Generally a company pays its dividend four times a year, but some stocks (over 300) pay dividends on a monthly basis. Maybe some people feel richer when they get more dividend checks over the year. I personally don't care about the payment periods of the company. I only look at the total annulized yield and I often try to buy the stock before the ex-dividend date in order to receive the next dividend sooner than later.

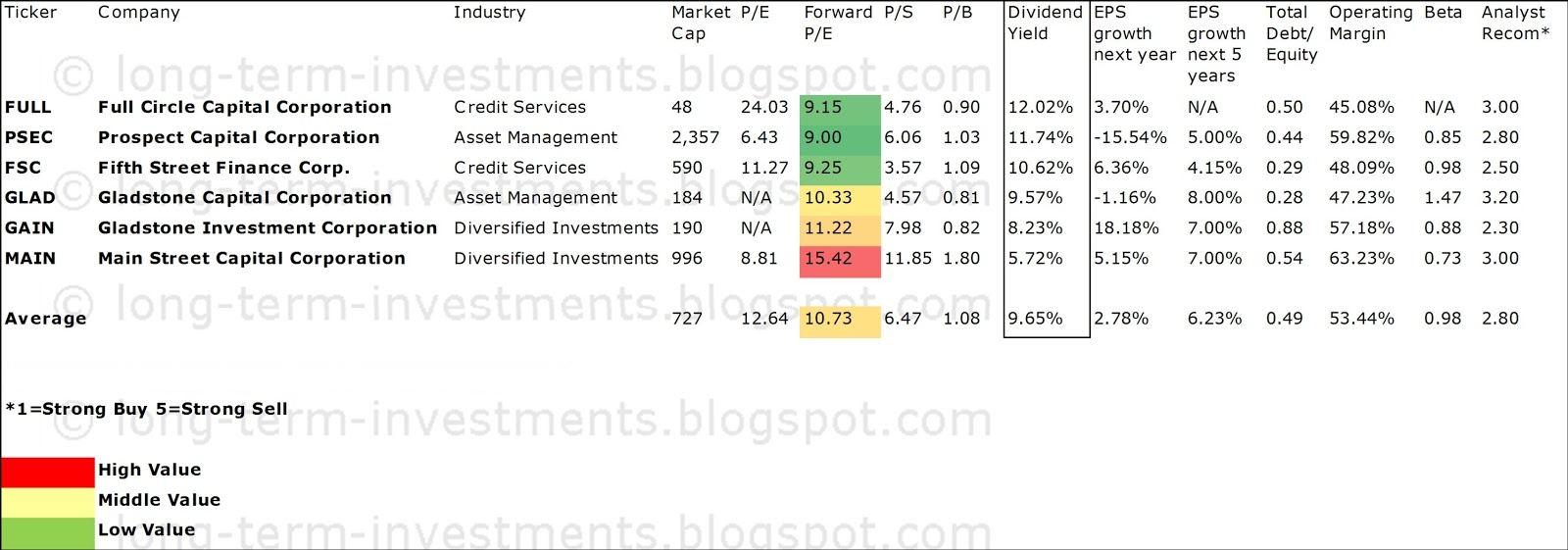

Recently I screened some interesting high yielding real estate investment trusts with monthly payments. Now I want to focus on monthly dividend paying stocks from the business development industry. Below is a small list of six high-yield stocks of which two are recommended to buy.

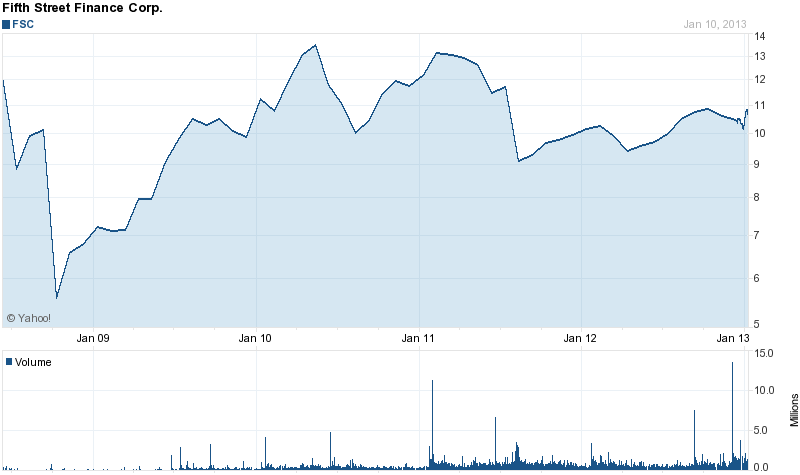

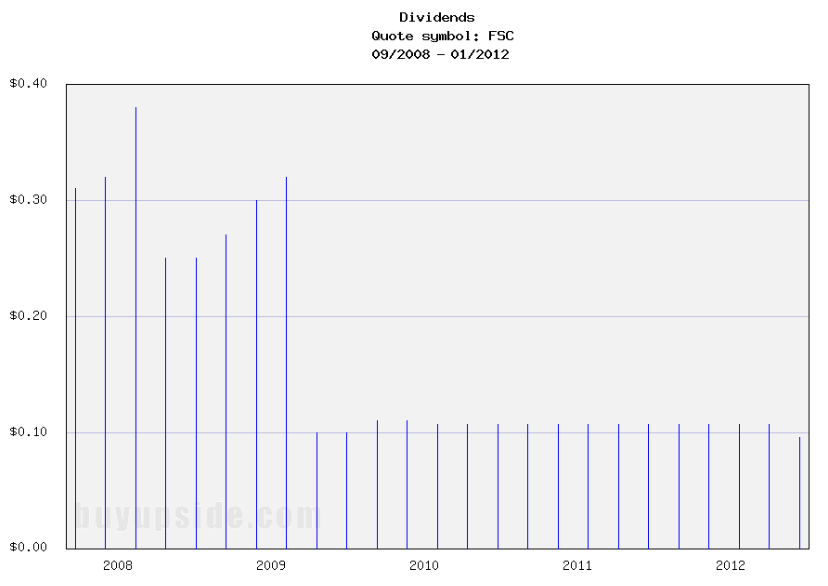

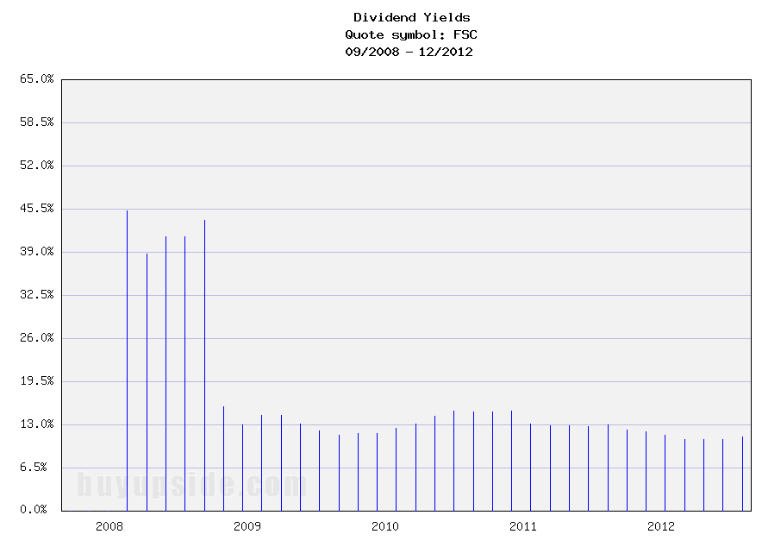

- Fifth Street Finance (FSC) has a market capitalization of $985.70 million. The company generates revenue of $165.12 million and has a net income of $79.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $109.68 million. The EBITDA margin is 66.43% (the operating margin is 48.09% and the net profit margin 48.09%).

The total debt represents 19.08% of the company’s assets and the total debt in relation to the equity amounts to 29.33%. Due to the financial situation, a return on equity of 9.73% was realized. Twelve trailing months earnings per share reached a value of $0.96. Last fiscal year, the company paid $1.18 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 11.31, the P/S ratio is 5.97 and the P/B ratio is finally 1.09. The dividend yield amounts to 10.62% and the beta ratio has a value of 0.98.

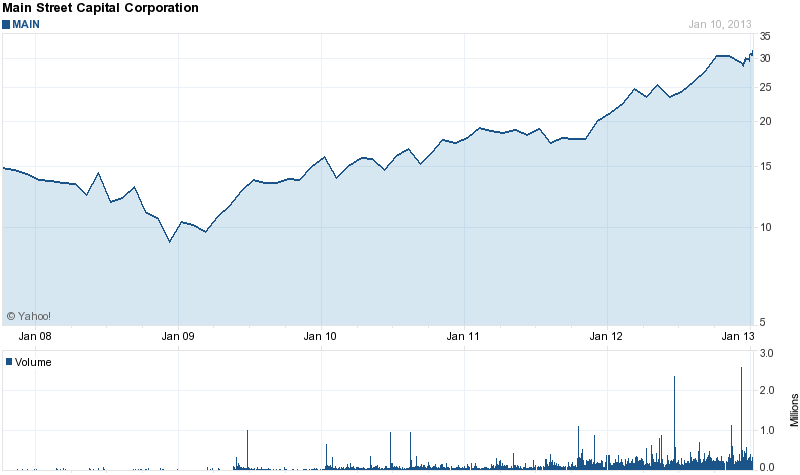

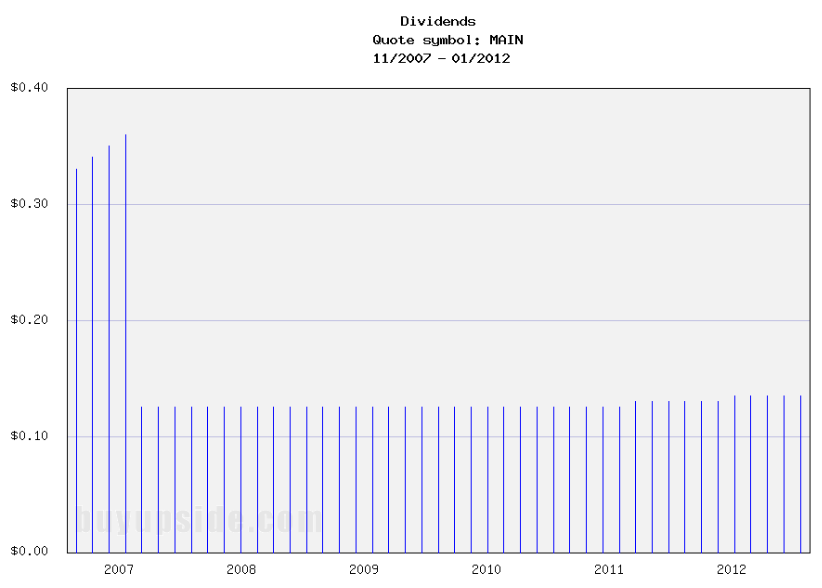

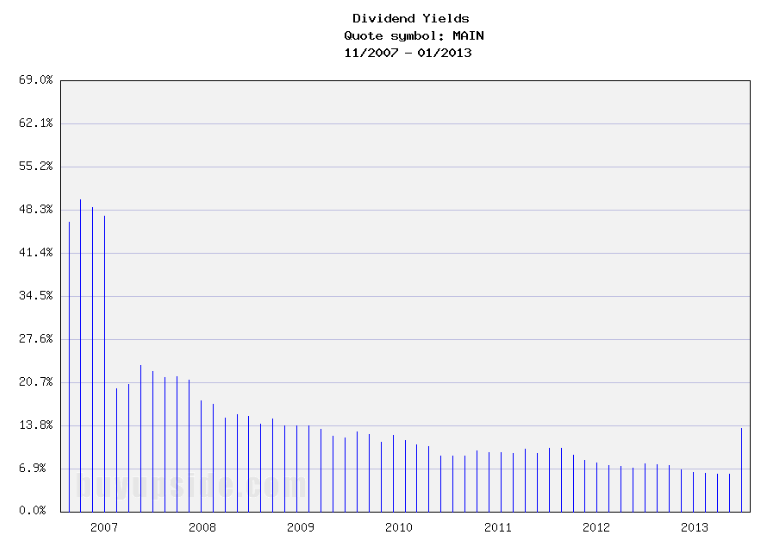

- Main Street Capital (MAIN) has a market capitalization of $995.62 million. The company employs 22 people, generates revenue of $66.24 million and has a net income of $64.11 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $52.80 million. The EBITDA margin is 79.70% (the operating margin is 59.30% and the net profit margin 96.78%).

Financial Analysis:

The total debt represents 41.87% of the company’s assets and the total debt in relation to the equity amounts to 76.13%. Due to the financial situation, a return on equity of 19.34% was realized. Twelve trailing months earnings per share reached a value of $3.57. Last fiscal year, the company paid $1.56 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 8.80, the P/S ratio is 15.03 and the P/B ratio is finally 2.07. The dividend yield amounts to 5.72% and the beta ratio has a value of 0.73.

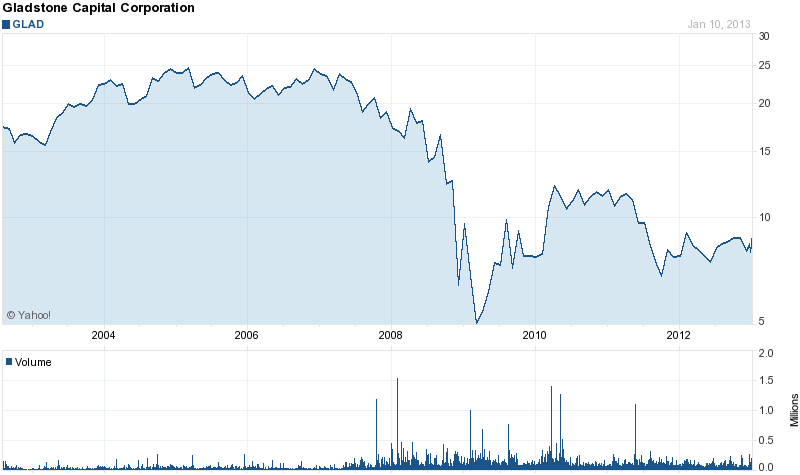

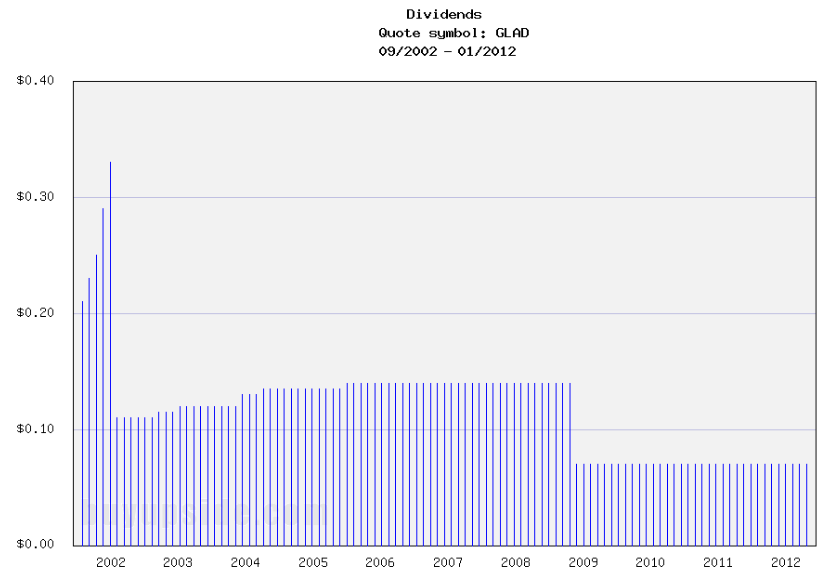

- Gladstone Capital (GLAD) has a market capitalization of $184.38 million. The company employs 56 people, generates revenue of $40.32 million and has a net income of $-8.01 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $21.54 million. The EBITDA margin is 53.41% (the operating margin is 47.23% and the net profit margin -19.86%).

The total debt represents 21.29% of the company’s assets and the total debt in relation to the equity amounts to 27.50%. Due to the financial situation, a return on equity of -3.98% was realized. Twelve trailing months earnings per share reached a value of $-0.38. Last fiscal year, the company paid $0.84 in the form of dividends to shareholders.

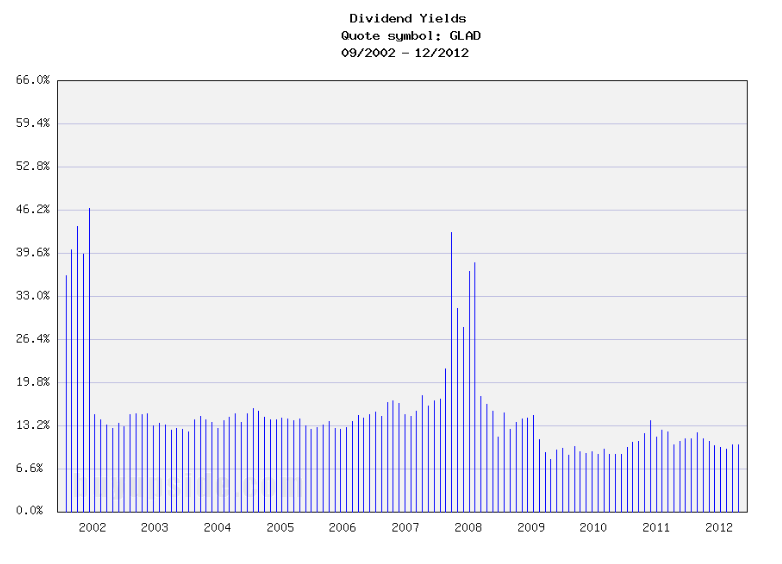

Market Valuation: Here are the price ratios of the company: The P/E ratio is not calculable, the P/S ratio is 4.57 and the P/B ratio is finally 0.98. The dividend yield amounts to 9.57% and the beta ratio has a value of 1.48.

Take a closer look at the full list of high yielding monthly dividend paying stocks. The average P/E ratio amounts to 12.64 and forward P/E ratio is 10.73. The dividend yield has a value of 9.65%. Price to book ratio is 1.08 and price to sales ratio 6.47. The operating margin amounts to 53.44% and the beta ratio is 0.98. Stocks from the list have an average debt to equity ratio of 0.49.

Related stock ticker symbols:

FULL, PSEC, FSC, GLAD, GAIN, MAIN

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.