Like gold, silver has been in a corrective downtrend following its peak early in September and it looks like it has further to run before its done – partly, of course, because we have a downside target for gold in the $1360-$1400 area before it turns up.

On silver's 6-month month chart, we can see how it has been stumbling lower within a downtrend and it looks like it will break down through the lower boundary of this downtrend to drop to a final downside target, probably at support in the $15.30-$15-60 area. It outperformed gold during the summer runup and has underperformed on the subsequent reaction, which is normal and, as we know, silver is weaker than gold during the early stages of a bull market so this near-term downside target seems reasonable.

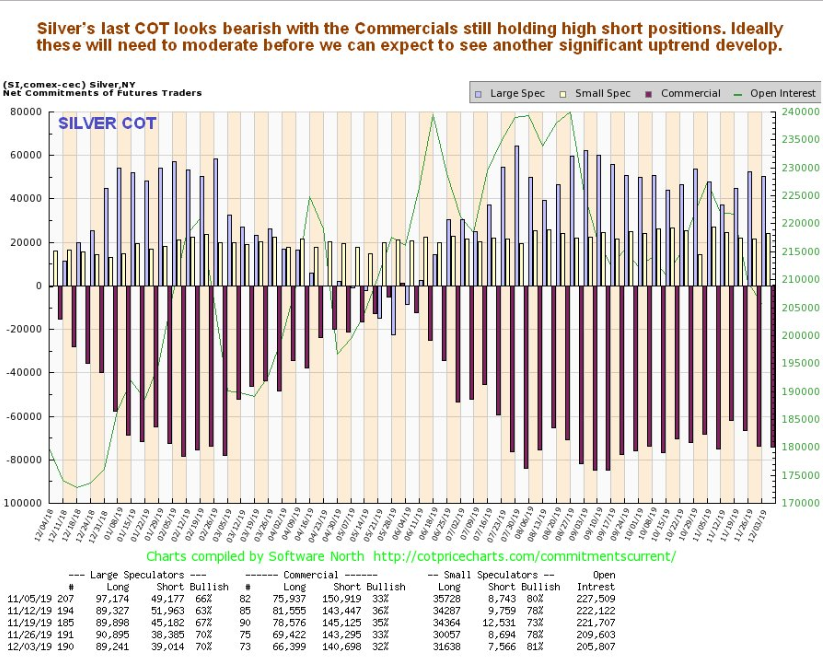

The last COT chart suggests that further losses are in the cards for the near-term. Commercial short positions are still high and ideally these will need to moderate before another significant uptrend can develop.

The 10-year chart, like gold's, presents a positive picture. While it has been weaker than gold recently, this chart shows silver rallying off the second low of a giant Double Bottom on strong volume in the summer, which is bullish. This reaction should present another good opportunity to load up on silver investments before the next major upleg starts.