Cleveland-Cliffs Inc. (NYSE:CLF) will report earnings ahead of the open tomorrow, July 19. The mining name is coming off back-to-back positive earnings reactions -- with the stock jumping 2.3% and 8.5% the day after the firm's April and February reports, respectively -- but today's options traders are betting against the trend.

At last check, 2,563 CLF puts were on the tape, nearly three times what's typically seen at this point in the day. Most of the action has centered at the July 10.50 put, where it looks like new positions are being purchased for a volume-weighted average price of $0.28. If this is the case, breakeven for the put buyers at tomorrow's close, when the front-month options expire, is $10.22 (strike less premium paid).

Skepticism has been ramping up outside of the options arena, too. Short interest on CLF jumped 11% in the most recent reporting period to 71.67 million shares -- the most since May 2015. This accounts for one-quarter of the equity's available float, or 7.6 times the average daily pace of trading.

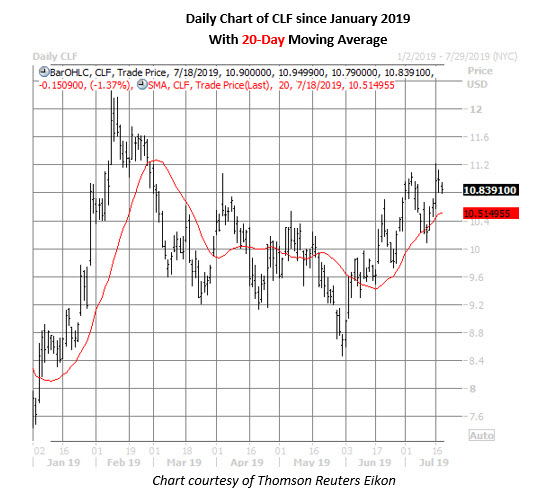

Such low expectations levied toward a stock that's up 41% year-to-date opens the door for more gains, especially if Cleveland-Cliffs turns in another well-received earnings report. More recently, the shares have surged 28% since bouncing off the $8.50 level in late May, with recent support emerging at their rising 20-day moving average. Today, CLF is down 1.4% at $10.84.

Looking closer at CLF's earnings history, the mining stock has averaged a 6.4% post-earnings move over the last eight quarters, regardless of direction. In addition to the two positive reactions mentioned above, Cleveland-Cliffs jumped 12.7% the day after earnings this time last year. The options market is pricing in an 11.1% swing for tomorrow's trading, per implied earnings deviation data from Trade-Alert.