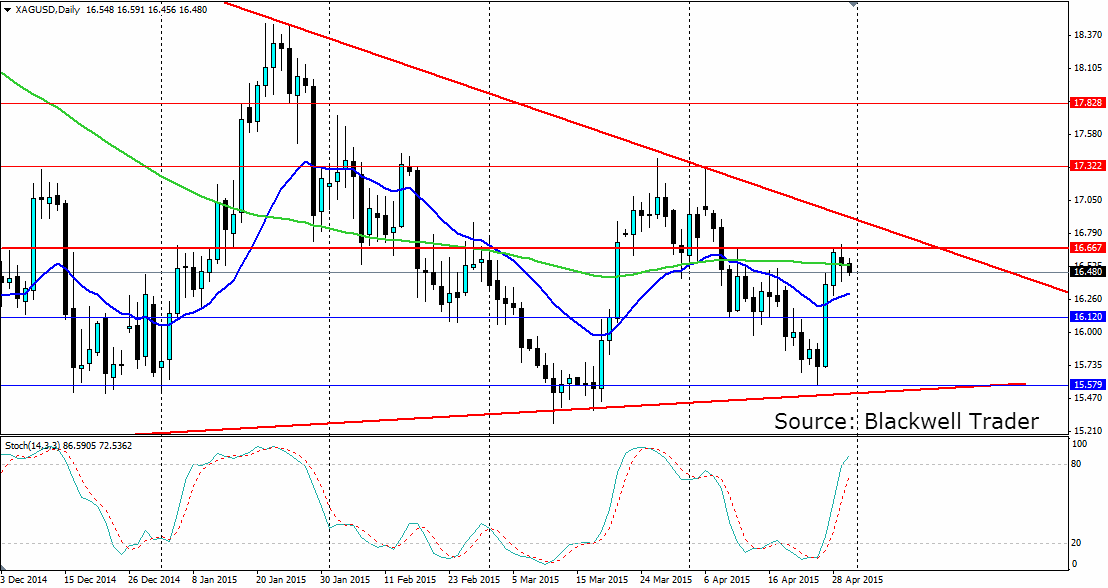

Silver has pushed higher in recent days but it has met some solid resistance at the 16.667 mark, which is well within the current consolidative pattern. A reversal from here will likely take silver back to the bottom of the range.

There have been some funny things going on in the silver market recently with rumours that JP Morgan has acquired the largest hoard of physical silver in history (rumoured at 350m ounces). The reason why is merely speculation at this stage, but it will be something to keep in mind if the global economy starts to go pear-shaped. But that’s for another time.

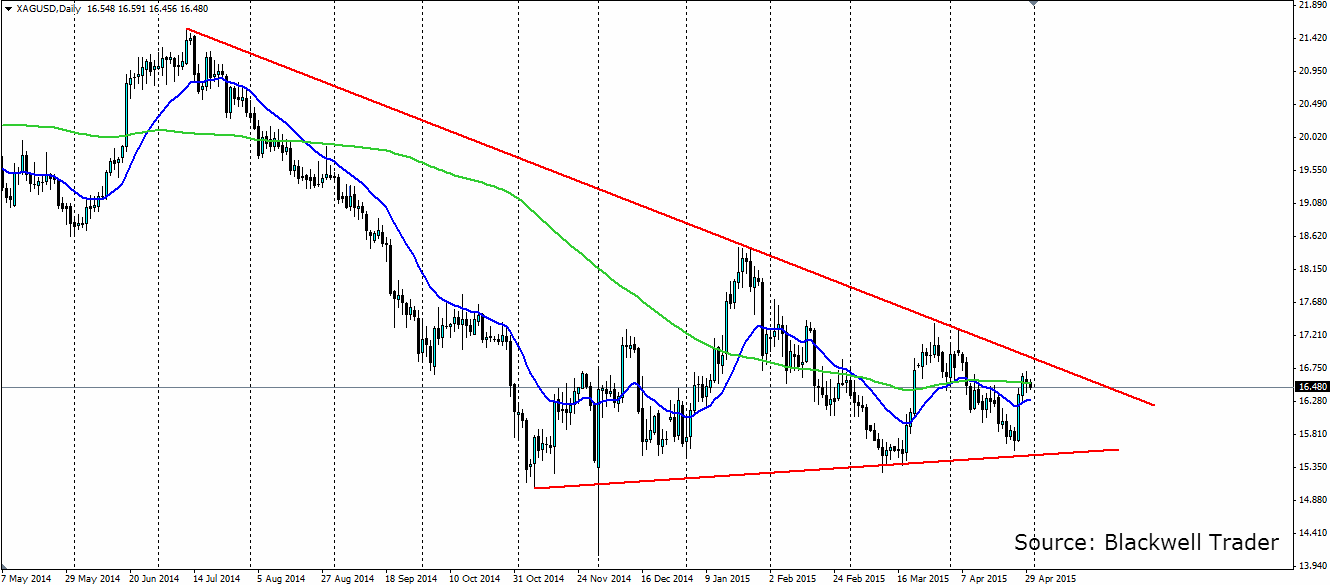

For now, silver continues to consolidate within the large pennant shape on the daily charts. The current short term bullish wave has met solid resistance at 16.667 along with resistance at the 100 day MA. A double top looks to have formed that could see a push back down to the recent lows found last week.

One thing to note is the current bullish push has run out of steam short of the bearish trend line, which could mean we see a secondary push up to this dynamic resistance. The Stochastic Oscillator moving into oversold territory would suggest this is unlikely, but it is something to keep in mind.

If we see a reversal of the current trend, look for support to be found at 16.120, 15.579 (the recent low) and 15.140 beyond. The price could also look for dynamic support at the bottom of the shape which would coincide with the most recent low. Resistance will be found at 16.667 and at the bearish trend line. If we see a breakout of this, look for resistance at 17.322 and 17.828.