- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Silver’s Ranging Pattern

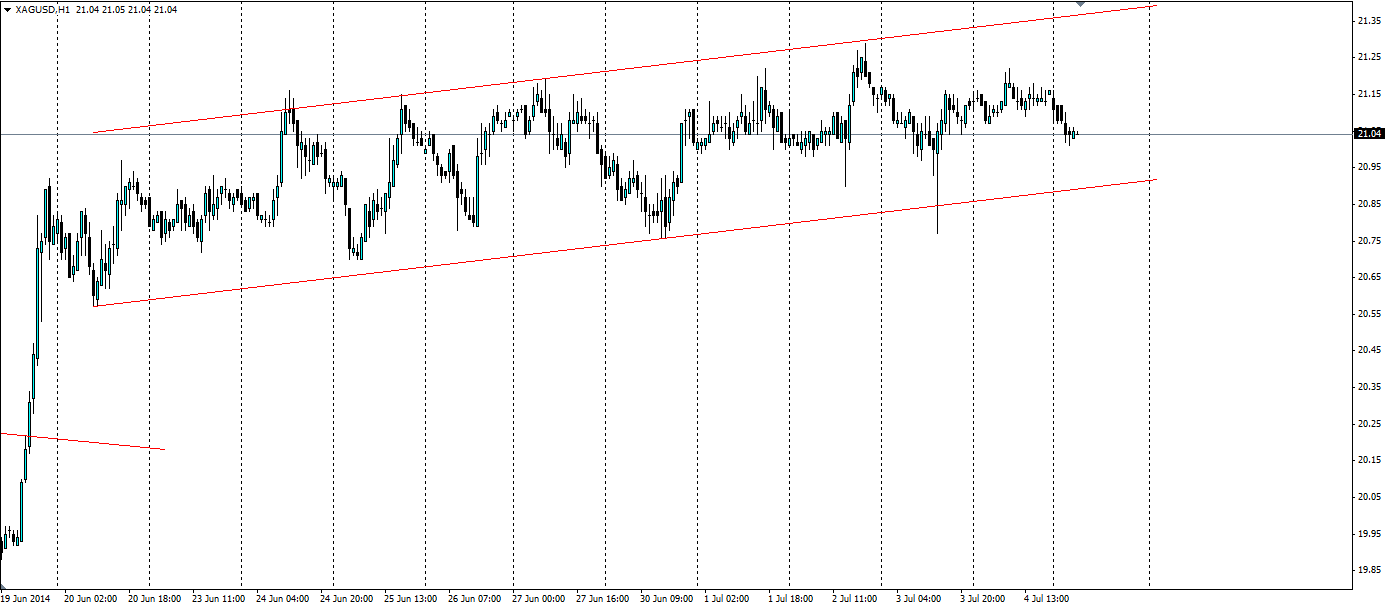

Silver is currently insistent is forming a range pattern with a slightly bullish trend to it that can be taken advantage of as it heads down to the lower end.

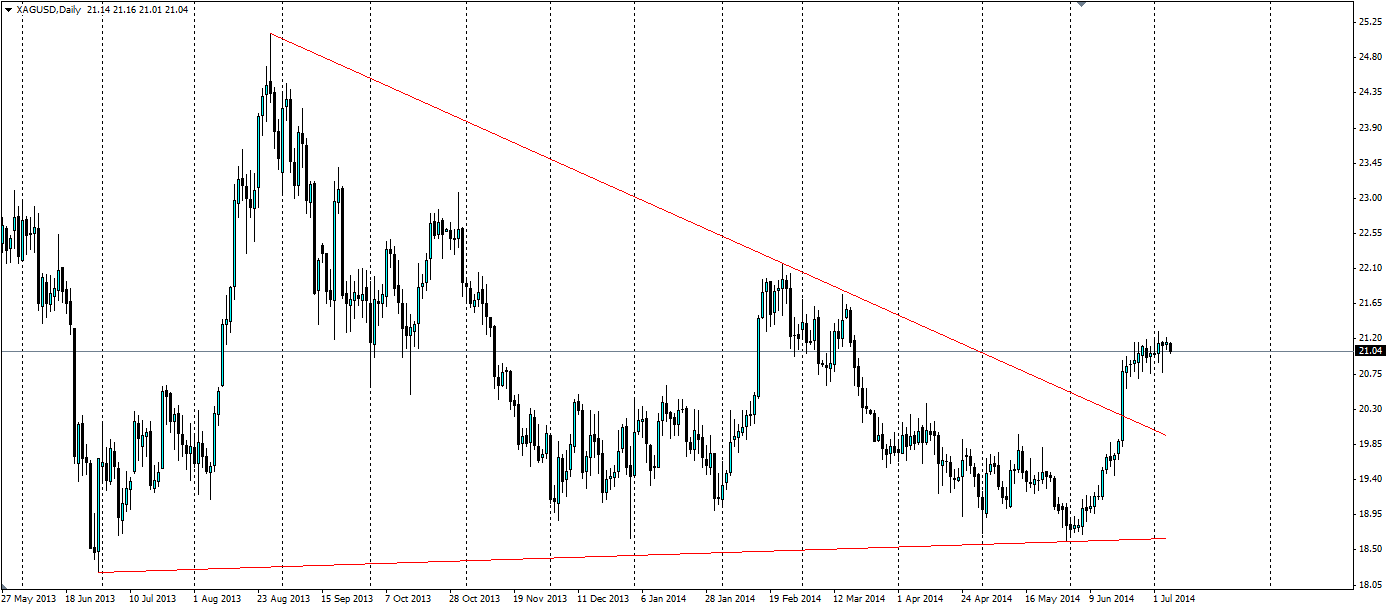

Silver recently broke out of a very old downward sloping triangle as it powered up over $1.00 per ounce, or over 5%. The breakout on the 19th June was largely down to the fact that the US Federal Reserve said that interest rates would remain low “for some time”. This in turn increased demand for haven assets, such as gold and silver, as the yield on US Treasury assets looks bleak. The strong breakout attests to how strong the triangle was.

The recent US nonfarm payroll data did not have as big an effect on silver as one might expect. The report showed the US economy added 288k jobs in June, much higher than the 215k the market was expecting. Logically, we would expect gold and silver to fall sharply on this news as it shows the US economy recovering, however the response was muted as the market is wary of the recent negative GDP data (-2.9% annually)and the uncertain outlook on interest rates. The resistance held firm at US$20.77 per ounce and a large bullish rejection wick formed as the price pushed over the $21.00 mark.

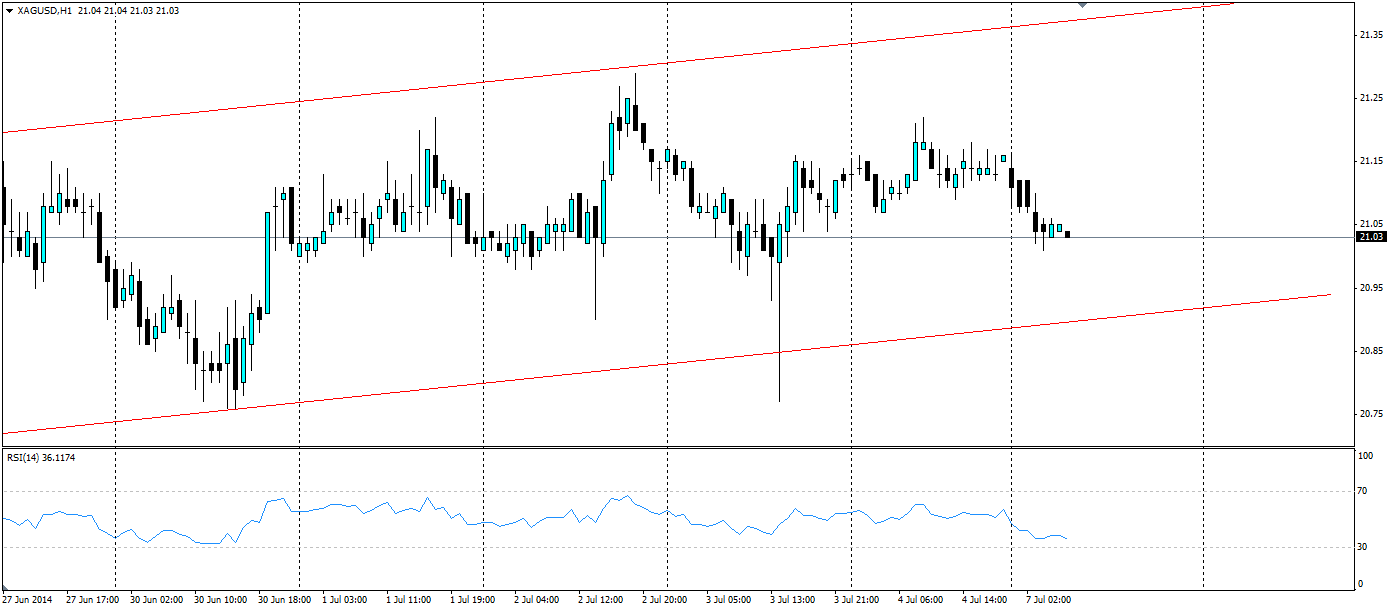

The ranging pattern has seen the support line tested several times with only the non-farm data providing a false breakout. This means the channel will hold in the near term and it will take quite a bit to break the channel down. Indeed the RSI shows the current momentum has reversed and is now back with the bulls having found support at 21.01. This could result in a touch of the upper resistance line.

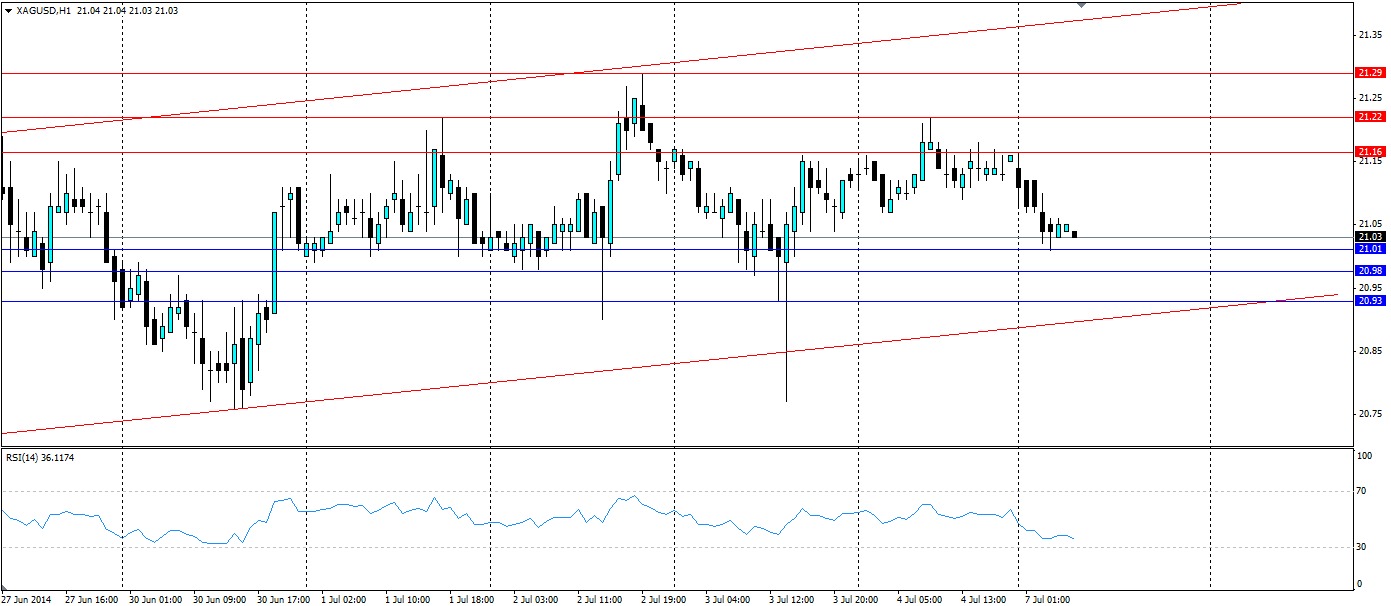

In this case there are four options for traders to take advantage of the price action. If there is a touch of the bottom support line, traders will look to have a stop sell below the trend line to take advantage of a break out, with a stop loss inside the line. At the same time a stop buy can be placed above the support line to catch the momentum of a bounce off the trend line.

If the price moves upwards to the top resistance line, a similar set up can be put in place.This will either catch a break out to the top side, or a bounce back down inside the channel. In any case, look for the levels of support and resistance when deciding price levels to target.

Related Articles

President Trump has had success bringing down oil prices by sheer force of will and keeping traders off balance. Perhaps the biggest success has a lot to do with not only...

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.