The dawn of 2025 has brought choppy waters to financial markets, creating a favorable environment for precious metals. Among them, silver has shone brightly, achieving significant gains throughout the first quarter. While gold steals the spotlight with its record-setting highs, silver has quietly carved out a 17% increase since January, cementing its dual role as an industrial powerhouse and a haven for cautious investors.

Market turbulence, driven in part by persistent tariff threats from the US administration, has rattled global equities and heightened economic unease. This backdrop has bolstered silver’s appeal, though questions linger about its industrial demand amid shifting global policies.

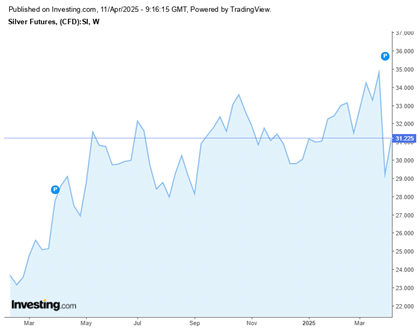

Tracking Silver’s Price Movements in Q1

Silver’s journey began with a high of $34.72 per ounce in October 2024, followed by a late-year slide that bottomed out at $28.94 on December 30. The new year sparked a turnaround, with silver opening at $29.53 on January 2 and swiftly crossing the $30 mark by January 7. By the end of January, it settled at $31.28.

February saw continued momentum, with the metal peaking at $32.94 on the 20th before easing to $31.13 by the month’s end. March delivered further gains, as silver topped $32 on March 5 and held above that level by March 12, reaching a quarterly high of $34.43 on March 27. However, April brought a stumble-prices slipped to $33.67 on the 1st and plunged below $30 after the U.S. unveiled new tariff measures on April 2.

Tariffs: A Double-Edged Sword for Silver

The U.S. administration’s relentless tariff rhetoric has fueled market volatility since the year began, pushing investors toward safe-haven assets like silver. This unrest has rippled across global financial systems, amplifying demand for stability. Yet, there’s a flip side: tariffs could squeeze industrial demand, a key driver of silver’s value.

Notably, it’s too early to predict the full fallout. There’s no solid evidence yet of a drop in industrial use, but the risk of cost-driven demand erosion is real. Interestingly, tariffs might boost silver in some sectors, like solar panel manufacturing, if nations prioritize energy independence.

Research from Heraeus Precious Metals suggests that while China, which is home to 80% of solar capacity, may see a dip, the switch to silver-heavy TOPCon cells from older PERC technology could sustain demand.

Recession Risks Cloud the Horizon

Adding to the complexity is the specter of a U.S. recession. Last year, experts widely agreed a downturn was brewing. Although 2024 saw U.S. GDP climb 2.8% year-on-year, the Federal Reserve Bank of Atlanta’s GDPNow tool now projects a -2.8% growth rate for Q1 2025- a troubling signal ahead of official data due April 30.

Some may say that a recession could hit silver hard, especially given its role in green energy- “Economic slowdowns cut demand for industrial materials like silver, making near-term investments dicey”. Solar panels (232 million ounces annually) and electric vehicles (EV for short, 80 million ounces) are major consumers, but tariffs on U.S. vehicle imports and a recession could delay purchases.

Supply Shortfalls and Market Sentiment

Despite these headwinds, the Silver Institute’s March 3 update revealed a fifth straight year of supply deficits, tightening the market. Some also may say, that silver should stay resilient and grow through 2025. They pointed to physical silver shipments from UK vaults to New York as a preemptive move against tariffs, adding, “We could see a supply crunch within six months.”

Another perspective ties silver’s fate to the public mood. The outlook might brighten if recession talk fades from the news cycle. But with the U.S. rolling out a 10% global tariff and targeted levies on April 2, volatility persists. Silver slipped toward $31 on April 3, possibly reflecting profit-taking or a broader retreat as investors recalibrate.

What Lies Ahead for Silver?

A short-term dip isn’t off the table. Silver isn’t overstretched, but gold might be. A gold correction could pull silver back to $29-$30, a great buying zone for the metal and miners.

In 2025, silver stands at a crossroads. Its industrial strength and safe-haven status create a tug-of-war for investors as tariffs, recession risks, and supply dynamics collide. Ultimately, the scales of supply and demand may tip the balance more than its protective allure.