Silver saw some choppy trading after the FOMC hiked interest rates. The precious metal rejected off the resistance that forms the upper level of a channel which could see it drift towards the support at the bottom.

The Federal Open Markets Committee announced their first interest rate hike in nine years, by 25 basis points, which was widely anticipated by the market. Silver initially saw weakness, largely thanks to relief selling that the Fed had actually followed through on their word. There was some volatility after the announcement, and during Janet Yellen’s statement, but the lack of wild swings is testament to the Fed managing the markets expectations correctly.

Federal Chairwoman Janet Yellen’s statement after the announcement contained something for everyone. For the silver bears she said stronger growth or faster inflation would make steeper hikes appropriate. For the bulls, she said disappointing growth would mean slower rises, which indicates the Fed will very much take a data driven approach to rate hikes. Interestingly, Yellen also said that wages have yet to show sustained pick up and that some cyclical weakness remains in the labour market, suggesting it may not be as robust as the Fed has previously made it out to be, which excited the silver bulls.

Overall the bears won on the day as the FOMC judged a modest increase in interest rates was appropriate. According to Yellen the actions from the Fed recognises the considerable progress in the economy. She also expects the transitory factors weighing on inflation to fade, which will lead inflation to rise to 2.0%.

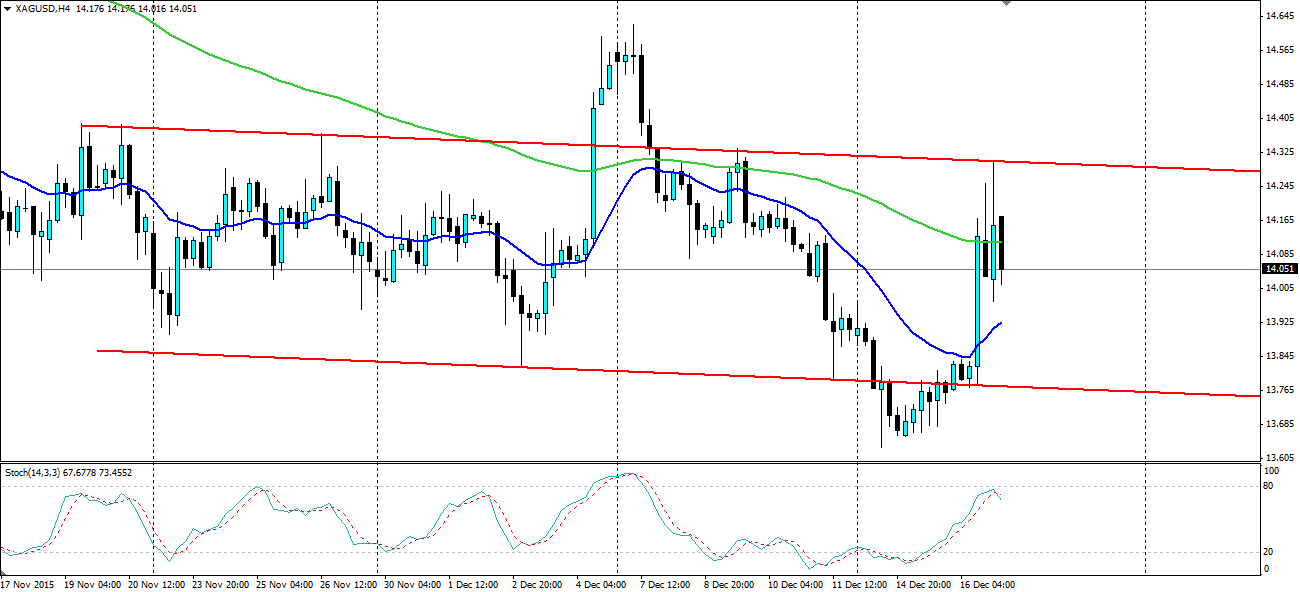

Silver hit a high of $14.303 which is right on the upper level of the channel silver is currently ranging in. The channel has seen false breakouts on both sides, so it is not exactly the strongest in history, but is certainly provides silver traders with points of reference in terms of support and resistance. The upper level of the channel may see another test as the market looks for equilibrium after such an event, but the strong rejection off the top is a clear sign that the bears are willing and able to defend their position, despite the volatility.

The stochastic oscillator is beginning to trend lower and price has broken back below the 100 H4 EMA (green line) which is a bearish signal. Look for price to drift towards the bottom of the channel where the bears will be waiting for their chance to defend. Support is found at $13.964, $13.705 and $13.447 while resistance is found at $14.101, $14.410 and $14.704, along with the channel acting as both support and resistance.