Skyworks Solutions (NASDAQ:SWKS) released its first quarter fiscal year 2015 earnings report on January 22nd. The semiconductor company exceeded guidance for both revenue and earnings per share, sparking a flurry of bullish ratings.

Skyworks posted quarterly revenue of $805.5 million, well above their original guidance of $770 million. The revenue figure represents a 59% year-over-year increase and a 12% sequential increase. This comes after the company’s Q4 report, which also boasted record-breaking results. The report posted earnings per share of $1.26 on a non-GAAP diluted basis, which topped estimates by $0.08 and represented an 88% year-over-year increase.

Looking forward, Skyworks CFO Donald W. Palette anticipates revenue of $750 million, a 56% year-over-year increase, and earnings per share of $1.12 on a non-GAAP diluted basis.

CEO David J. Aldrich noted, “Our business results are being fueled by a global surge in connectivity across a wide-ranging set of applications and by the increase in analog-rich content that is required to power today’s most innovative devices.” The report included several Q1 highlights, most of which were partnerships with other companies such as GM, Samsung, and LG. The report did not mention the flourishing sales of iPhones, seen to be a strong factor in Skyworks’ success because they supply the chips.

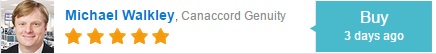

On January 22nd, analyst Michael Walkley of Canaccord Genuity reiterated a Buy rating on SWKS and raised his price target from $78 to $90. Walkley commented, “We believe the strong quarterly results and guidance were driven by very strong iPhone 6 sales with strong Skyworks RF $-content, growing sales of higher $-content Skyworks integrated solutions to Chinese smartphone OEMs, and Skyworks’ growing traction in its non-handset broad markets business.” The analyst continued, “Given Skyworks’ broad RFIC portfolio and customer base, we believe Skyworks’ diverse analog portfolio is enabling content share gains with its smartphone customers. Further, we anticipate Skyworks’ share gains in markets such as WiFi 802.11ac, wireless infrastructure, and the [Internet of Things] market are also driving strong growth trends.”

Michael Walkley has rated Skyworks 13 times since March 2013. He has a 100% success rate recommending the stock and a +76.4% average return per Skyworks recommendation. Overall, Walkley has a 71% success rate recommending stocks with a +23.8% average return per recommendation.

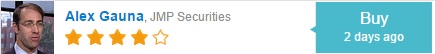

Separately, analyst Alex Gauna of JMP Securities reiterated a Market Outperform rating on Skyworks Solutions with a $95 price target on January 23rd. Gauna attributed the successful quarterly report to “broad-based strength across its diversifying smartphone, analog/mixed-signal, automotive, and Internet-of-Things (IoT) opportunities.” He continued, “After more than doubling in 2014 and advancing 9% YTD (SOX -1%), shares of SWKS were little changed in aftermarket trading in response to the strong result and guidance, and we believe this represents yet another attractive opportunity to buy the stock while it trades at a mid-teens multiple and a discount to its semiconductor peer group, despite demonstrating consistent growth and profitability outperformance.”

Alex Gauna has a 100% success rate recommending Skyworks with a +81.7% average return per SWKS recommendation. Overall, Gauna has a 57% success rate recommending stocks with a +7.2% average return per recommendation.

On average, the top analyst consensus for Skyworks Solutions on TipRanks is Moderate Buy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Skyworks Solutions Q1 Report Beats Guidance

ByTipRanks

AuthorSarah Roden

Published 01/25/2015, 08:53 AM

Updated 05/14/2017, 06:45 AM

Skyworks Solutions Q1 Report Beats Guidance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.