest contribution from Saudi Arabia and Iran.

However, there is a much larger problem that OPEC needs to address. Record highs of new coronavirus cases in Europe and new lockdowns in the region threaten not only the original plan to raise production quotas at the end of the year, but also to back new cuts on the table if the situation continues to deteriorate.

The cloud around oil has been thickening dramatically over the past week, forcing it to give up several critical technical levels. These factors now further reinforce the sale. For example, Brent and WTI have fallen below the lows of September and early October, reaching their lowest levels since late May.

Both of the most popular oil grades on the stock exchanges were under increased pressure after falling under the 200-day average. This is a clear signal that major players have moved away from the idea of normalising the supply and demand balance.

The new round of pressure may send oil quotes into the area of past consolidation. For WTI, this level is the area around $25, where, in May, we saw a prolonged tug-of-war. Brent was at $30 at the time, which now seems an important psychological level and could be a significant area of support.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Slippery Slope For Crude Oil

Published 11/02/2020, 05:58 AM

Updated 03/21/2024, 07:45 AM

Slippery Slope For Crude Oil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.