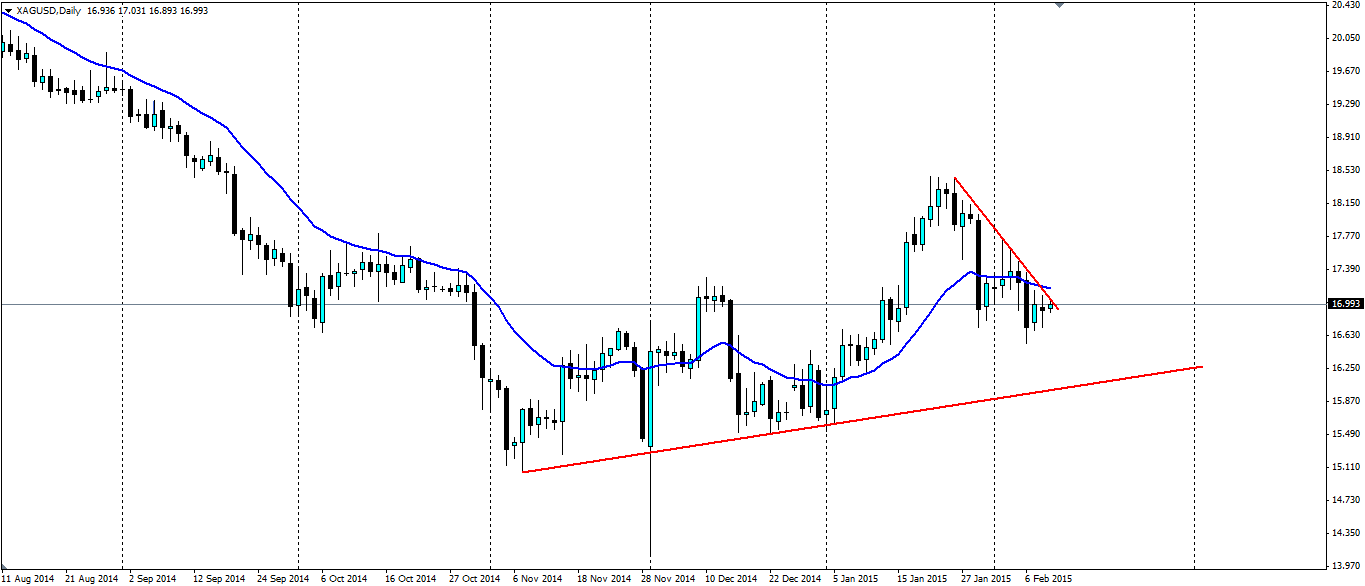

The silver market has taken a bit of a downward turn lately and is following a clear bearish trendline. This could result in all of the gains made this year being wiped out for silver, but for traders it presents an opportunity to catch the momentum.

Strong labor market readings from the US have not been favorable for silver bulls. US non-farm payrolls came in at 257k the market's expectation was 231k and the JOLTS job openings cracked the 5 million mark for the first time ever, up from 4.97m to 5.03m. The probability that we will see a rate rise from the Fed around the middle of the year is still strong.

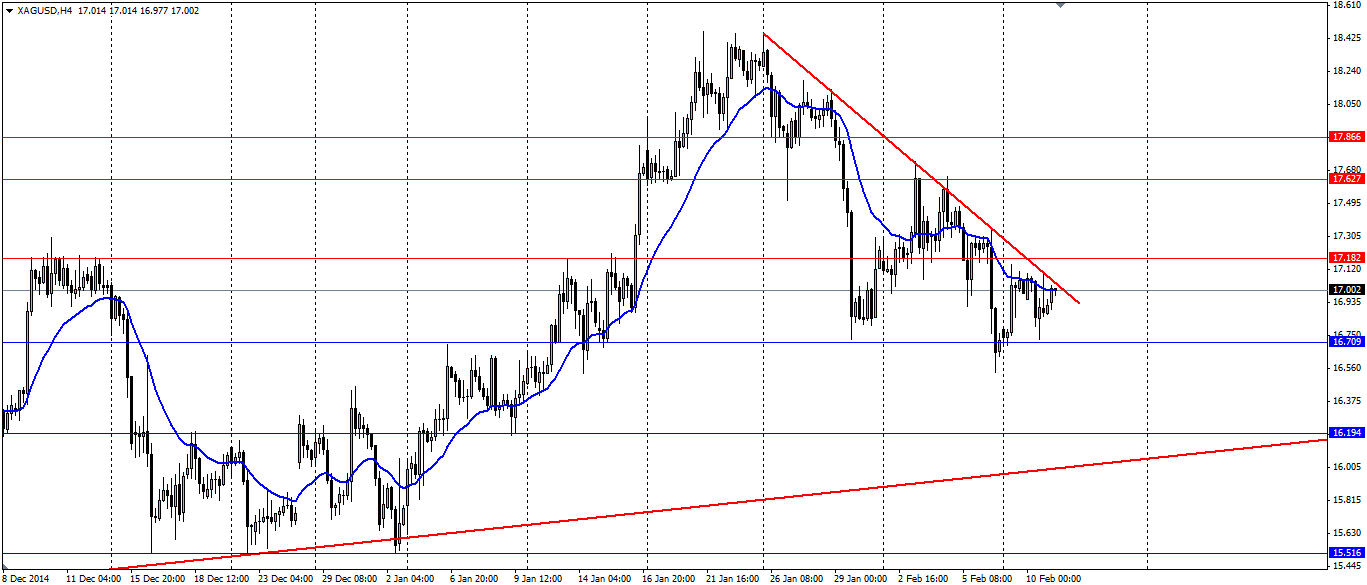

From the technical side of things, the bearish trend line that has formed over the last two weeks is looking quite solid after a number of tests. With the price sitting just under the trendline, and just under the resistance at the magical $17.000 mark, we could very well see another rejection.

The current squeeze in the price between the short term bearish trendline and the support at 16.709 is likely to lead to a breakout. If the momentum holds it will be carried lower where it will run headlong into the older trendline with a slight bullish bias. This will again lead to a squeeze and would be a good place for anyone short on silver to take profits off the table.

If we see an upside breakout from the current position, the price will look for resistance at 17.182, 17.627 and 17.866. A bearish breakout will occur once the support at 16.709 has broken with further support at 16.194 and 15.516 and of course the older trendline mentioned above will act as dynamic support.