- Silver prices have risen due to a supply and demand gap, with demand outstripping supply for the fifth consecutive year.

- Industrial demand, driven by green energy, AI, and EVs, now accounts for 64% of global silver demand.

- A potential slowdown in China’s economy and prolonged high interest rates could dampen silver prices.

- Bullish Pennant pattern breakout hints at further upside. Will inflation data halt the move?

Silver prices have seen a remarkable rise this year, and with six months still to go, many are wondering just how high they could climb. One key factor to watch is the supply and demand dynamics, as demand for silver continues to outstrip supply.

According to the World Silver Survey, 2024 is the fifth year in a row with a silver shortage. In 2023, silver demand was higher than supply, leading to a market deficit of over 142 million ounces.

By the end of 2024, this shortfall is expected to nearly double to 265 million ounces because of increasing industrial demand.

Source: LSEG

Historically, half of the demand for silver was for industrial use, and the other half was for investment. Recently, industrial demand has grown significantly, now making up 64% of global silver demand, up 19% from last year.

This trend shows no signs of slowing. The primary drivers of the silver supply squeeze are the Green Energy Transition, particularly solar energy, and the high demand from the Artificial Intelligence and electric vehicle (EV) sectors. These industries are among the fastest-growing in the world today.

The only worry has been a recent dip in demand from China and the possibility of a slowdown in the Chinese economy. This could help balance the demand-supply gap. Prolonged higher interest rates from Central Banks could also dampen silver prices and possibly stop the rally. The sooner the US Federal Reserve cuts rates, the better it would be for silver prices.

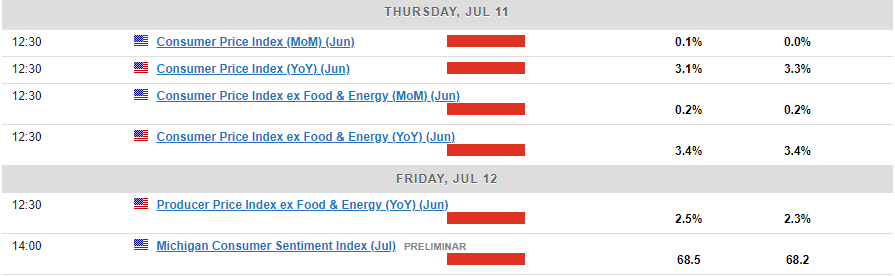

The US CPI data has the potential to provide silver a shot in the arm and provide some impetus for a move away from the psychological 30.00 handle. A hot inflation print today could have the opposite impact and push silver below the 30.00 handle in the short term, but the overall bullish trend is likely to remain intact.

Technical Analysis

From a technical standpoint, silver broke out of a bullish pennant pattern on the daily chart on July 3, which led to a rally up to around 31.50 before entering a pullback and consolidation phase.

Since then, silver has been forming lower highs and higher lows, creating a new bullish pennant pattern.

Another important factor to watch is the moving averages; the 100-day MA is nearing a golden cross with the 200-day MA, suggesting further upside and bullish momentum.

However, if a 4-hour candle closes below the 30.600 level, it would signal a change in structure, invalidating the current bullish setup.

Support

- 30.60

- 30.20

- 30.00 (psychological level)

Resistance

- 31.35

- 31.70

- 32.00

Source: TradingView.com (click to enlarge)