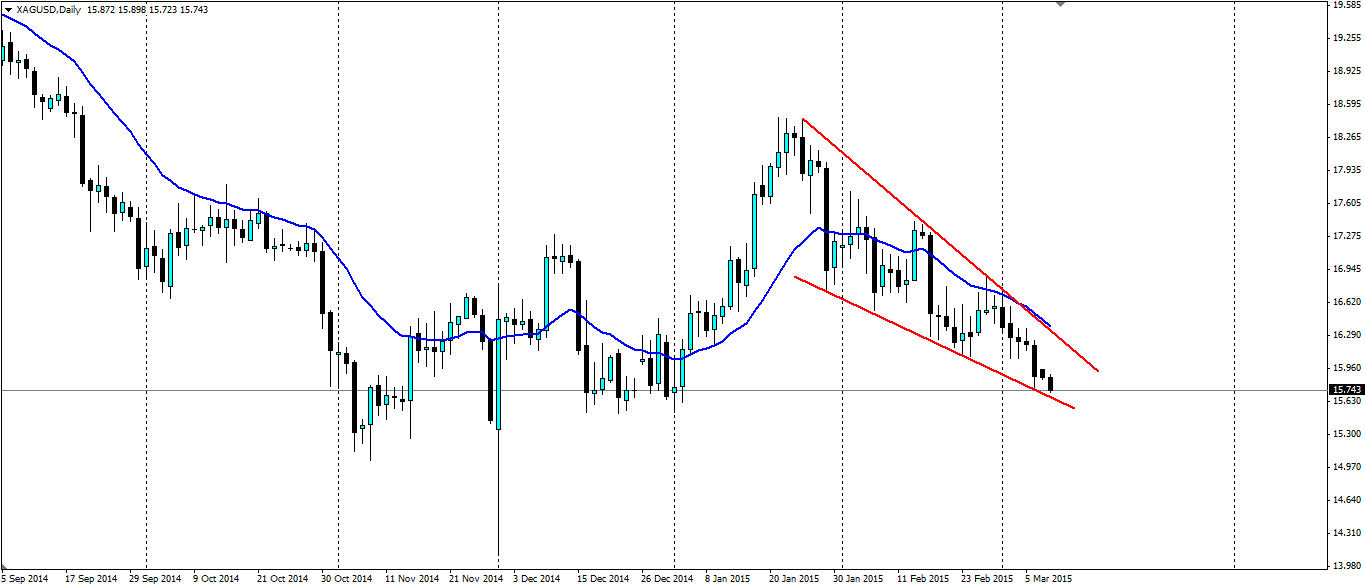

Silver has been forming a descending wedge since the high reached at the end of January. The US Non-farm result on Friday has left the wedge intact despite the pickup in volatility which is good news for any traders salivating over this technical setup.

The silver market has turned bearish over the last five weeks as the US Federal Reserve has remained committed to their goal of raising interest rates by mid-year. This puts a bearish spin on metals as an investment as US Treasuries will return relatively more. Further adding bearish pressure is the reduction in global risks leading to a drop in demand for haven investments.

At the end of last week we saw a very strong US Non-farm result with the creation of 295,000 jobs in February vs the expected 238,000. The result pushed Silver lower, but not as far as some had hoped, and the bottom line of the wedge held firm. This further validates the technical setup and more traders will now look for it to play out.

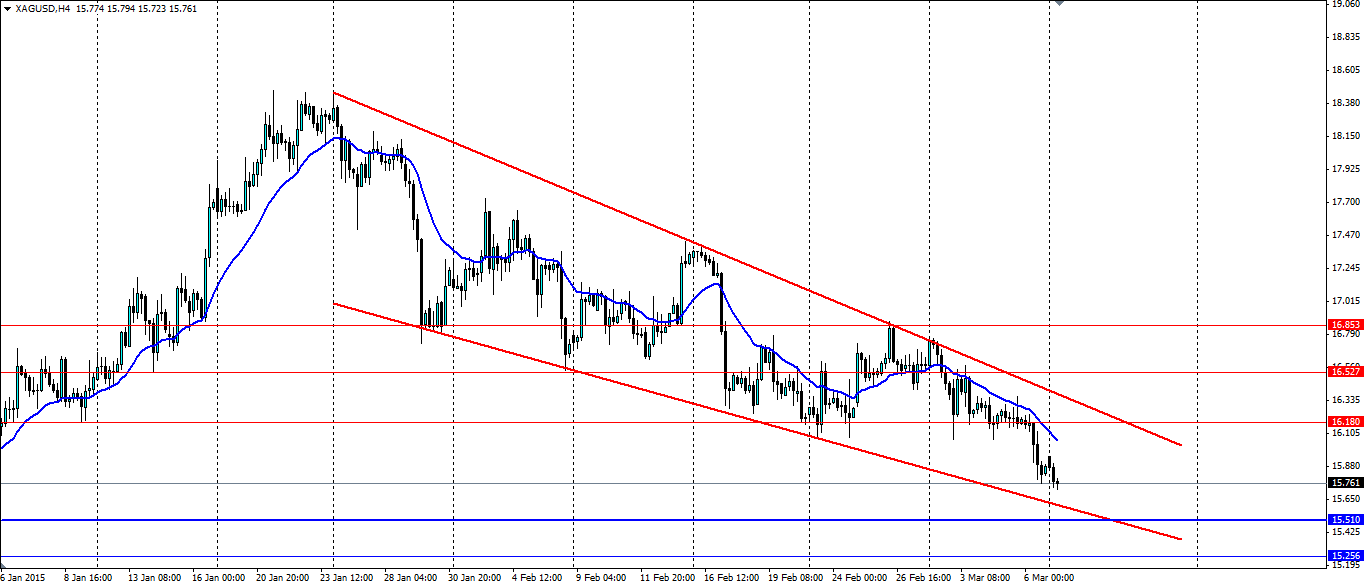

Going forward we could see further falls in silver from a fundamental perspective as higher interest rates and a stronger US economy erode demand for the haven metal. But from a technical side we have some very strong support for silver at $15.51 an ounce which could see a rejection. If this level holds, look for another rejection off the top line of the wedge as the pattern continues to consolidate.

Overall the wedge is a bullish breakout pattern so it will be interesting to see if the fundamental or technical traders take charge in the silver markets. As long as we remain open to either an upside or downside breakout, we can profit from the resulting scenario.

As stated above, look for solid support at 15.510 with further support if this breaks found at 15.256 and 14.967 while the bottom of the wedge will act as dynamic support for now. Resistance for an upside breakout is found at 16.180, 16.527 and 16.853 with the upper level of the wedge acting as dynamic resistance until we have a breakout.