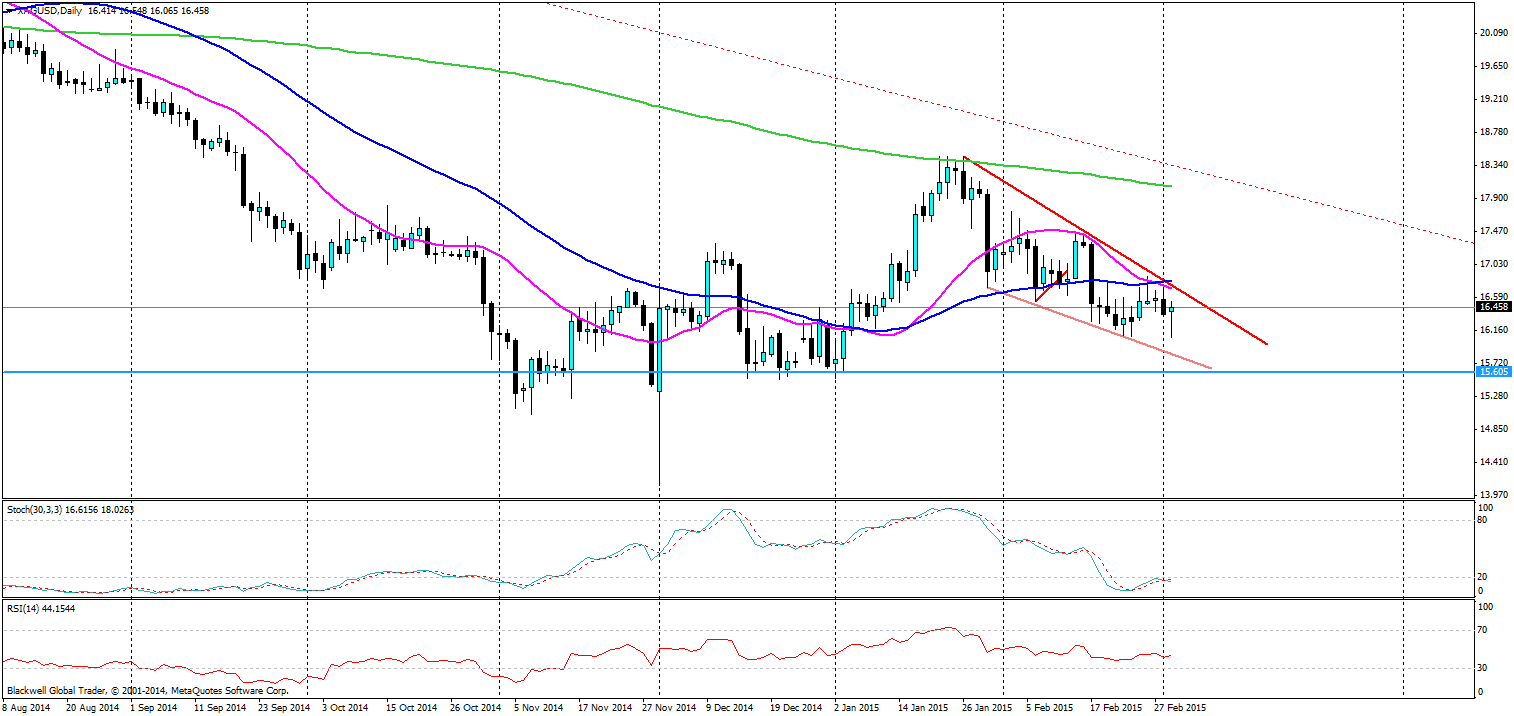

(Source: Blackwell Trader XAG/USD, D1)

The silver wedge continues to tighten as markets look to shift into a lower gear and drop down the charts.

The question is how much further can we drop at present with the silver market looking very timid. Not much further I feel as currently we have seen a strong resistance patch at 15.065 and the market will most certainly be looking to play to this level at least.

What the market this week will be focused on is labor data and the build-up for FED action. The labor market has so far been quite positive, and as a result the market will be looking for driving points to get it lower. Each time we have the prospect of rate rises on the horizon in a talk we see silver shift lower and non-farm this week is expected to be 238K, a rather weak reading to previous ones, so there its certainly room for a large drop lower.

So with Yellen wanting to talk up the prospect of interest rate rises to the market, it’s inevitable that we will see lower lows in silver, at least down to the 15.065 level. But from a technical perspective, we have a solid wedge forming and we also have a golden cross forming as the 20 MA crosses through the 50 MA pointing to bearish sentiment picking up the pace.

Long term a descending wedge is a breakout pattern upwards, however, we have some more time to go before that is a reality and once we have a touch on the 15.065 level, there will be scope for a breakout higher for the silver market; just not right now while we continue to trend lower.