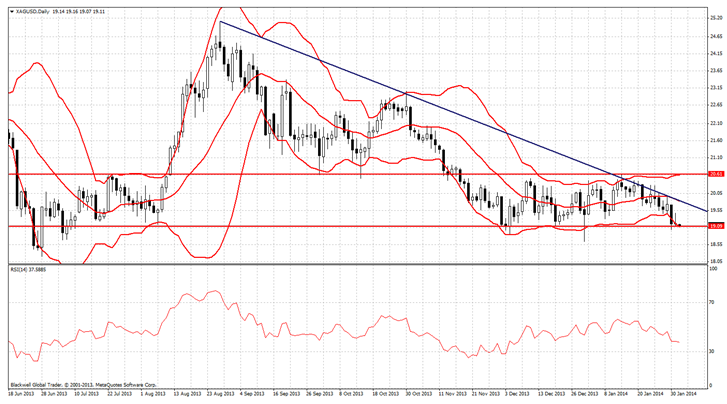

In my last article on Silver, I touched on the bearish nature of the trend line at play in the Silver market, and how we should be paying close attention to the strength of it. If you had been following, you would have seen its strength has held over the last week, and now more than ever, it looks stronger after being tested regularly over the past week.

However, that does not mean you should always be short in the market, as with all trading, opportunities are both sides of the coin and not just one sided. Anyone that thinks it's all one way traffic is missing out on catching silver as it looks to pull back.

Current analysis of silver charts shows that we have pushed down to a new heavy level of support at 19.09. Why is this of importance? Well, this support line hasheld for some time now, with the last time it was breached back in July 2013; this was followed by a rally of silver to 24.50 over the course of the next month.

Why should you pay attention? Well it’s clear that markets are indecisive as to the next move for the metal, and so they should be. Despite many major banks saying that commodities are heading for losses in 2014, it seems that hedge funds in the US are increasing their net long positions in gold (40% increase for the month of Janurary). This has some flow on effects to silver, as speculating in gold does in fact lead to speculating in silver as can be seen from the last global financial crisis.

I’m not going to say that there will be another crisis just yet, despite the recent emerging markets’ stress on some financial markets. But it's certainly important to factor in the fact that silver does well in growing markets as its heavily used in the electronics industry, and now the medical industries. This makes its demand ever growing in a very hungry market for the latest electronics and complex electronic devices.

The technical aspect of silver is the main driver though, this much is clear. The RSI shows heavy selling pressure over the last week, and certainly a pullback could be on the cards given how strong the support level is currently. Additionally, if the support does break and silver dives through, I would look for further lows at 18.39 and 17.33; a level not seen since 2010.

Either way, the next 24 hours will certainly help to decide direction, and I wouldn’t be surprised to see it jump back up. However, overall long term trends still point to silver declining all together, as current market positions show the majority of contracts are currently short and I don’t see that changing unless we see gold push up out of its trend line or bad U.S economic data.