On Aug 12, SINA Corp. (NASDAQ:SINA) was downgraded to a Zacks Rank #5 (Strong Sell). Going by the Zacks model, companies carrying a Zacks Rank #5 are likely to underperform the broader market in the next one to three months.

Why the Downgrade?

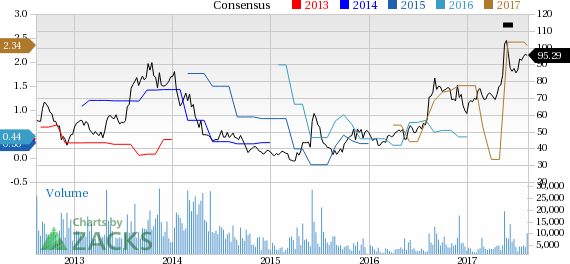

The Zacks Consensus Estimates for fiscal 2017 has declined by 2.9% (7 cents) to $2.41 in the last 30 days. Also, estimates have reduced by 10.7% (45 cents) to $4.20 for fiscal 2018. These downward estimate revisions have primarily resulted in the downgrade of the stock.

We believe that uncertainty over advertising business and portal is preventing management from providing quarterly guidance. This can be attributed as the primary reason behind the decline in estimates.

Further, we believe that continuing investments in Weibo and other verticals like Internet finance, automobile and sports will hurt profitability, going forward. SINA’s monetization efforts may see regulatory pressure due to restrictions imposed by the Chinese government, which may hurt subscriber growth. The company is also seeing some headwinds in regards to obtaining new media rights for sports in China.

Additionally, competition within the online advertising business in China is fierce, with rapid technological changes along with frequent new product and service rollouts. SINA faces stiffening competition in most of its operational markets from companies including Tencent Holding Ltd. (OTC:TCEHY) , Sohu.com Inc. (NASDAQ:SOHU) , and NetEase, Inc. (NASDAQ:NTES) .

We also note that SINA’s shares have gained 31.7% in the last year; outperforming the industry’s gain of 27.6%. However, the aforesaid headwinds can pull down the momentum in the rest of 2017.

You can see the complete list of today’s Zacks #1 Rank Stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Sina Corporation (SINA): Free Stock Analysis Report

NetEase, Inc. (NTES): Free Stock Analysis Report

Sohu.com Inc. (SOHU): Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis Report

Original post

Zacks Investment Research