Skyworks Solutions Inc (NASDAQ:SWKS) was upgraded by investment analysts at Vetr from a "buy" rating to a "strong-buy" rating in a research note issued to investors on Tuesday, MarketBeat.com reports. The brokerage presently has a $116.28 target price on the semiconductor manufacturer's stock. Vetr's price objective would indicate a potential upside of 12.57% from the stock's current price.

A number of other brokerages have also recently weighed in on SWKS.

Craig Hallum boosted their price target on shares of Skyworks Solutions from $110.00 to $120.00 and gave the company a "buy" rating in a research report on Friday, April 28th. Pacific Crest raised shares of Skyworks Solutions from a "sector weight" rating to an "overweight" rating and set a $120.00 price target for the company in a research report on Tuesday, April 4th.

BidaskClub cut shares of Skyworks Solutions from a "strong-buy" rating to a "buy" rating in a research report on Thursday, June 29th. Argus initiated coverage on shares of Skyworks Solutions in a research report on Thursday, July 6th. They issued a "buy" rating and a $120.00 price target for the company.

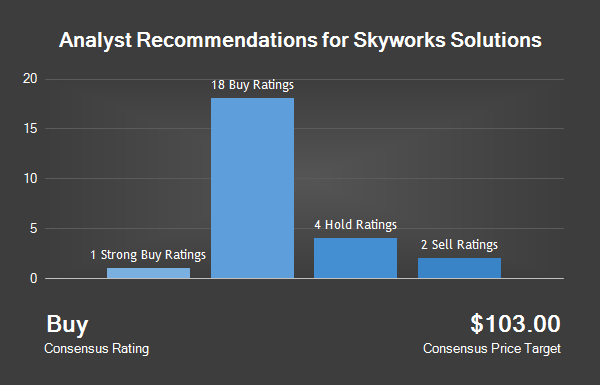

Finally, Charter Equity reissued a "buy" rating on shares of Skyworks Solutions in a research report on Monday, March 20th. Two investment analysts have rated the stock with a sell rating, six have assigned a hold rating, nineteen have issued a buy rating and three have assigned a strong buy rating to the company. The company presently has a consensus rating of "Buy" and an average price target of $102.93.

Skyworks Solutions opened at 103.30 on Tuesday, MarketBeat.com reports. The stock has a market cap of $19.06 billion, a price-to-earnings ratio of 21.29 and a beta of 0.81. Skyworks Solutions has a 52 week low of $62.40 and a 52 week high of $112.11. The company has a 50-day moving average price of $104.22 and a 200-day moving average price of $94.94.

Skyworks Solutions last issued its earnings results on Thursday, April 27th. The semiconductor manufacturer reported $1.33 EPS for the quarter, topping analysts' consensus estimates of $1.30 by $0.03. Skyworks Solutions had a net margin of 27.27% and a return on equity of 28.00%. The firm had revenue of $851.70 million during the quarter, compared to the consensus estimate of $840.43 million. During the same quarter in the previous year, the firm posted $1.25 earnings per share. The company's revenue was up 9.9% compared to the same quarter last year. Equities research analysts anticipate that Skyworks Solutions will post $6.32 EPS for the current year.

In other news, insider Liam Griffin sold 21,000 shares of the stock in a transaction that occurred on Monday, May 1st. The shares were sold at an average price of $100.25, for a total value of $2,105,250.00. Following the sale, the insider now directly owns 74,782 shares in the company, valued at $7,496,895.50.

The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, VP Robert John Terry sold 3,233 shares of the stock in a transaction that occurred on Monday, May 1st. The shares were sold at an average price of $100.26, for a total transaction of $324,140.58. The disclosure for this sale can be found here. Insiders sold 93,458 shares of company stock worth $9,512,091 over the last quarter. Company insiders own 0.49% of the company's stock.

Several hedge funds have recently added to or reduced their stakes in SWKS.

BancorpSouth Inc raised its stake in Skyworks Solutions by 0.7% in the third quarter. BancorpSouth Inc now owns 3,219 shares of the semiconductor manufacturer's stock valued at $245,000 after buying an additional 21 shares in the last quarter. Winslow Evans & Crocker Inc. raised its stake in Skyworks Solutions by 3.3% in the second quarter. Winslow Evans & Crocker Inc. now owns 1,085 shares of the semiconductor manufacturer's stock valued at $104,000 after buying an additional 35 shares in the last quarter.

New England Research & Management Inc. raised its stake in Skyworks Solutions by 0.8% in the third quarter. New England Research & Management Inc. now owns 5,950 shares of the semiconductor manufacturer's stock valued at $453,000 after buying an additional 50 shares in the last quarter.

Cleararc Capital Inc. raised its stake in Skyworks Solutions by 1.1% in the first quarter. Cleararc Capital Inc. now owns 4,544 shares of the semiconductor manufacturer's stock valued at $445,000 after buying an additional 50 shares in the last quarter.

Finally, Norinchukin Bank The raised its stake in Skyworks Solutions by 0.6% in the third quarter. Norinchukin Bank The now owns 10,038 shares of the semiconductor manufacturer's stock valued at $764,000 after buying an additional 59 shares in the last quarter. Institutional investors and hedge funds own 81.27% of the company's stock.

Skyworks Solutions Company Profile

Skyworks Solutions Inc designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets.