Trump's tariff threat hasn't served oil prices well. They folded like a cheap suit. While they're rebounding today, the decline could very well be far from over. How likely is that? Let's find out.

We'll take a closer look at the chart below (chart courtesy of www.stooq.com ).

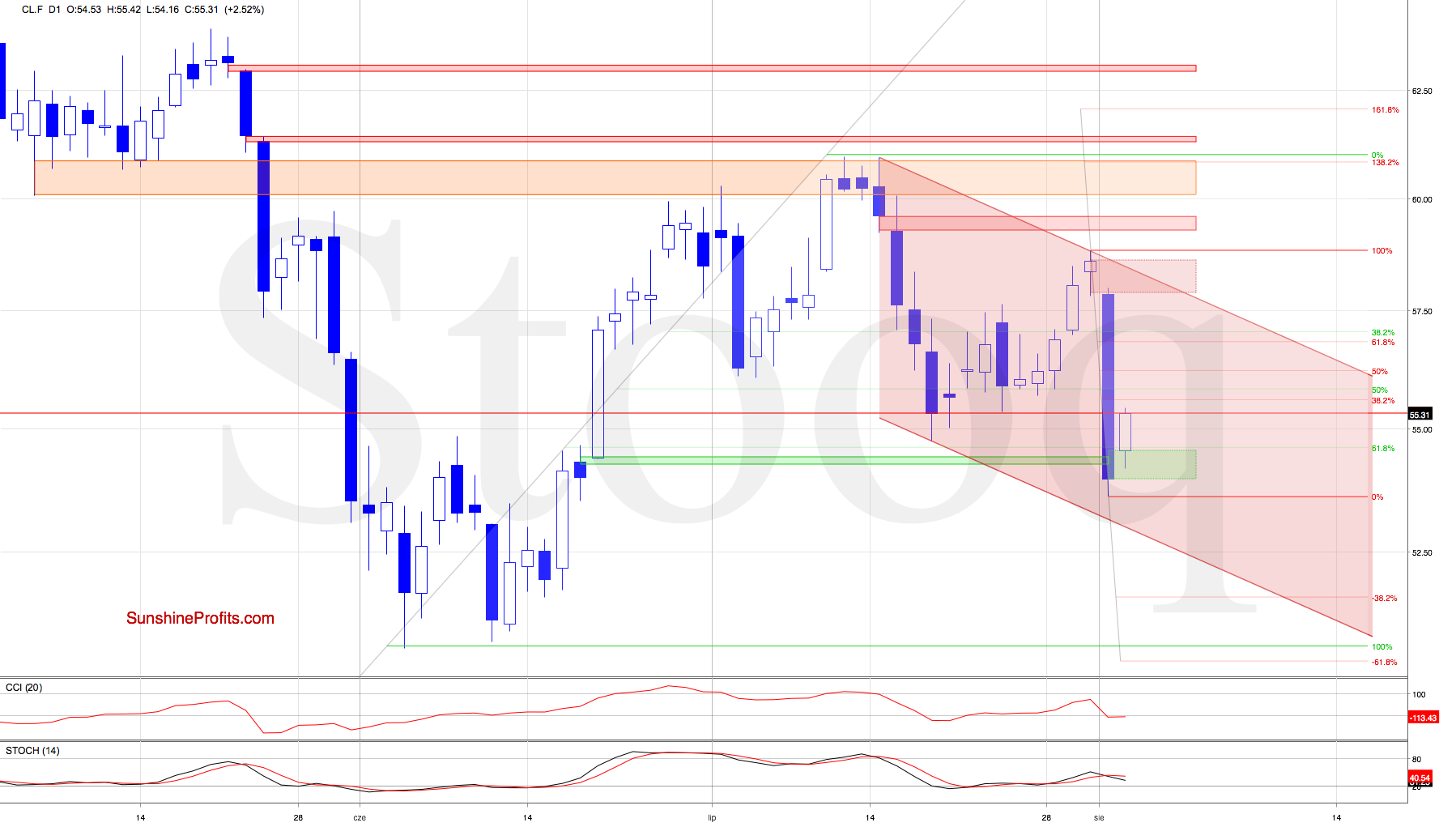

On Wednesday, crude oil futures invalidated the earlier tiny intraday breakout above the 61.8% Fibonacci retracement (based on the decline from July highs to July lows, as marked in our Friday's Alert's chart) and finished the day below it.

Black gold has gapped lower Friday, triggering a sharp move to the downside. This has made our newly opened position immediately profitable.

Thanks to Friday's waterfall decline, crude oil futures not only broke below the mid-July lows, but also below the green gap created on July 20. As a result, the oil bulls lost an important support.

Earlier today, the futures opened with a green gap. While that's bullish on the surface, let's consider the following factors. The magnitude of Friday's slide, the position of the daily indicators (Stochastic Oscillator has renewed its sell signal) and the size of today's rebound, lead us to the conclusion that one more attempt to move lower, aiming to retest Friday's low as a minimum is ahead of us.

What could happen if the bears push the futures below it? Then, their first downside target will be around $53.50, where the June 19 low is. However, if it is broken, the sellers could test the lower border of the red declining trend channel in the coming week (currently at around $53).

Summing up, crude oil's slide Friday has pushed through an important support and today's recovery efforts can't compare to the preceding plunge. A further move to the downside is supported by the reissued sell signal of Stochastic Oscillator. Keeping the profitable short position open is therefore warranted.