flutiform performing to expectations

The focus is now on flutiform; its performance (particularly in Europe) will define Skyepharma's, (SKP) future. The trading statement confirms the sales uptake in Europe is still matching Mundipharma’s expectations. Launch preparations for Japan, and other markets, are underway and planned for 2014. These, admittedly, still-early signs augur well for the refinancing of any remaining debt when the 2017 bond repayment is due.

Operational factors are now the key

With the debt and interest repayments now better aligned with the expected cash inflows, Skyepharma’s prospects hinge on commercial rather than financial factors. Revenues arise from royalties on 14 products; however, despite this broad portfolio, the investment case rests on the success of flutiform. This one product is expected to contribute over half Skyepharma’s royalty income by 2017, as well as profit from a manufacturing and supply agreement.

Flutiform launch roll-out continuing

flutiform is an inhaled combination of fluticasone and formoterol for treating asthma, and its progress in Europe is rightly the focus of investor attention. flutiform has been approved in 21 European countries and launched in 12. Further launches, including in France, are expected in 2014. Kyorin, the Japanese partner, has received approval and is also expected to launch next year. Sanofi, the partner for Latin America, has begun filings for approval with first launches over 2014-15.

Forecasts for FY13 and FY14 are reduced

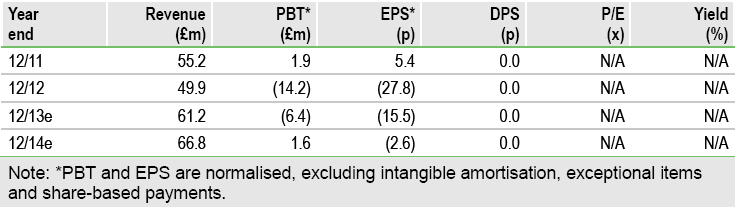

The disagreement with Aenova over the lease on the Lyon manufacturing site shows no signs of amicable agreement and has been referred to an external adjudicator. The uncertainty means we have removed all expected rental income from our model. This, together with shifting the €3m milestone for the launch of flutiform in France to FY14, means we have reduced both our FY13 and, to a lesser extent, FY14 expectations. These are detailed in the Financials section.

Valuation: Equity holders now share in upside

Following the trading update we have made a number of changes to our forecasts. Our valuation is now 189p a share, which compares to our previous 198p per share. We value Skyepharma using a DCF model based on individual product sales projections through to 2024. This yields an enterprise value of £203.0m, which, after adjusting for net debt, results in an equity value of £87.2m, or 189p per share.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Skyepharma: Forecasts For FY13 And FY14 Are Reduced

Published 10/15/2013, 07:39 AM

Updated 07/09/2023, 06:31 AM

Skyepharma: Forecasts For FY13 And FY14 Are Reduced

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.