Slacking off or $work(ing) hard? What a play on words, but Slack Technologies Inc (NYSE:WORK) mean business and from the get-go are doing things differently. This U.S. software company and popular work messaging service decided not to do an Initial Public Offering (IPO) but rather move forward with a direct listing.

Direct listings might be an alternative approach, but not uncommon as Spotify (NYSE:SPOT) also opted for a direct listing in 2018. Both these brands are world renowned which counts in their favour as is evident in the 48% gain from it’s $26 per share reference price we saw on Slack’s debut. The stock closed at $38.62 per share which evaluated the company over $20 Billion.

What is a direct listing you may ask?

A direct listing allows companies like Slack to go public without selling new shares of its stock. Companies instead bypass the exorbitant fees associated with IPO’s (like roadshows, hiring investment bankers) and begin trading by selling existing shares held by investors, insiders and employees.

Slack’s main objective is to replace traditional methods of communication in the workplace, and for companies adopting a more Agile way of working it fits in perfectly. Slack Technologies Inc. has over 600 000 companies across 150 countries using its service.

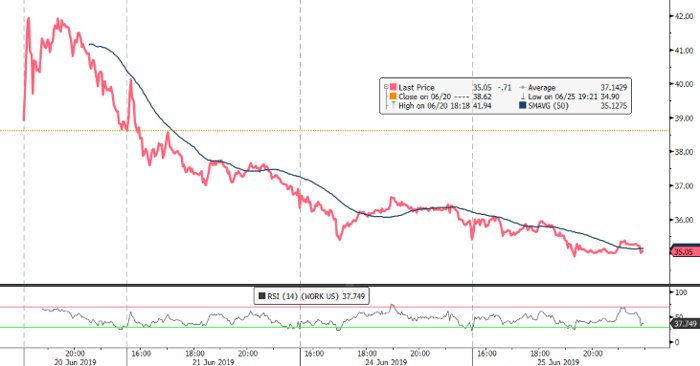

Chart Life:

As software as a service (SaaS) continues to be sought after, we might expect companies like Slack to be a great long-term prospect.

Portfolio particulars:

- Portfolio Buy (Current)

- Portfolio Buy opportunity: around $36.00 per share, might be revised lower.

- Long term Target price: $42.00 per share (Future)

Know your company: Slack Technologies Inc. (Work)

- Slack began as an internal communications tool for Slack CEO and Co-founder Stewart Butterfield’s company Tiny Speck during the development of the online game Glitch.

- He recently joined the Billionaires club with his 8.6% stake in Slack at the opening of the listing day.

- Slack is an acronym for “Searchable Log of All Conversation and Knowledge”

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.