Our last analysis of Silver expected more downwards movement, which is exactly what has happened. The target was 21.158. So far the price has reached down to 20.588, 0.57 below the target.

I have a new alternate for you this week. I have continued looking, and finally have found an alternate which has a reasonable probability.

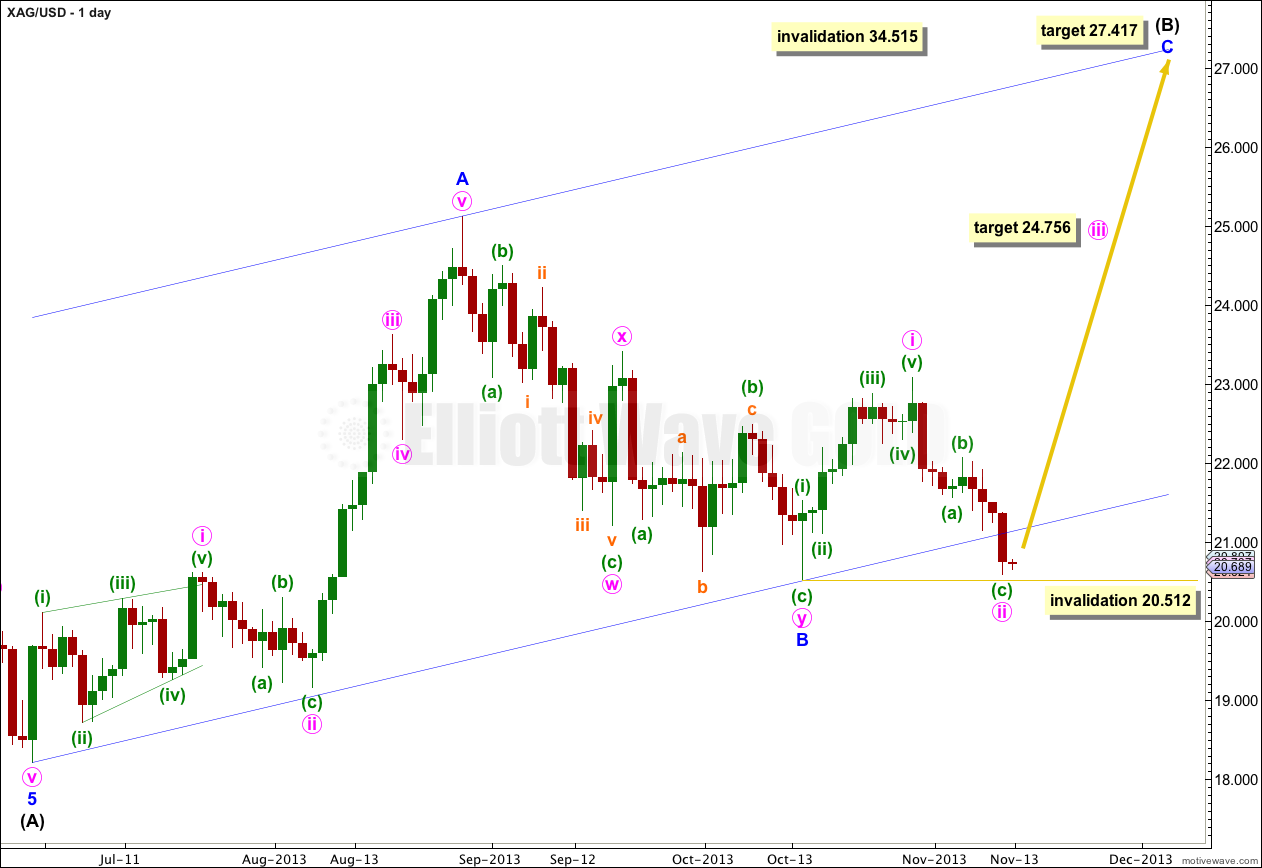

Main Wave Count.

Intermediate wave (B) is unfolding as a simple zigzag. Minor wave A subdivides as a five, and minor wave B is now a complete “three” (a double zigzag).

At 27.417 minor wave C would reach equality in length with minor wave A. Minor wave A lasted 43 days, and minor wave B lasted a Fibonacci 34 days. I would expect minor wave C to last between 34 and 43 days, or thereabouts.

The parallel channel drawn here is Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy upon the end of minor wave A. I will expect minor wave C to find resistance at the upper edge of this channel, and it is most likely to end there.

Within minor wave C minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 20.512.

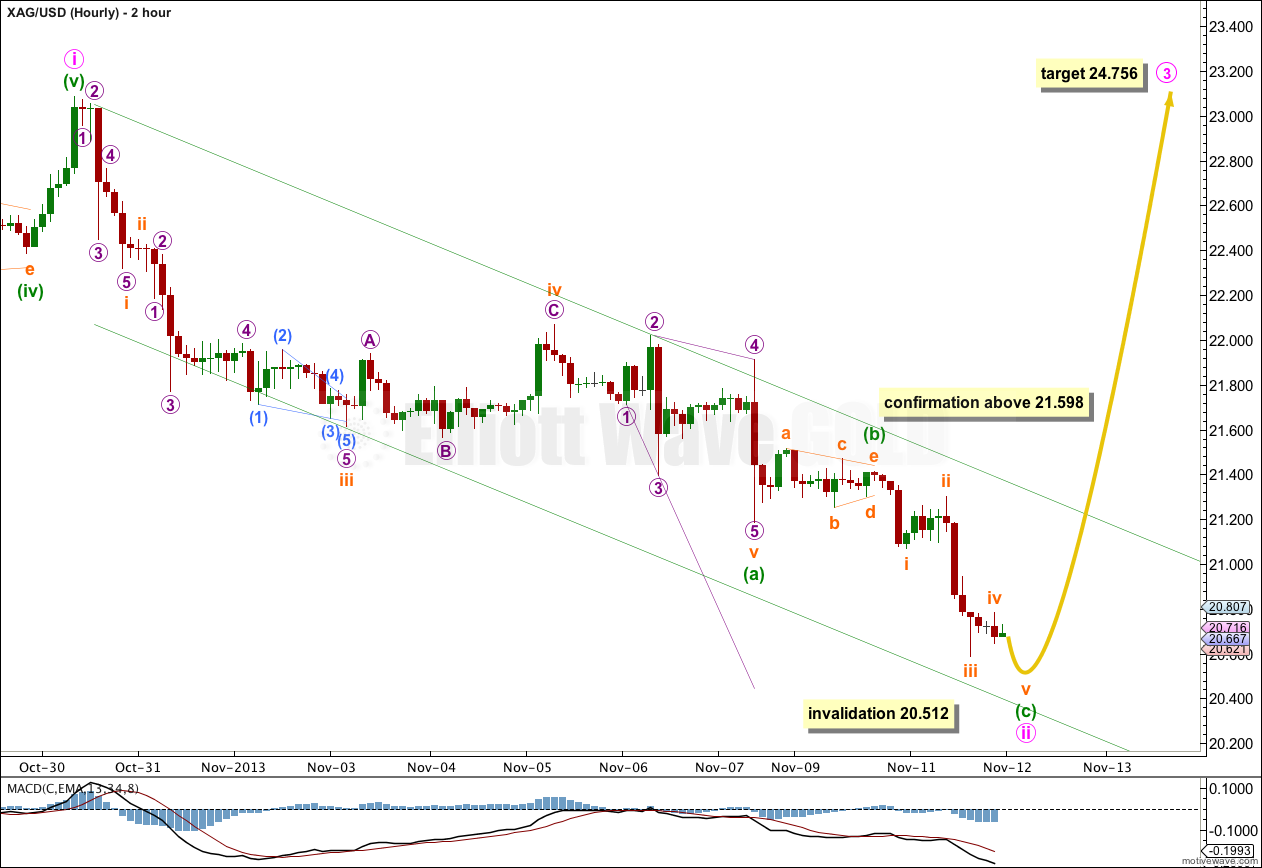

The key to this wave count and the reason why I judge it to have a higher probability is the triangle labeled minuette wave (b). This structure looks so typically like a contracting triangle. It subdivides nicely into a series of zigzags, with the b wave longer lasting and having deeper retracements on the five minute chart.

If this structure is a triangle then it is either a B wave or a fourth wave. It cannot fit as a fourth wave so it may be a B wave.

Within minute wave ii zigzag minuette waves (a) and (b) may be complete. Minuette wave (c) may be very close to completion, only the last fifth wave downwards needs to complete.

If price moves above 21.598 in the next few days then I would have confidence in this wave count. At that stage I would expect overall upwards movement for about another 23 days from today’s date. At 24.756 minute wave iii would reach 1.618 the length of minute wave i.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 20.512.

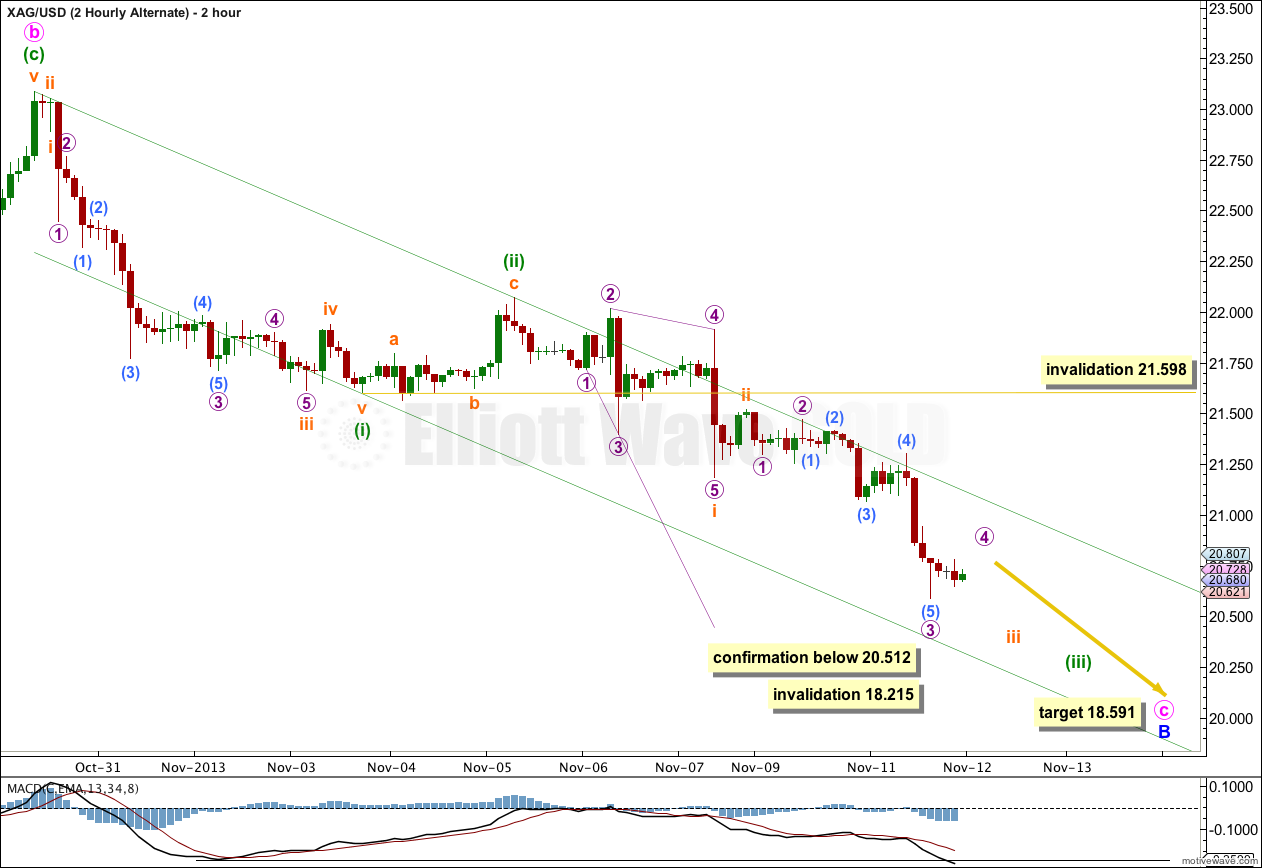

Alternate Wave Count.

My first alternate included a rare running flat. I discarded it due to a low probability.

This idea has a better fit. It is possible that minor wave B is an incomplete zigzag.

Within minor wave B minute wave a subdivides nicely as a leading expanding diagonal. Within the leading diagonal all the subwaves are zigzags except the third wave which is an impulse. For this piece of movement this structure has the best fit.

Minute wave b is labeled as an expanded flat correction. Within it minuette waves (a) and (b) both subdivide as three wave zigzags, and minuette wave (b) is a 106% correction of minuette wave (a). There is no Fibonacci ratio between minuette waves (a) and (c).

Minuette wave (c) is an incomplete impulse. At 18.591 minute wave c would reach equality in length with minute wave a.

If this wave count is confirmed with movement below 20.512 then I would add to the target calculation for minute wave c when there is enough structure within it to use minuette wave degree, so this target may change or widen to a small zone.

Minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 18.215.

Although this wave count has a very good fit on the daily chart it does not have as nice a fit on the 2 hourly or five minute charts.

This wave count cannot see a triangle where the main wave count sees it’s minuette wave (b). This alternate must see this piece of movement as a series of overlapping first and second waves. Although this is very common it seems to be a stretch, and it seems to be ignoring what looks like an obvious triangle. However, on the five minute chart it does fit, although there is at least a running flat in there for a second wave.

For this alternate there is so far a slight increase in downwards momentum for the possible third wave of this impulse. This does fit, but the increase is not convincing. If downwards momentum increases further in momentum then this wave count would increase in probability.

Within this alternate wave count there are three more fourth wave corrections which should unfold during the next few days or so. The last of them, minuette wave (iv), may not move into minuette wave (i) price territory. This alternate wave count is invalidated with movement above 21.598.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Technical Analysis: More Downwards Momentum

Published 11/13/2013, 12:44 AM

Updated 07/09/2023, 06:32 AM

Silver Technical Analysis: More Downwards Momentum

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.