Investing.com’s stocks of the week

It's been a pretty quiet stretch for Ulta Beauty Inc (NASDAQ:ULTA) stock, per its 60-day historical volatility of 26.7% -- in the 22nd annual percentile. The options market is bracing for big swing on Friday, after the cosmetics retailer takes its turn in the earnings confessional after the market closes tomorrow, Dec. 5.

Specifically, Trade-Alert currently places ULTA stock's implied earnings deviation of 7.6%. This is more than the 4.7% next-day move the equity has averaged over the last two years. Those post-earnings reactions have been mixed, though the security most recently surged 6.4% after its August report. And only two of those performances were large enough to match or beat what's expected this time around -- a 7.6% pop in March and a 9.1% decline in August 2017.

It appears options traders have been positioning for a downside move. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), ULTA's 10-day put/call volume ratio of 1.00 ranks in the 74th annual percentile, meaning puts have been bought to open over calls at a quicker-than-usual clip.

Skepticism has spiked outside of the options pits, too. Short interest on Ulta Beauty is up more than 76% from its June annual low to 3.14 million shares -- surging 28.5% in the last two reporting periods alone. ULTA stock's ability to rally to new highs in the face of such intense selling pressure speaks to its underlying strength.

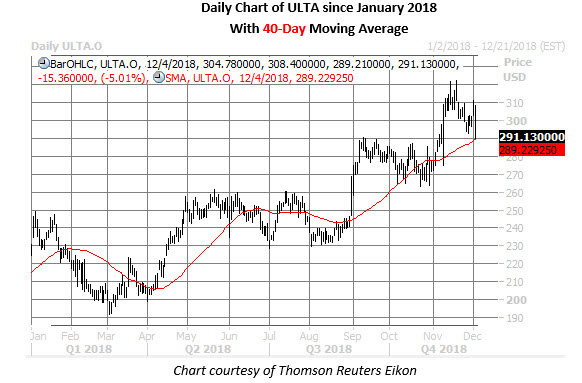

In fact, ULTA stock tagged that record high of $322.49 just over two weeks ago on Nov. 19. While the shares have pulled back from this notable peak, they appear to have found a foothold at their 40-day moving average and a trendline connecting a series of higher lows since August. Ulta Beauty shares closed last night at $291.13, up 30.2% in 2018.