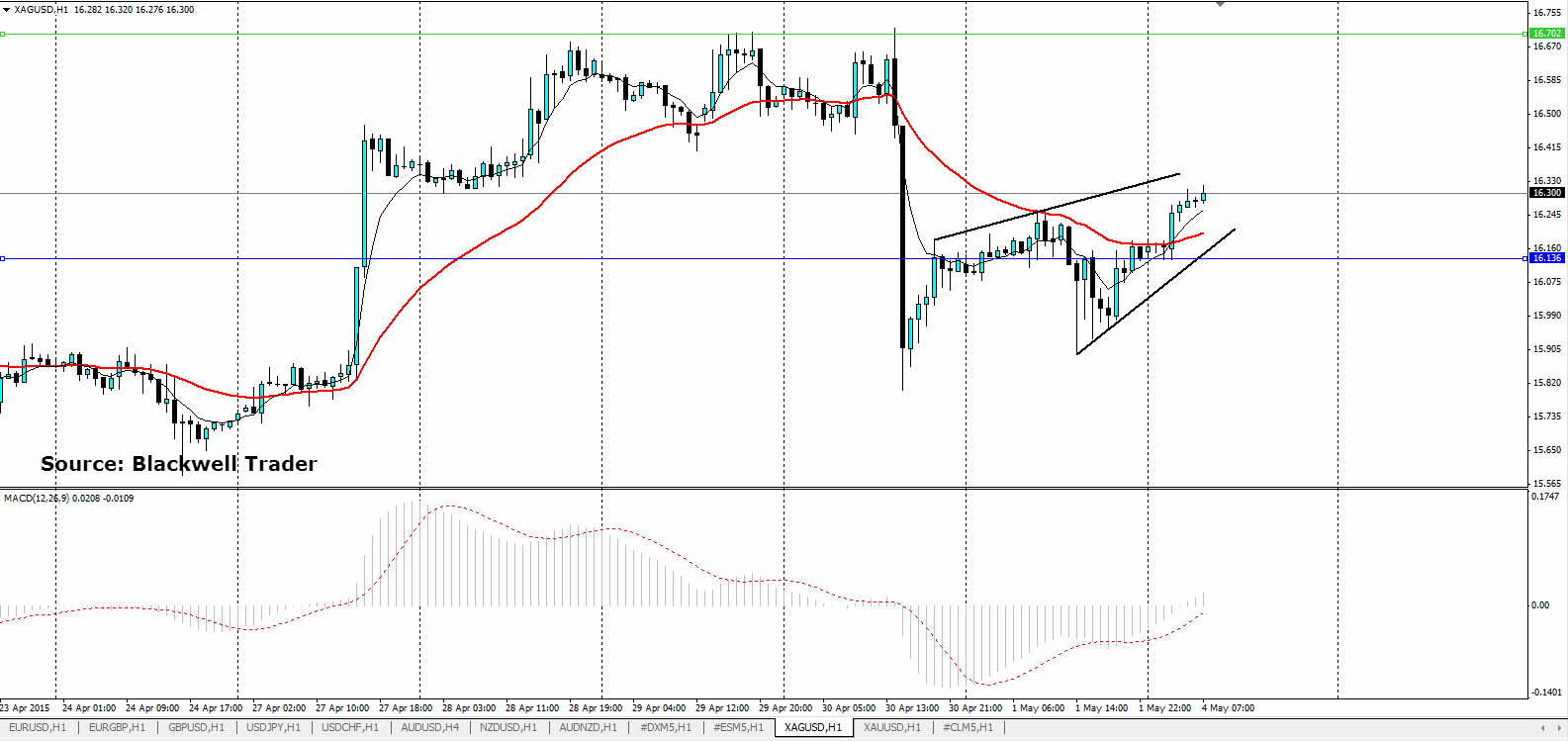

Silverhas continued to consolidate its position, within a very tight trading range, since experiencing a strong selloff a week ago. Despite the bearish pressure,silver has managed to close through some limited resistance at 16.220 and it now appears in the early stages of forming a rising wedge. Considering that the highs are getting higher, it might be time for Silver to retrace some of the gains it lost over the past few days.

Silver has also been under considerable scrutiny of late as JP Morgan has acquired a significant position in the commodity with some analysts suggesting that they are now in a position to corner the market. Obviously, any move by JP Morgan to corner the silver market, is likely to benefit those holding long positions. Despite their analysis, no one really knows why JP Morgan has acquired the physical position, or whether it was acquired on behalf of a customer. Regardless, it has refocused attention upon the metal and that is positive for those of us with a long bias.

For now, silver continues to consolidate its price action within the rising trend channel but it is starting to look decidedly interesting considering the wedge like appearance of the pattern. The moving averages also tell the tale as the price has crossed over the 30SMA on H4 and MACD is starting to trend higher showing some momentum moving towards the long side of the trade.

If we do indeed see a definite wedge form over the next 12 hours, it is likely that pressure will build quickly for an upside breakout considering the indicators and market conditions. Support currently exists at 16.129, and 15.950, whilst strong resistance exists at 16.376, and a close above this level may see 16.705 within range.

Ultimately, the factors favour some upside movement for the metal but it is important to also keep an eye out for some of the economic data due out from the US this week. The US Trade Balance and ISM Non-Manufacturing PMI is likely to impact the commodity and should be monitored.