Skechers U.S.A (NYSE:SKX) just released its fourth quarter fiscal 2017 financial results, posting earnings of 21 cents per share and revenues of $970.6 million. SKX is trading up 4.7% to $40 a share shortly after the report was released.

Currently, SKX is a #3 (Hold) on the Zacks Rank, and earnings estimate revisions are on a slight upward trend for the next few quarters.

Skechers:

Beat earnings estimates. The shoe maker posted adjusted earnings of 21 cents per share, topping the Zacks Consensus Estimate of 13 cents per share. Gross profit for the quarter was $454.1 million for the quarter.

Beat revenue estimates. The company saw revenue figures of $970.6 million, soaring past our consensus estimate of $879.07 million and growing 27% year-over-year.

Company-owned global retail sales increased 25.8%, while comparable same store sales grew 12% globally.

Gross margin for Q4 was 46.8%.

For the first quarter of 2018, Skechers anticipates sales in the range of $1.175 billion to $1.2 billion, and diluted EPS in the range of 70 cents to 75 cents.

“2017 was a monumental year for Skechers as we achieved sales of more than $4 billion for the first time in our 25-year history,” said Robert Greenberg, Skechers chief executive officer. “This growth is due to our continued focus on efficiencies and infrastructure as well as innovation, comfort, and relevancy within our product design.”

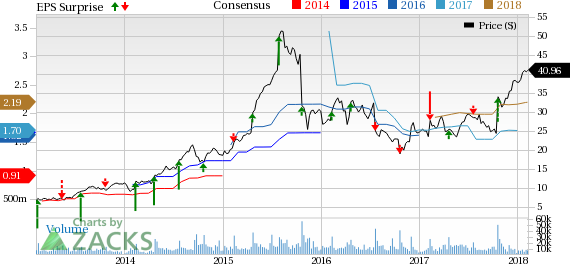

Here’s a graph that looks at Skechers’ price, consensus, and EPS surprise:

Skechers designs, develops and markets a diverse range of lifestyle footwear for men, women and children, as well as performance footwear for men and women. Skechers footwear is available in the United States and over 160 countries and territories worldwide via department and specialty stores, more than 2,305 SKECHERS Company-owned and third-party-owned retail stores, and the Company's e-commerce websites. The Company manages its international business through a network of global distributors, joint venture partners in Asia and the Middle East, and wholly-owned subsidiaries in Canada, Japan, throughout Europe and Latin America.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

Skechers U.S.A., Inc. (SKX): Free Stock Analysis Report

Original post

Zacks Investment Research