The selloff in silver over the last month and a half has been brutal for anyone holding the precious metal as speculation mounts that the Fed will make a move on monetary policy. The market may have moved too early and is now playing the waiting game.

The selling has come as the market sentiment swings bullish for the dollar on bets the Fed will raise interest rates at their December 15th Meeting. Some support has been found just below the $14.000 handle, as the market waits to see if the interest rate “liftoff” will materialise. Comments from Federal Reserve Chairwoman Janet Yellen yesterday suggest they are closer than ever to a rate rise. She said her confidence in inflation has been bolstered by the strength in the labour market, which is at its tightest level in seven years.

The upcoming US nonfarm employment change figures will be critical as it is the last release before the much anticipated December 16th meeting.Anything remotely solid could see silver trade lower as the expectation of a rate rise increases. But it may not be as big a move as what would normally be expected.

A rate rise is priced in by 70-80% and a solid nonfarm result will not change that by much given the Fed’s track record of not acting. Only when the Fed actually increases rates will we see silver move accordingly. The 20% chance of the Fed not acting is what is keeping silver from breaking through the current support level.

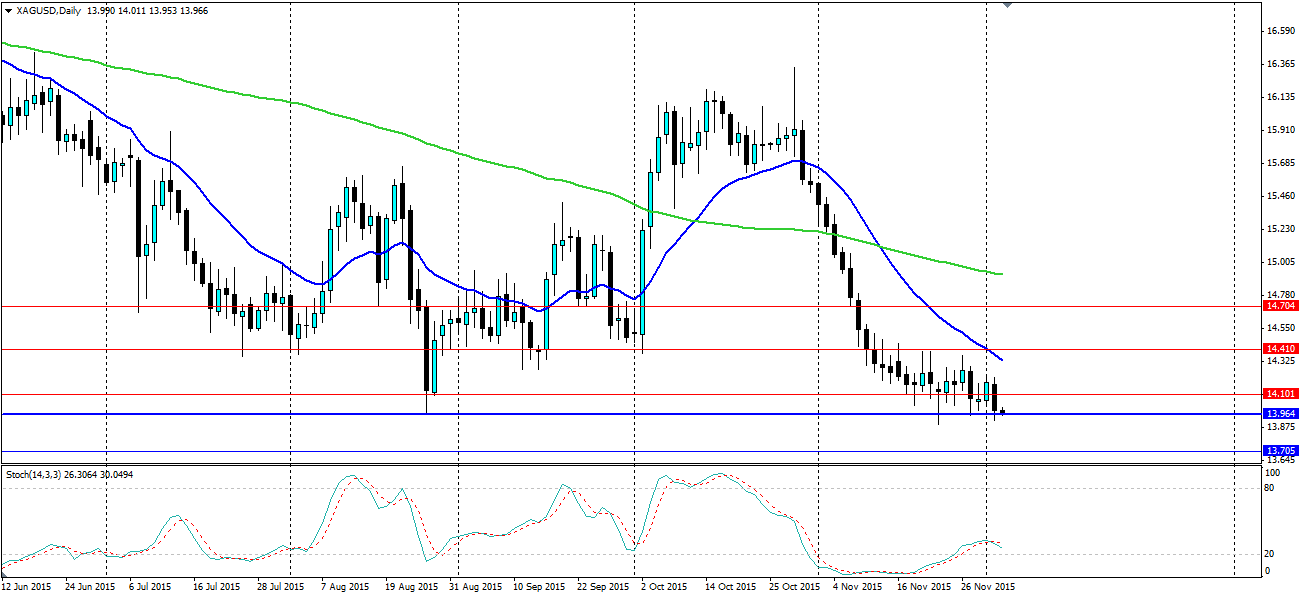

The moving averages are still trending lower as the price is squeezed onto the support level at $13.964. The highs are getting lower, but the support is remaining firm indicating a good battle between the bears and the bulls. The Stochastic oscillator has pulled up out of oversold despite price remaining depressed indicating a downside breakout may be forthcoming. It just may take until December 15th to get there.

The six year low at $13.964 is where price sits at present, although the low has been pushed out slightly, but the market quickly rejected the breakout and defended the level. Historically, $13.964 has been an important level, below that we have to go back six years to find support levels to watch. $13.705 and $13.447 look to be the next levels, although there is no guarantee the market will respect these, given the last time they were tested was a long time ago. Alternatively, for a bounce off the support, look for resistance at $14.100, $14.410, $14.704 and $15.055.