Source: Blackwell Trader

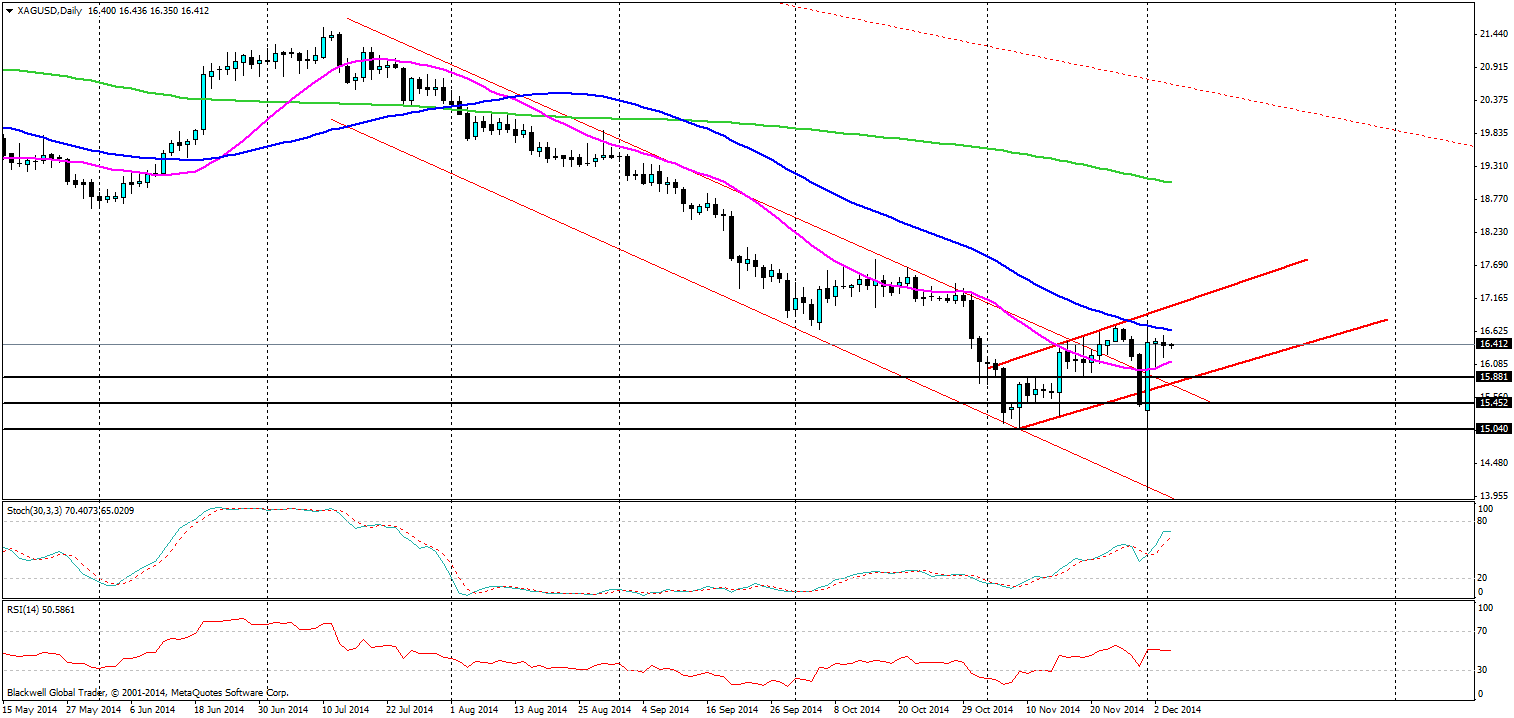

The Silver market has been looking very volatile as of late, after some massive moves last week with a candle forming a massive low at 14.10 at one stage, before the market regained control and forced it back higher. I’ve been a little cautious over further trading opportunities in the market, but what is clear is that the 20 day MA and the 50 day MA are acting as a band at present and one is going to have to go shortly, and it may just be the 50 day MA if we see a rush higher.

Overall though, silver has been very volatile and has looked to form a new channel in the short to medium term. Could this be the return of Silver bulls to the market? It’s very possible that is indeed the case for Silver traders and buyers. I’m a little cautious though, due to the close relationship of Silver and Gold.

Source: Blackwell Trader

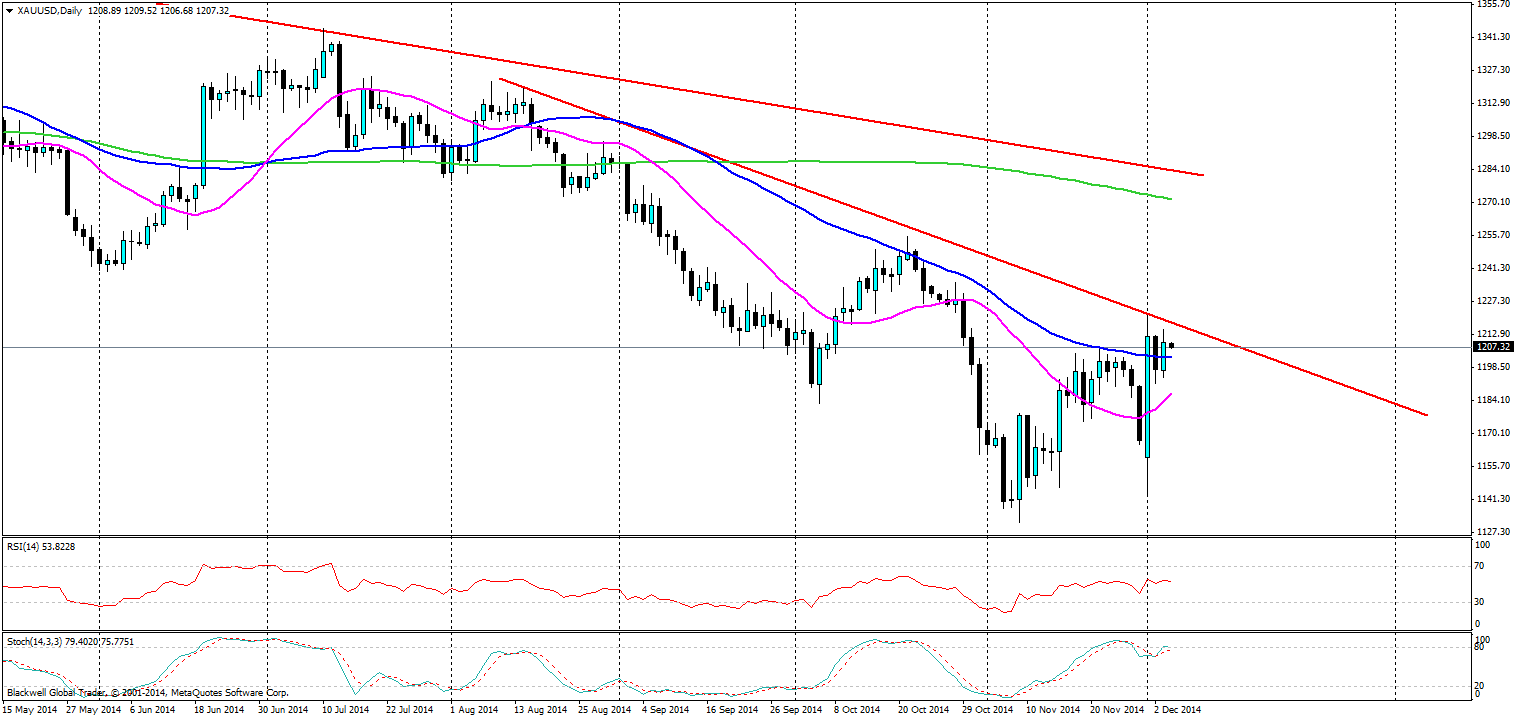

As we can see, there is a trend line in the market and Gold could be forced off it and further down. Should that happen, it will most likely drag on Silver, as it has been shown numerous times that there is a minor correlation between the two.

Overall, Silver is currently bullish in the current channel forming. However, to play it, I would look for it to push down and touch the bottom and confirm the channel further before looking to take this seriously. But at the same time be very careful of the power of the Non-farm Payroll announcement tomorrow on the metal markets as that can be aggressive, to say the least.