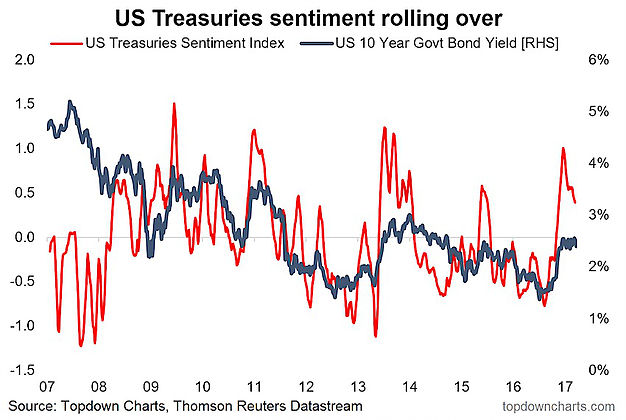

This article looks at a unique market indicator that we’ve put together on the bond market. It provides a nice gauge of expectations for bonds in 2017 and beyond.

It is designed to capture Bond Market sentiment and it does a fairly good job of flagging short-to-medium term turning points in bond yields.

The chart appeared in the latest edition of the weekly Macro Technicals report and the main conclusion is that there is a shift in sentiment underway in bond markets. Confidence in the outlook that 10-year bond yields have changed trend from down to up appears to be wavering as the sentiment indicator has rolled over from the extreme readings it hit late last year.

As also discussed in the report, looking at the weekly chart of the US 10-year Treasury bond yield, it appears to be undergoing a double top formation. Thus the conclusion was that yields could head lower yet.

Indicators like this can be quite helpful in reading the mood of the market, and take observable facts that can inform expectations on probabilities and the outlook.

In basic terms the bond sentiment indicator incorporates signals from bond market implied volatility, speculative futures positioning, mutual fund flows, and global sovereign bond market breadth. Taking similar indicators that have slightly different information can be a good way of taking a holistic and more reliable, meaningful gauge of the market.

My longer term bias would be to expect higher bond yields, but even then, you probably do actually need to see a reset in the bond sentiment indicator to help clear the way for that.