Sirius XM Holding Inc (NASDAQ:SIRI), reports preliminary financial results for the quarter ended December 31, 2014.

Satellite radio service provider Sirius XM Holding Inc (NASDAQ:SIRI) beat analyst expectations when it reported fourth quarter results this week. Profit climbed 120 percent in the quarter to $143.1 million or $0.03 per share. Revenue rose 9.1 percent to $1.09 B, while operating expenses increased 5.6 percent to $797.3 million from customer service and marketing costs.

The company’s performance came largely from its success at adding new subscribers. Sirius had 27.3 million subscribers as of quarter end, up from 25.6 million a year ago, adding more than 500,000 new subscribers in the quarter. This was the largest quarterly increase in eight years. The rate at which subscribers left, or churn, fell to 1.8 percent from 1.9 percent a year earlier.

Sirius attracts new customers by partnering with car manufacturers such as GM and Ford to offer free service to customers who purchase or rent cars. The company then hopes that these customers will convert to paying, or self-pay, subscribers. Strong auto sales help drive performance, as it costs less to reach new potential subscribers. Sirius added more than 508,000 self-pay subscribers in the quarter.

This earnings release follows the earnings announcements from the following peers of Sirius XM Holdings, Inc. – Pandora Media Inc (NYSE:P).

Highlights

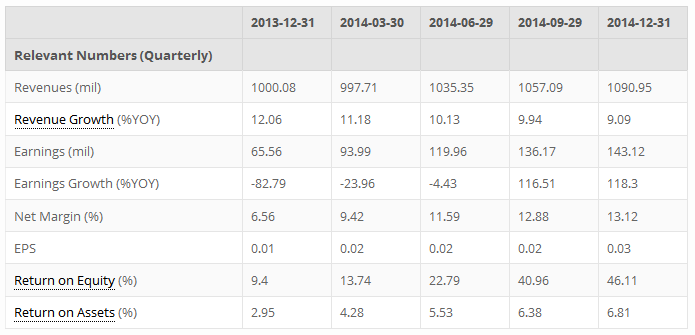

- Summary numbers: Revenues of $1.09 billion, Net Earnings of $143.12 million, and Earnings per Share (EPS) of $0.03.

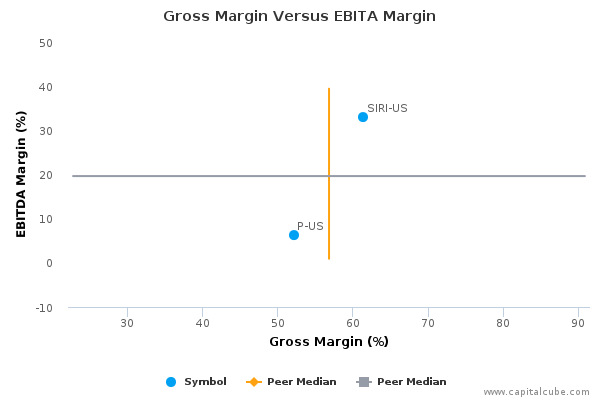

- Gross margins widened from 60.37% to 61.40% compared to the same quarter last year, operating (EBITDA) margins now 33.00% from 30.57%.

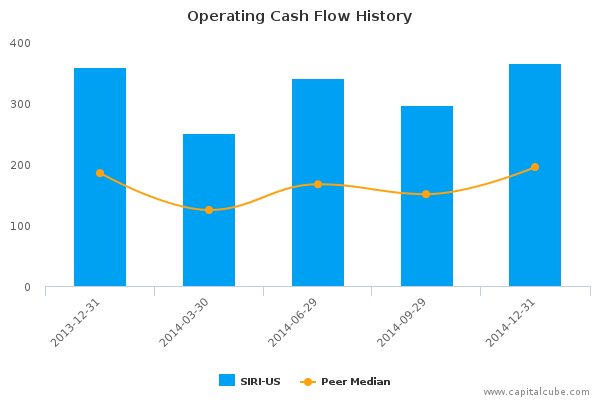

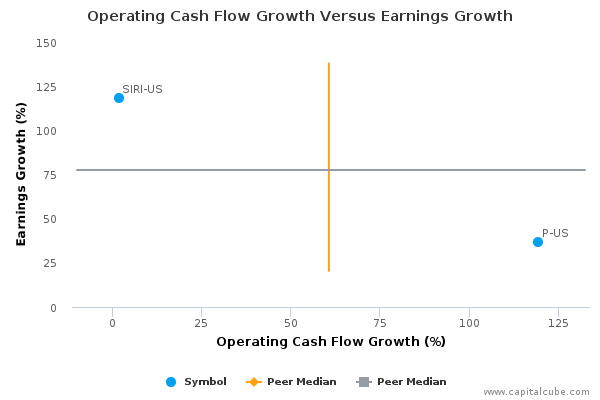

- Change in operating cash flow of 1.81% compared to same quarter last year trailed change in earnings, earnings potentially benefiting from some unlocking of accruals.

- Earnings growth from operating margin improvements as well as one-time items.

- Earnings per Share (EPS) growth exceeded earnings growth.

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

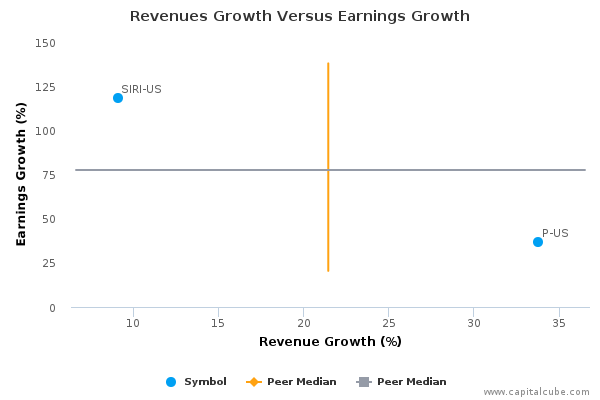

Market Share Versus Profits

Companies sometimes focus on market share at the expense of profits or earnings growth.

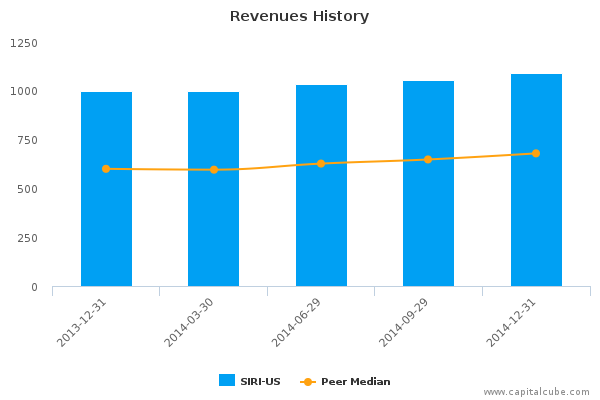

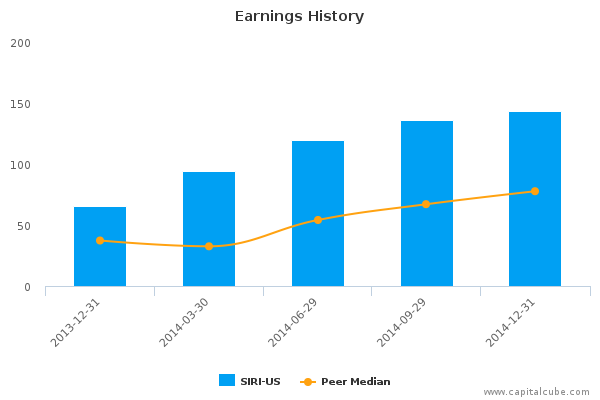

SIRI-US's change in revenue compared to the same period last year of 9.09% lagged its change in earnings which was 118.30%. The company's performance this period suggests an effort to boost profitability. While this is good to a point, the fact that the company's revenue performance is lower than the average of the results announced to date by its peers does not bode well from a long-term market share perspective. Also, for comparison purposes, revenues changed by 3.20% and earnings by 5.11% compared to the immediate last quarter.

Earnings Growth Analysis

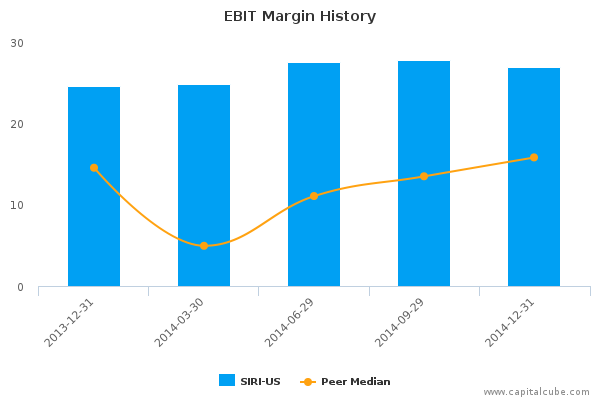

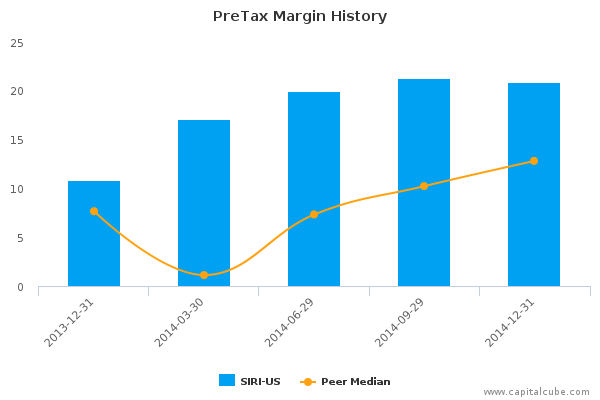

The company's earnings growth was influenced by year-on-year improvement in gross margins from 60.37% to 61.40% as well as better cost controls. As a result, operating margins (EBITDA margins) rose from 30.57% to 33.00% compared to the same period last year. For comparison, gross margins were 61.83% and EBITDA margins were 33.92% in the quarter ending September 30, 2014.

Cash Versus Earnings – Sustainable Performance?

SIRI-US's year-on-year change in operating cash flow of 1.81% trailed its change in earnings. This leads Capital Cube to question whether the earnings number might have been achieved from some unlocking of accruals. On a positive note, the increase in operating cash flow was better than the average announced thus far by its peer group.

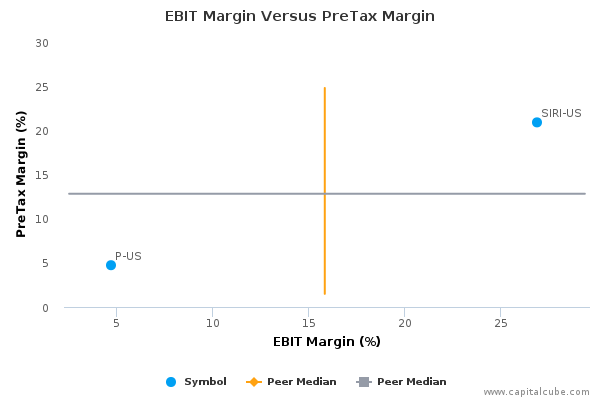

Margins

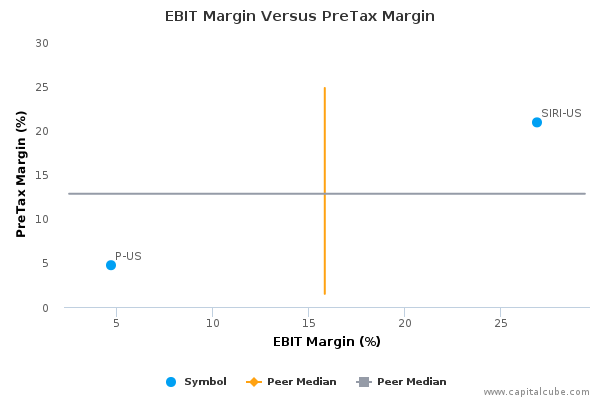

The company's earnings growth has also been influenced by the following factors: (1) Improvements in operating (EBIT) margins from 24.53% to 26.92% and (2) one-time items. The company's pretax margins are now 20.90% compared to 10.82% for the same period last year.

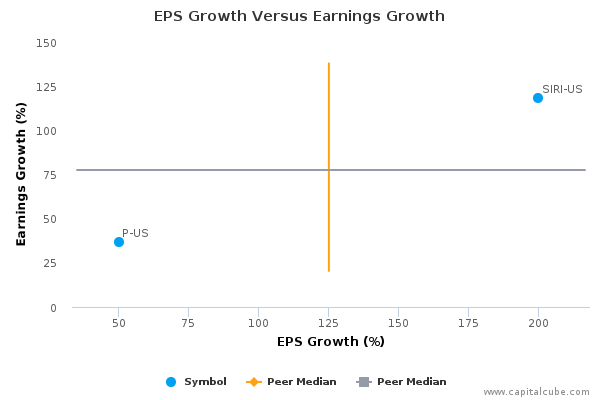

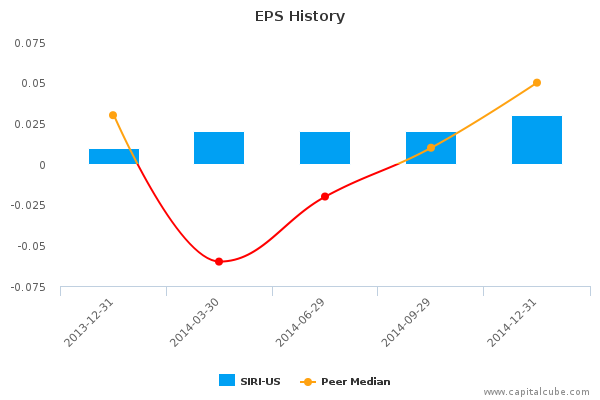

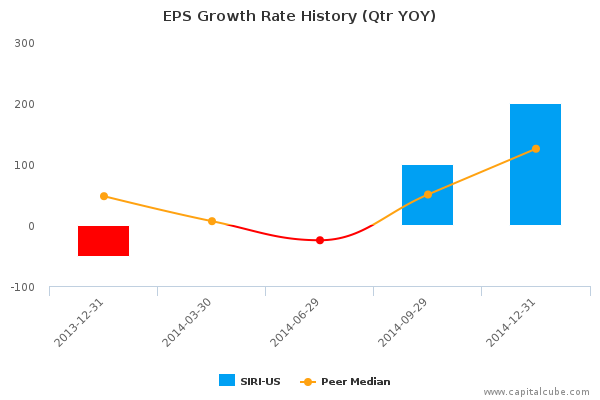

EPS Growth Versus Earnings Growth

SIRI-US's change in Earnings per Share (EPS) of 200% compared to the same quarter last year is better than its change in earnings of 118.30%. However, this change in earnings is better than the peer average among the results announced to date, suggesting that the company is gaining ground in generating profits from its competitors.

Company Profile

Sirius XM Radio, Inc. provides satellite radio broadcasting services. It operates through its wholly owned subsidiary Sirius XM Radio, Inc. Sirius XM creates and broadcasts commercial-free music, premier sports and live events, news and comedy and talk programming in radio. The company also provides telematics and connected vehicles services, providing safety, security and convenience services to a host of major automotive manufacturers. The company was founded in 1990 and is headquartered in New York, NY.