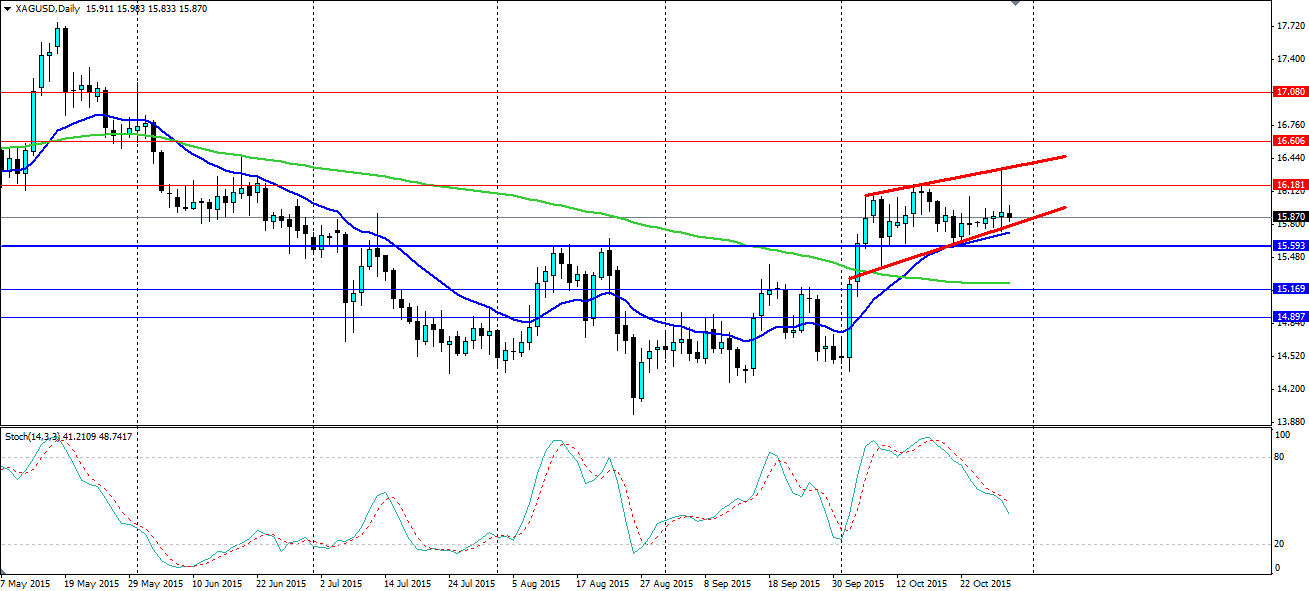

The wedge on the Silver daily chart has remained intact despite the Fed hinting that a December rate hike may be on the cards. The markets may call the Fed’s bluff which will see Silver break to the upside.

The economic slowdown in China is causing a rout in commodities across the board and industrial metals in particular are feeling the pinch. Silver is used as a store of wealth in times of uncertainty, however, where it differs from Gold is its use in manufacturing and production. The PBOC remains optimistic, but the recent rounds of fresh stimulus signal that perhaps all is not as well as it seems. Certainly China remains a risk for the Silver bulls.

The Fed on the other hand holds the majority of the power. Yesterday we saw the Fed turn more hawkish than expected by saying “In determining whether it will be appropriate to raise [rates]… at its next meeting, the committee will assess progress”. This does not guarantee a rate hike, but it is as good a signal as you will get from the Fed. That saw Silver lose most of the day’s gains after the market had been expecting more dovishness.

The market may still call the Fed’s bluff which will see pressure put on the upper side of the wedge that Silver is currently trading in. We have seen silver gain recently on speculation that the Fed will not have the data to raise rates this year. They didn’t have the data in September, and things haven’t improved much (if at all), so it’s difficult to see how a rate rise will be justified. To that end, we may see Silver continue on upward over the next month and a half.

The upward sloping wedge has constrained the movements of Silver over the last few weeks. The Fed turning hawkish could not force a breakout lower, so it is safe to assume the wedge will remain intact for a little yet. The 100 day MA has flattened out and could turn positive, giving a boost to the bullish sentiment. The rejection off the top of the shape could be an ominous sign as it indicates the bears are lurking and ready to strike.

The Stochastic Oscillator has pulled right back to neutral territory which leaves plenty of room on the upside. Silver will look to use the bottom of the wedge as support for a shift higher. If it does, resistance will be found at $16.181, $16.606 and $17.080 along with dynamic resistance at the top of the wedge. Should the market take the Fed’s hawkish stance seriously, we could see a break out lower that will find solid support at $15.593 with further support at $15.169 and $14.897. Also look for the 100 day MA to act as dynamic support. In the meantime, expect silver to bounce between the upper and lower levels of the wedge.