Large speculators in most markets are usually late to the party and use outdated technical analysis to provide lagging confirmation on when to open a position on futures markets. They are, more often than not, wrong.

The professionals circle on these traders like hawks and often sell to them at the tops and offload shorts at the bottoms. We recently saw this play out in silver. It has created a buy signal based upon an event that happened only thrice in the last 20 years.

Since the exchange for physical blow-up in 2020, which led to massive rallies in gold and silver, both the metals have spent the last two years stuck in illogical price channels moving sideways to down.

Astute to these low prices, China and Russia have been loading up on precious metals, taking full advantage of the unreasoned and artificially suppressed levels.

In September 2021, I wrote an article titled: China, the Petrodollar and Gold, outlining how there is a power shift from the West to the East and how China and Russia are using gold to their advantage.

This is evidenced in the last six months to the extent that the BRICS nations are now creating a new reserve currency to crush the US Dollar. Russia is also proposing a new exchange to trade metals.

The Comex and the LBMA have used paper contracts created out of thin air to suppress the price for years. JP Morgan traders were again found guilty of manipulating prices only a few weeks ago.

The Shanghai exchange in China already has a significant spread in Gold prices between the rigged benchmark futures prices. The purpose of the Shanghai exchange and the Russian proposal is to use physical metals and not make belief paper, therefore, creating true price discovery.

If successful – and the footprints are already there in China – this will lead to the futures markets being abandoned by traders fed up with price suppression and creating a much higher gold and silver price.

While this is the theory, it could also create a contango of sorts and lead to a drain on the Comex, potentially ending it altogether. Vast amounts of gold and silver are already being withdrawn from the Comex, which is the same story for the LME.

Adding to this, interest rates being raised into a recession which is a first-ever, and the debt market on the precipice of blowing up will only lead to a quick influx of money into precious metals.

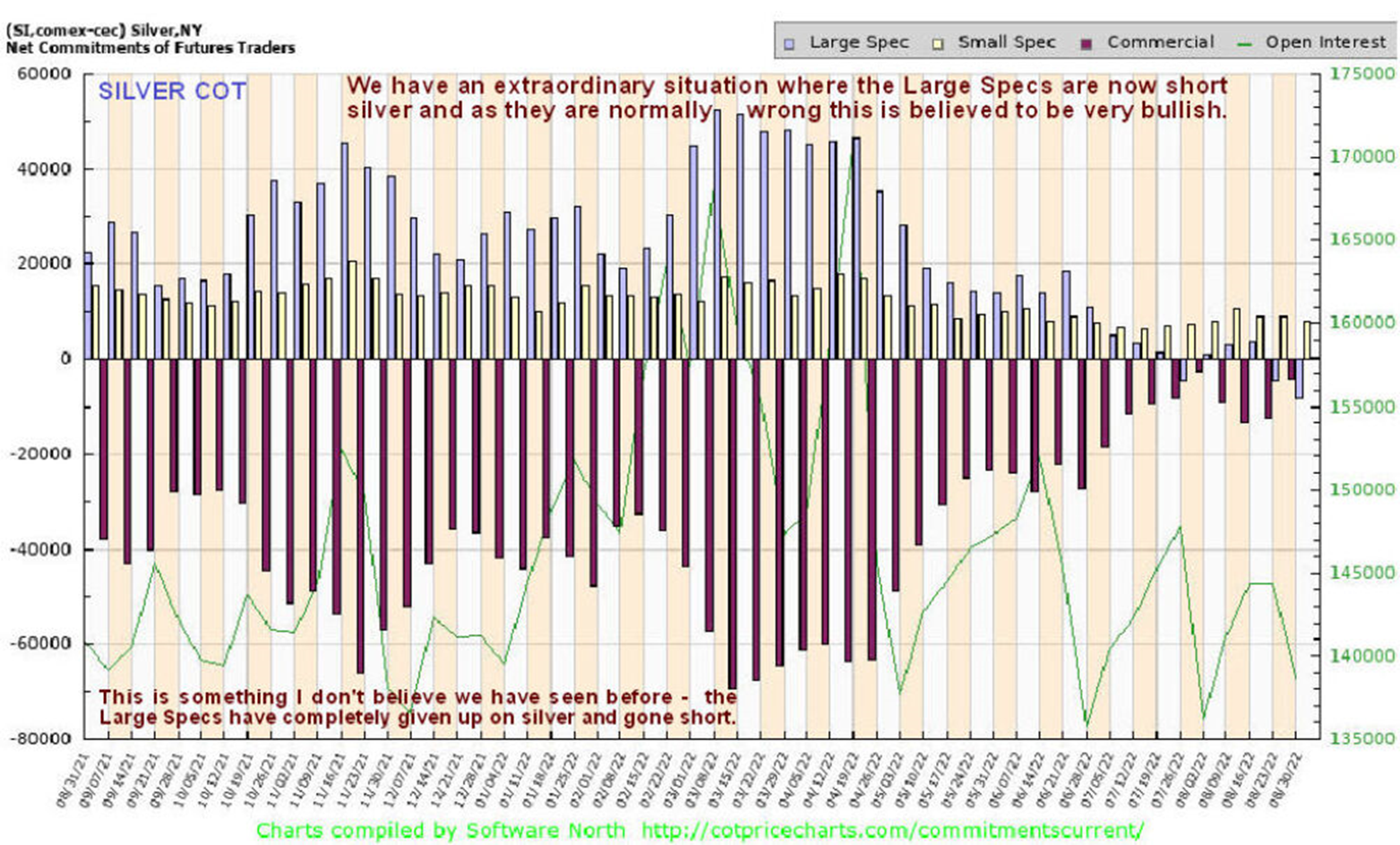

All of the above has led to a situation we now find ourselves in, highlighted by the chart below.

The latest COT report chart shows that the consistently wrong large speculators have flipped from net long to net short. This is at a time when silver is at multi-year lows.

They have thrown in the towel and gone the other way. However, way more important is the commercials, who, having hedged their long positions for years by shorting paper, have now gone majority net long.

As outlined in the first paragraph, this is the third time in 20 years this has happened. Just look at the charts to work out the other two times.

Historically this development has led to the formation of substantial rallies and waves goodbye to a major bottom. While not always straight away, it is usually very close.

Could last week’s venture into the 17s in silver be that bottom?