Silver Non-Commercial Positions:

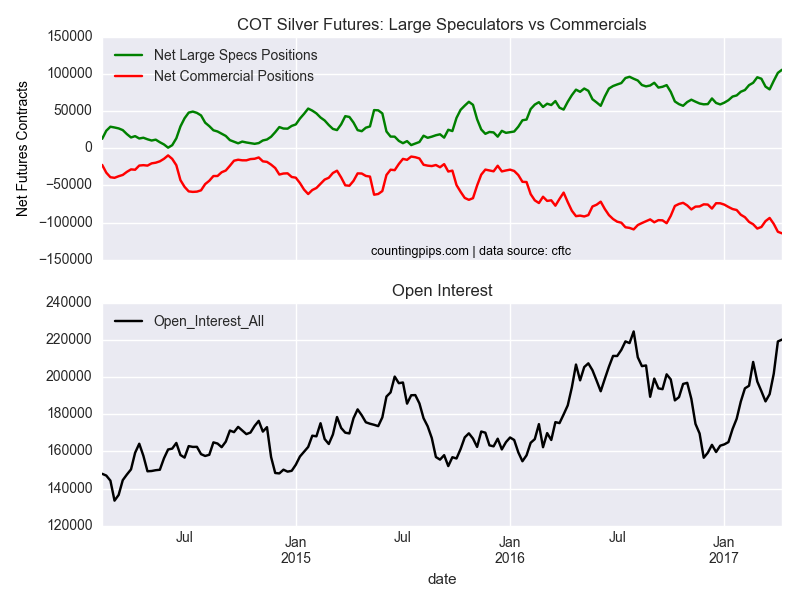

Large speculators and traders continued to boost their bullish net positions in the silver futures markets last week for a third consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex silver futures, traded by large speculators and hedge funds, totaled a net position of 105,515 contracts in the data reported through April 11th. This was a weekly gain of 4,133 contracts from the previous week which had a total of 101,382 net contracts.

The latest data brings the net position to the most bullish speculative level on record and marks the second straight week over the +100,000 net contract level. Silver speculative positions have grown by +26,403 net contracts in just the past three weeks.

Silver Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -114,414 contracts last week. This is a weekly change of -2,068 contracts from the total net of -112,346 contracts reported the previous week.

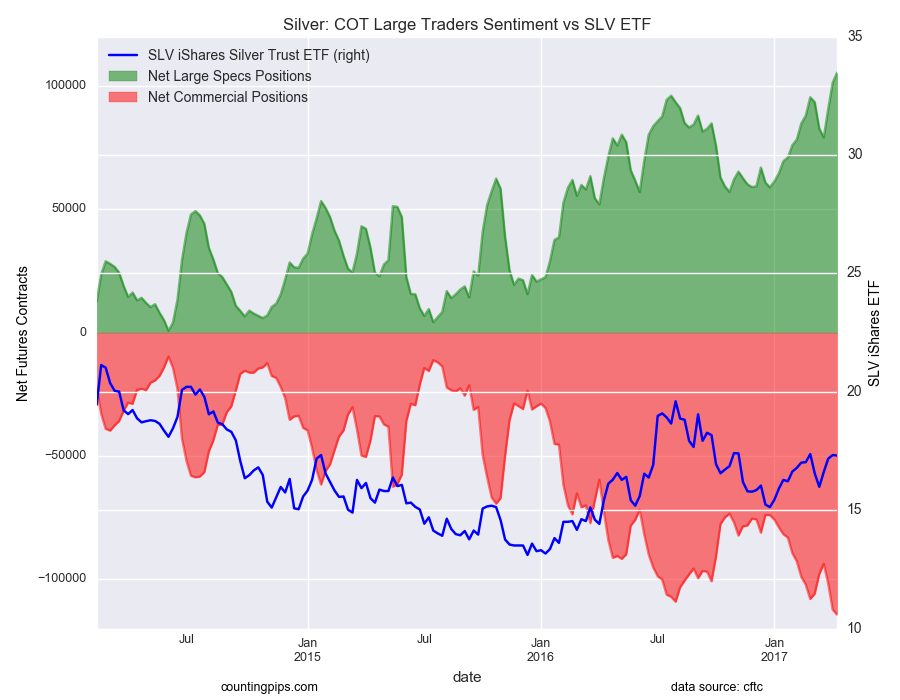

Silver ETF (NYSE:SLV):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SLV ishares ETF, which tracks the price of silver, closed at approximately $17.31 which was an edge lower of $-0.02 from the previous close of $17.33, according to ETF financial market data.