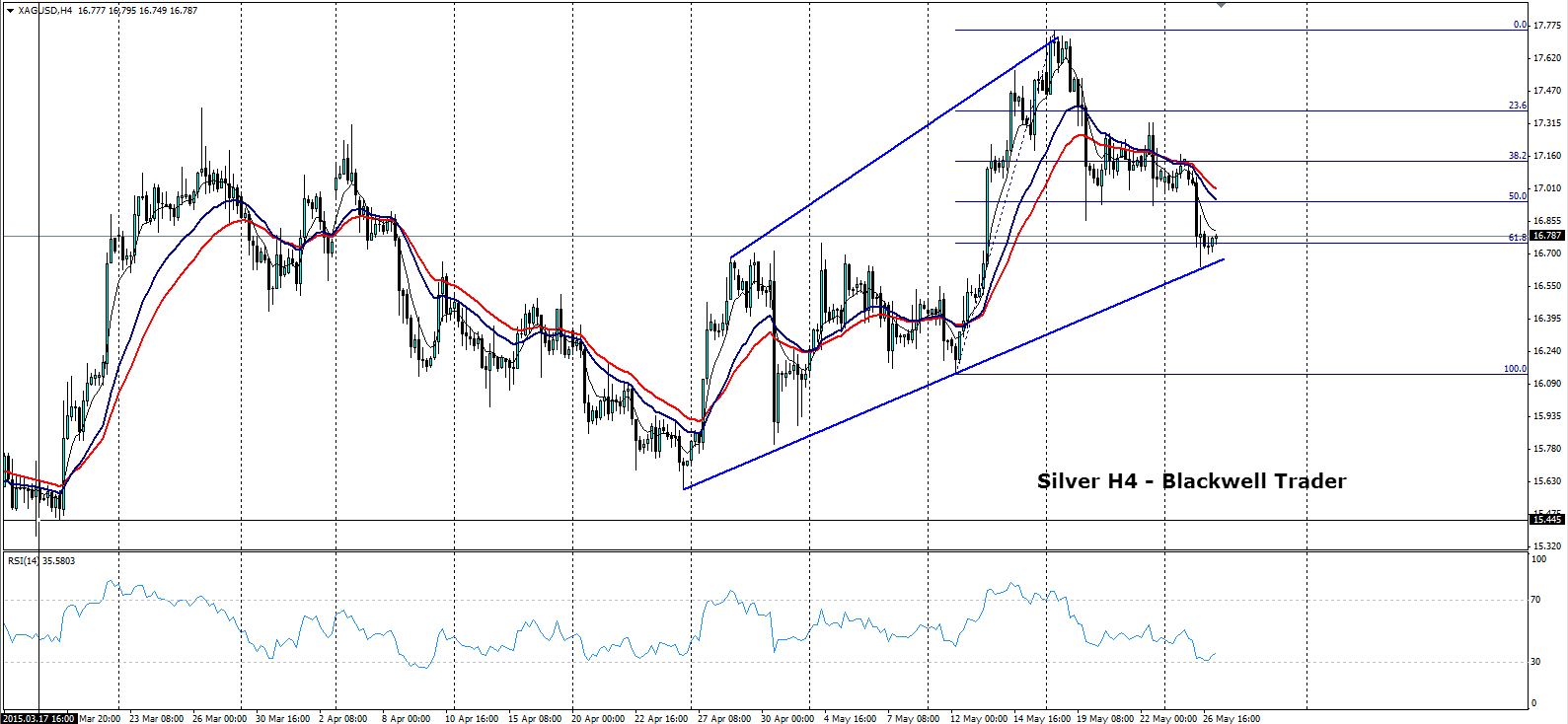

Silver fell strongly overnight, breaching a key psychological level at 17.10, to rest upon support at 16.75. The metal now sits upon a bullish trend-line that is providing plenty of support and may see the commodity retrace within the coming days.

The precious metal currently trades around 16.75, which also represents the 61.8% Fibonacci retracement level. The bearish push to this level seemed to stall at a key convergence of the dynamic trend-line and the 61.8% retracement level. Subsequently, this area of support provides an excellent base from which a retracement can occur.

Taking a look at an oscillator shows relative strength as having touched upon the oversold range before flattening and starting to trend higher. This seems to indicate that any bullish move will have plenty of room to move on the upside.

In the near term, silver will need to surmount resistance at 17.10, the 38.2% Fibonacci level, to confirm a move higher. Any subsequent breach of this key level could see the commodity moving sharply to test resistance at 17.31.

Either way, any bounce or retracement from the dynamic trend-line is likely to provide plenty of trading opportunities in the coming days. Resistance can be found at 17.10, 17.35, and 17.56, whilst any breach of the bullish trend-line will find support at, 16.41, and 16.12.