Clothing retailer Abercrombie & Fitch Company (NYSE:ANF) is slated to report first-quarter earnings before the market opens tomorrow. Abercrombie stock is down 7.1% at $23.91 at last check, pressured by a post-earnings drop for sector peer American Eagle Outfitters (NYSE:AEO). However, ANF shares have a history of positive earnings reactions, which could help send the retail stock on its next leg higher.

In fact, ANF stock has closed higher in the session following each of the company's last five reports, averaging a gain of 15.2%. Widening the scope, the stock has averaged a one-day post-earnings swing of 15.7% over the past two years, regardless of direction, in line with what the options market is pricing this time around, per data from Trade-Alert.

Another post-earnings move to the upside could have analysts re-evaluating their ratings on the equity. Fourteen firms currently follow ANF, 11 of which maintain a "hold" or "strong sell" rating -- leaving the door wide open for more upgrades. Further, the stock's average 12-month price target of $22.54 stands at a more than 5% discount to present trading levels.

The retail stock is heavily shorted, too, with the 14.6 million shares sold short representing nearly 22% of the available float. At ANF's average daily trading volume, it would take more than a week for shorts to cover their bearish bets -- meaning there's ample fuel for a short-squeeze rally.

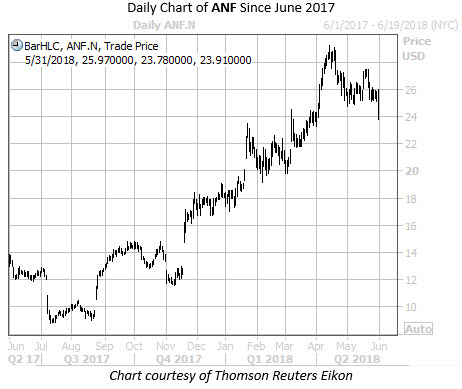

Taking a closer look at ANF's technical backdrop, the clothing stock has been on a tear over the past 12 months, gaining 81%, and touching a two-year high of $29.20 on April 13. More recently, the security has been consolidating near the $24 region, home to its March highs.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI